ONE ROOF

ONE ROOF

ONE ROOF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

* The aggregate figures<br />

for the HOCHTIEF Con cessions<br />

division include the division’s<br />

own admin istrative expenses.<br />

**The 2009 figure includes the<br />

71 employees of the fully consolidated<br />

HOCHTIEF PPP<br />

Schulpartner project company.<br />

96 Annual Report 2009<br />

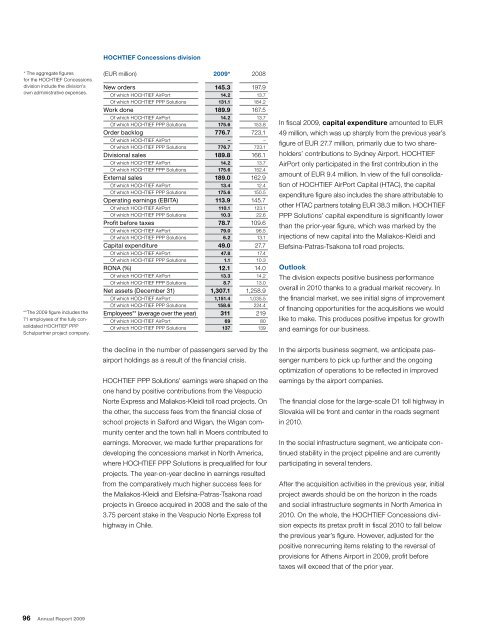

HOCHTIEF Concessions division<br />

(EUR million) 2009* 2008<br />

New orders 145.3 197.9<br />

Of which HOCHTIEF AirPort 14.2 13.7<br />

Of which HOCHTIEF PPP Solutions 131.1 184.2<br />

Work done 189.9 167.5<br />

Of which HOCHTIEF AirPort 14.2 13.7<br />

Of which HOCHTIEF PPP Solutions 175.6 153.8<br />

Order backlog 776.7 723.1<br />

Of which HOCHTIEF AirPort – –<br />

Of which HOCHTIEF PPP Solutions 776.7 723.1<br />

Divisional sales 189.8 166.1<br />

Of which HOCHTIEF AirPort 14.2 13.7<br />

Of which HOCHTIEF PPP Solutions 175.6 152.4<br />

External sales 189.0 162.9<br />

Of which HOCHTIEF AirPort 13.4 12.4<br />

Of which HOCHTIEF PPP Solutions 175.6 150.5<br />

Operating earnings (EBITA) 113.9 145.7<br />

Of which HOCHTIEF AirPort 110.1 123.1<br />

Of which HOCHTIEF PPP Solutions 10.3 22.6<br />

Profit before taxes 78.7 109.6<br />

Of which HOCHTIEF AirPort 79.0 96.5<br />

Of which HOCHTIEF PPP Solutions 6.2 13.1<br />

Capital expenditure 49.0 27.7<br />

Of which HOCHTIEF AirPort 47.8 17.4<br />

Of which HOCHTIEF PPP Solutions 1.1 10.3<br />

RONA (%) 12.1 14.0<br />

Of which HOCHTIEF AirPort 13.3 14.2<br />

Of which HOCHTIEF PPP Solutions 8.7 13.0<br />

Net assets (December 31) 1,307.1 1,258.9<br />

Of which HOCHTIEF AirPort 1,151.4 1,035.5<br />

Of which HOCHTIEF PPP Solutions 158.6 224.4<br />

Employees** (average over the year) 311 219<br />

Of which HOCHTIEF AirPort 69 80<br />

Of which HOCHTIEF PPP Solutions 137 139<br />

the decline in the number of passengers served by the<br />

airport holdings as a result of the financial crisis.<br />

HOCHTIEF PPP Solutions’ earnings were shaped on the<br />

one hand by positive contributions from the Vespucio<br />

Norte Express and Maliakos-Kleidi toll road projects. On<br />

the other, the success fees from the financial close of<br />

school projects in Salford and Wigan, the Wigan community<br />

center and the town hall in Moers contributed to<br />

earnings. Moreover, we made further preparations for<br />

developing the concessions market in North America,<br />

where HOCHTIEF PPP Solutions is prequalified for four<br />

projects. The year-on-year decline in earnings resulted<br />

from the comparatively much higher success fees for<br />

the Maliakos-Kleidi and Elefsina-Patras-Tsakona road<br />

projects in Greece acquired in 2008 and the sale of the<br />

3.75 percent stake in the Vespucio Norte Express toll<br />

highway in Chile.<br />

In fiscal 2009, capital expenditure amounted to EUR<br />

49 million, which was up sharply from the previous year’s<br />

figure of EUR 27.7 million, primarily due to two shareholders’<br />

contributions to Sydney Airport. HOCHTIEF<br />

AirPort only participated in the first contribution in the<br />

amount of EUR 9.4 million. In view of the full consolidation<br />

of HOCHTIEF AirPort Capital (HTAC), the capital<br />

expenditure figure also includes the share attributable to<br />

other HTAC partners totaling EUR 38.3 million. HOCHTIEF<br />

PPP Solutions’ capital expenditure is significantly lower<br />

than the prior-year figure, which was marked by the<br />

injections of new capital into the Maliakos-Kleidi and<br />

Elefsina-Patras-Tsakona toll road projects.<br />

Outlook<br />

The division expects positive business performance<br />

overall in 2010 thanks to a gradual market recovery. In<br />

the financial market, we see initial signs of improvement<br />

of financing opportunities for the acquisitions we would<br />

like to make. This produces positive impetus for growth<br />

and earnings for our business.<br />

In the airports business segment, we anticipate pas-<br />

senger numbers to pick up further and the ongoing<br />

optimization of operations to be reflected in improved<br />

earnings by the airport companies.<br />

The financial close for the large-scale D1 toll highway in<br />

Slovakia will be front and center in the roads segment<br />

in 2010.<br />

In the social infrastructure segment, we anticipate con-<br />

tinued stability in the project pipeline and are currently<br />

participating in several tenders.<br />

After the acquisition activities in the previous year, initial<br />

project awards should be on the horizon in the roads<br />

and social infrastructure segments in North America in<br />

2010. On the whole, the HOCHTIEF Concessions division<br />

expects its pretax profit in fiscal 2010 to fall below<br />

the previous year’s figure. However, adjusted for the<br />

positive nonrecurring items relating to the reversal of<br />

provisions for Athens Airport in 2009, profit before<br />

taxes will exceed that of the prior year.