ONE ROOF

ONE ROOF

ONE ROOF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

As of December 31, 2009, HOCHTIEF Aktiengesellschaft held<br />

a total of 3,455,685 shares of treasury stock as defined in<br />

Section 160 (1) 2 of the German Stock Corporations Act<br />

(AktG). These shares were purchased over the course of fiscal<br />

2008 for the purposes provided for in the resolution of the<br />

General Shareholders’ Meeting of May 8, 2008. The holdings<br />

of treasury stock represent EUR 8,846,554 (4.94 percent) of<br />

the Company’s capital stock.<br />

44,068 shares of treasury stock were sold in July 2009 to em-<br />

ployees of HOCHTIEF or its affiliates. Of these shares, 22,183<br />

were sold at a price of EUR 10.95 each and 21,885 at a price<br />

of EUR 12.95 each. The shares represent EUR 112,814 (0.06<br />

percent) of the Company’s capital stock.<br />

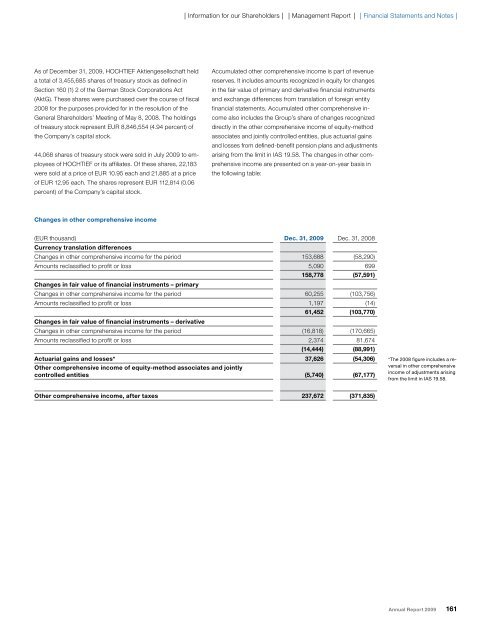

Changes in other comprehensive income<br />

❘ Information for our Shareholders ❘ ❘ Management Report ❘ ❘ Financial Statements and Notes ❘<br />

Accumulated other comprehensive income is part of revenue<br />

reserves. It includes amounts recognized in equity for changes<br />

in the fair value of primary and derivative financial instruments<br />

and exchange differences from translation of foreign entity<br />

financial statements. Accumulated other comprehensive in-<br />

come also includes the Group’s share of changes recognized<br />

directly in the other comprehensive income of equity-method<br />

associates and jointly controlled entities, plus actuarial gains<br />

and losses from defined-benefit pension plans and adjustments<br />

arising from the limit in IAS 19.58. The changes in other comprehensive<br />

income are presented on a year-on-year basis in<br />

the following table:<br />

(EUR thousand) Dec. 31, 2009 Dec. 31, 2008<br />

Currency translation differences<br />

Changes in other comprehensive income for the period 153,688 (58,290)<br />

Amounts reclassified to profit or loss 5,090 699<br />

158,778 (57,591)<br />

Changes in fair value of financial instruments – primary<br />

Changes in other comprehensive income for the period 60,255 (103,756)<br />

Amounts reclassified to profit or loss 1,197 (14)<br />

Changes in fair value of financial instruments – derivative<br />

61,452 (103,770)<br />

Changes in other comprehensive income for the period (16,818) (170,665)<br />

Amounts reclassified to profit or loss 2,374 81,674<br />

(14,444) (88,991)<br />

Actuarial gains and losses*<br />

Other comprehensive income of equity-method associates and jointly<br />

37,626 (54,306)<br />

controlled entities (5,740) (67,177)<br />

Other comprehensive income, after taxes 237,672 (371,835)<br />

*The 2008 figure includes a reversal<br />

in other comprehensive<br />

income of adjustments arising<br />

from the limit in IAS 19.58.<br />

Annual Report 2009 161