ONE ROOF

ONE ROOF

ONE ROOF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

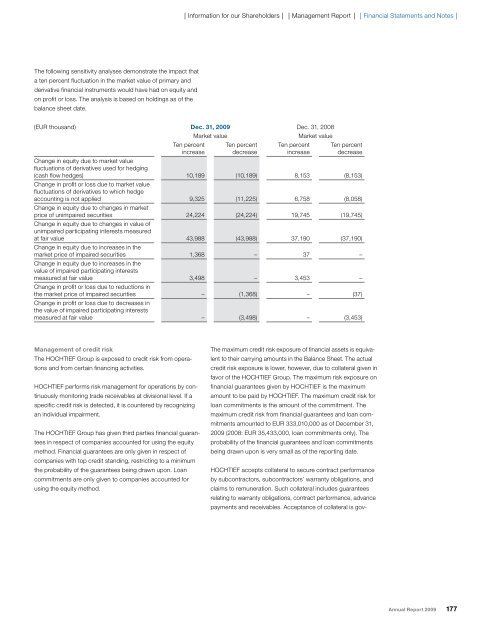

The following sensitivity analyses demonstrate the impact that<br />

a ten percent fluctuation in the market value of primary and<br />

derivative financial instruments would have had on equity and<br />

on profit or loss. The analysis is based on holdings as of the<br />

balance sheet date.<br />

Management of credit risk<br />

The HOCHTIEF Group is exposed to credit risk from operations<br />

and from certain financing activities.<br />

HOCHTIEF performs risk management for operations by con-<br />

tinuously monitoring trade receivables at divisional level. If a<br />

specific credit risk is detected, it is countered by recognizing<br />

an individual impairment.<br />

The HOCHTIEF Group has given third parties financial guaran-<br />

tees in respect of companies accounted for using the equity<br />

method. Financial guarantees are only given in respect of<br />

companies with top credit standing, restricting to a minimum<br />

the probability of the guarantees being drawn upon. Loan<br />

commitments are only given to companies accounted for<br />

using the equity method.<br />

❘ Information for our Shareholders ❘ ❘ Management Report ❘ ❘ Financial Statements and Notes ❘<br />

(EUR thousand) Dec. 31, 2009 Dec. 31, 2008<br />

Ten percent<br />

increase<br />

Market value Market value<br />

Ten percent<br />

decrease<br />

Ten percent<br />

increase<br />

Ten percent<br />

decrease<br />

Change in equity due to market value<br />

fluctuations of derivatives used for hedging<br />

(cash flow hedges)<br />

Change in profit or loss due to market value<br />

fluctuations of derivatives to which hedge<br />

10,189 (10,189) 8,153 (8,153)<br />

accounting is not applied<br />

Change in equity due to changes in market<br />

9,325 (11,225) 6,758 (8,058)<br />

price of unimpaired securities<br />

Change in equity due to changes in value of<br />

unimpaired participating interests measured<br />

24,224 (24,224) 19,745 (19,745)<br />

at fair value<br />

Change in equity due to increases in the<br />

43,988 (43,988) 37,190 (37,190)<br />

market price of impaired securities<br />

Change in equity due to increases in the<br />

value of impaired participating interests<br />

1,368 – 37 –<br />

measured at fair value<br />

Change in profit or loss due to reductions in<br />

3,498 – 3,453 –<br />

the market price of impaired securities<br />

Change in profit or loss due to decreases in<br />

the value of impaired participating interests<br />

– (1,368) – (37)<br />

measured at fair value – (3,498) – (3,453)<br />

The maximum credit risk exposure of financial assets is equiva-<br />

lent to their carrying amounts in the Balance Sheet. The actual<br />

credit risk exposure is lower, however, due to collateral given in<br />

favor of the HOCHTIEF Group. The maximum risk exposure on<br />

financial guarantees given by HOCHTIEF is the maximum<br />

amount to be paid by HOCHTIEF. The maximum credit risk for<br />

loan commitments is the amount of the commitment. The<br />

maximum credit risk from financial guarantees and loan commitments<br />

amounted to EUR 333,010,000 as of December 31,<br />

2009 (2008: EUR 35,433,000, loan commitments only). The<br />

probability of the financial guarantees and loan commitments<br />

being drawn upon is very small as of the reporting date.<br />

HOCHTIEF accepts collateral to secure contract performance<br />

by subcontractors, subcontractors’ warranty obligations, and<br />

claims to remuneration. Such collateral includes guarantees<br />

relating to warranty obligations, contract performance, advance<br />

payments and receivables. Acceptance of collateral is gov-<br />

Annual Report 2009 177