ONE ROOF

ONE ROOF

ONE ROOF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Consolidated Financial Statements<br />

154 Annual Report 2009<br />

As in the prior year, there were no impairment charges on<br />

investment properties.<br />

The fair values of investment properties came to EUR 53,388,000<br />

as of December 31, 2009 (2008: EUR 63,281,000). These are<br />

assessed using internationally accepted valuation methods,<br />

such as taking comparable properties as a guide to current<br />

market prices or by applying the discounted cash flow method.<br />

EUR 25,155,000 (2008: EUR 30,655,000) of this total is accounted<br />

for by fair value adjustments following independent<br />

external appraisals.<br />

Rental income from investment properties in the reporting<br />

year totaled EUR 2,247,000 (2008: EUR 2,203,000). Direct<br />

operating expenses totaling EUR 4,168,000 (2008: EUR<br />

3,977,000) consisted of EUR 1,515,000 (2008: EUR 931,000)<br />

in expenses for rented and EUR 2,653,000 (2008: EUR<br />

3,046,000) in expenses for unrented investment properties.<br />

Investment properties to the value of EUR 3,332,000 (2008:<br />

EUR 3,349,000) are subject to restrictions in the form of real<br />

estate liens.<br />

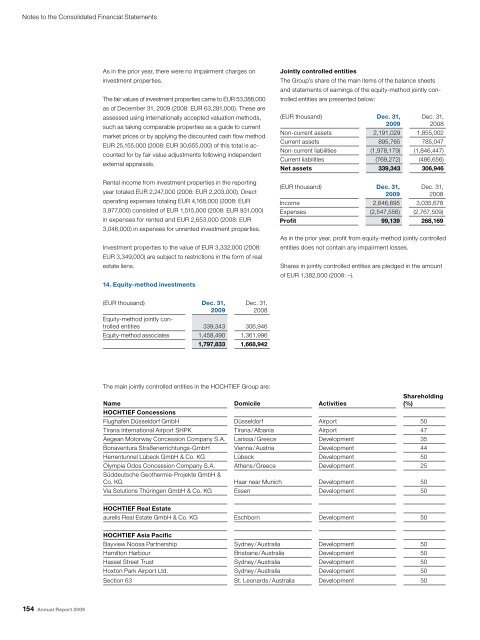

14. Equity-method investments<br />

(EUR thousand) Dec. 31,<br />

2009<br />

Dec. 31,<br />

2008<br />

Equity-method jointly controlled<br />

entities 339,343 306,946<br />

Equity-method associates 1,458,490 1,361,996<br />

1,797,833 1,668,942<br />

The main jointly controlled entities in the HOCHTIEF Group are:<br />

Jointly controlled entities<br />

The Group’s share of the main items of the balance sheets<br />

and statements of earnings of the equity-method jointly controlled<br />

entities are presented below:<br />

(EUR thousand) Dec. 31,<br />

2009<br />

(EUR thousand) Dec. 31,<br />

2009<br />

Dec. 31,<br />

2008<br />

Non-current assets 2,191,029 1,855,002<br />

Current assets 895,765 785,047<br />

Non-current liabilities (1,978,179) (1,846,447)<br />

Current liabilities (769,272) (486,656)<br />

Net assets 339,343 306,946<br />

Dec. 31,<br />

2008<br />

Income 2,646,695 3,035,678<br />

Expenses (2,547,556) (2,767,509)<br />

Profit 99,139 268,169<br />

As in the prior year, profit from equity-method jointly controlled<br />

entities does not contain any impairment losses.<br />

Shares in jointly controlled entities are pledged in the amount<br />

of EUR 1,382,000 (2008: –).<br />

Name<br />

HOCHTIEF Concessions<br />

Domicile Activities<br />

Shareholding<br />

(%)<br />

Flughafen Düsseldorf GmbH Düsseldorf Airport 50<br />

Tirana International Airport SHPK Tirana / Albania Airport 47<br />

Aegean Motorway Concession Company S.A. Larissa / Greece Development 35<br />

Bonaventura Straßenerrichtungs-GmbH Vienna / Austria Development 44<br />

Herrentunnel Lübeck GmbH & Co. KG Lübeck Development 50<br />

Olympia Odos Concession Company S.A.<br />

Süddeutsche Geothermie-Projekte GmbH &<br />

Athens / Greece Development 25<br />

Co. KG Haar near Munich Development 50<br />

Via Solutions Thüringen GmbH & Co. KG Essen Development 50<br />

HOCHTIEF Real Estate<br />

aurelis Real Estate GmbH & Co. KG Eschborn Development 50<br />

HOCHTIEF Asia Pacific<br />

Bayview Noosa Partnership Sydney / Australia Development 50<br />

Hamilton Harbour Brisbane / Australia Development 50<br />

Hassel Street Trust Sydney / Australia Development 50<br />

Hoxton Park Airport Ltd. Sydney / Australia Development 50<br />

Section 63 St. Leonards / Australia Development 50