ONE ROOF

ONE ROOF

ONE ROOF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

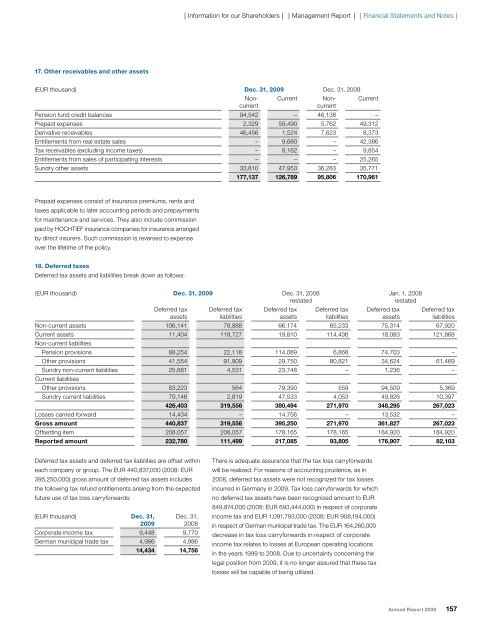

17. Other receivables and other assets<br />

Prepaid expenses consist of insurance premiums, rents and<br />

taxes applicable to later accounting periods and prepayments<br />

for maintenance and services. They also include commission<br />

paid by HOCHTIEF insurance companies for insurance arranged<br />

by direct insurers. Such commission is reversed to expense<br />

over the lifetime of the policy.<br />

18. Deferred taxes<br />

Deferred tax assets and liabilities break down as follows:<br />

Deferred tax assets and deferred tax liabilities are offset within<br />

each company or group. The EUR 440,837,000 (2008: EUR<br />

395,250,000) gross amount of deferred tax assets includes<br />

the following tax refund entitlements arising from the expected<br />

future use of tax loss carryforwards:<br />

❘ Information for our Shareholders ❘ ❘ Management Report ❘ ❘ Financial Statements and Notes ❘<br />

(EUR thousand) Dec. 31, 2009 Dec. 31, 2008<br />

Non- Current Non- Current<br />

currentcurrent<br />

Pension fund credit balances 94,542 – 46,138 –<br />

Prepaid expenses 2,329 59,490 5,762 49,312<br />

Derivative receivables 46,456 1,524 7,623 8,373<br />

Entitlements from real estate sales – 9,660 – 42,386<br />

Tax receivables (excluding income taxes) – 8,162 – 9,854<br />

Entitlements from sales of participating interests – – – 25,265<br />

Sundry other assets 33,810 47,953 36,283 35,771<br />

177,137 126,789 95,806 170,961<br />

(EUR thousand) Dec. 31, 2009 Dec. 31, 2008<br />

restated<br />

Deferred tax<br />

assets<br />

Deferred tax<br />

liabilities<br />

Deferred tax<br />

assets<br />

Deferred tax<br />

liabilities<br />

There is adequate assurance that the tax loss carryforwards<br />

will be realized. For reasons of accounting prudence, as in<br />

2008, deferred tax assets were not recognized for tax losses<br />

incurred in Germany in 2009. Tax loss carryforwards for which<br />

no deferred tax assets have been recognized amount to EUR<br />

849,874,000 (2008: EUR 693,444,000) in respect of corporate<br />

income tax and EUR 1,091,793,000 (2008: EUR 908,194,000)<br />

in respect of German municipal trade tax. The EUR 164,260,000<br />

decrease in tax loss carryforwards in respect of corporate<br />

income tax relates to losses at European operating locations<br />

in the years 1999 to 2008. Due to uncertainty concerning the<br />

legal position from 2009, it is no longer assured that these tax<br />

losses will be capable of being utilized.<br />

Deferred tax<br />

assets<br />

Jan. 1, 2008<br />

restated<br />

Deferred tax<br />

liabilities<br />

Non-current assets 106,141 78,888 66,174 65,233 75,314 67,920<br />

Current assets 11,404 118,727 19,810 114,436 18,083 121,868<br />

Non-current liabilities<br />

Pension provisions 88,254 22,118 114,089 6,868 74,703 –<br />

Other provisions 41,554 91,909 29,750 80,821 34,624 61,469<br />

Sundry non-current liabilities 25,681 4,531 23,748 – 1,236 –<br />

Current liabilities<br />

Other provisions 83,223 564 79,390 559 94,509 5,369<br />

Sundry current liabilities 70,146 2,819 47,533 4,053 49,826 10,397<br />

426,403 319,556 380,494 271,970 348,295 267,023<br />

Losses carried forward 14,434 – 14,756 – 13,532 –<br />

Gross amount 440,837 319,556 395,250 271,970 361,827 267,023<br />

Offsetting item 208,057 208,057 178,165 178,165 184,920 184,920<br />

Reported amount 232,780 111,499 217,085 93,805 176,907 82,103<br />

(EUR thousand) Dec. 31,<br />

2009<br />

Dec. 31,<br />

2008<br />

Corporate income tax 9,448 9,770<br />

German municipal trade tax 4,986 4,986<br />

14,434 14,756<br />

Annual Report 2009 157