ONE ROOF

ONE ROOF

ONE ROOF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements<br />

182 Annual Report 2009<br />

Because current financial instruments have short residual terms<br />

and are measured at market value, their carrying amounts<br />

correspond to market value as of the balance sheet date. Noncurrent<br />

securities in the available-for-sale category are measured<br />

at fair value through equity, and as such their carrying<br />

amounts also correspond to fair value.<br />

The fair value of shares in non-consolidated subsidiaries and<br />

other participating interests is stated if it can be reliably determined.<br />

If fair value cannot be reliably determined, items are<br />

measured at cost in the available-for-sale category.<br />

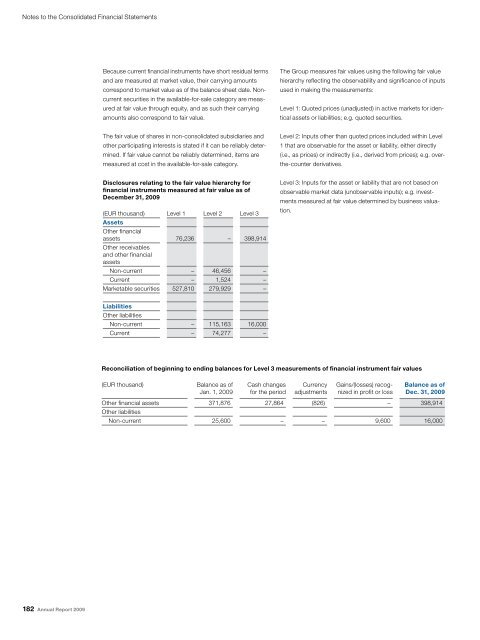

Disclosures relating to the fair value hierarchy for<br />

financial instruments measured at fair value as of<br />

December 31, 2009<br />

(EUR thousand)<br />

Assets<br />

Other financial<br />

Level 1 Level 2 Level 3<br />

assets<br />

Other receivables<br />

and other financial<br />

assets<br />

76,236 – 398,914<br />

Non-current – 46,456 –<br />

Current – 1,524 –<br />

Marketable securities 527,810 279,929 –<br />

Liabilities<br />

Other liabilities<br />

Non-current – 115,163 16,000<br />

Current – 74,277 –<br />

The Group measures fair values using the following fair value<br />

hierarchy reflecting the observability and significance of inputs<br />

used in making the measurements:<br />

Level 1: Quoted prices (unadjusted) in active markets for iden-<br />

tical assets or liabilities; e.g. quoted securities.<br />

Level 2: Inputs other than quoted prices included within Level<br />

1 that are observable for the asset or liability, either directly<br />

(i.e., as prices) or indirectly (i.e., derived from prices); e.g. overthe-counter<br />

derivatives.<br />

Level 3: Inputs for the asset or liability that are not based on<br />

observable market data (unobservable inputs); e.g. investments<br />

measured at fair value determined by business valuation.<br />

Reconciliation of beginning to ending balances for Level 3 measurements of financial instrument fair values<br />

(EUR thousand) Balance as of<br />

Jan. 1, 2009<br />

Cash changes<br />

for the period<br />

Currency<br />

adjustments<br />

Gains/(losses) recognized<br />

in profit or loss<br />

Balance as of<br />

Dec. 31, 2009<br />

Other financial assets<br />

Other liabilities<br />

371,876 27,864 (826) – 398,914<br />

Non-current 25,600 – – 9,600 16,000