ONE ROOF

ONE ROOF

ONE ROOF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Consolidated Financial Statements<br />

148 Annual Report 2009<br />

Of the share of profits and losses of equity-method associates<br />

and jointly controlled entities, EUR 105,817,000 (2008: EUR<br />

48,832,000) relates to associates and EUR 99,139,000 (2008:<br />

EUR 268,169,000) to jointly controlled entities. Most of the<br />

profits were generated by the Asia Pacific division with EUR<br />

103,356,000 (2008: EUR 219,537,000) and the Concessions<br />

division with EUR 68,207,000 (2008: EUR 72,886,000). The<br />

share of profits and losses of equity-method associates and<br />

jointly controlled entities does not include any impairments<br />

(2008: impairments of EUR 35,652,000).<br />

Net income from other participating interests includes EUR<br />

20,965,000 (2008: EUR 37,354,000) in distributed profits of<br />

Southern Cross Airports Corporation Holdings Ltd. from the<br />

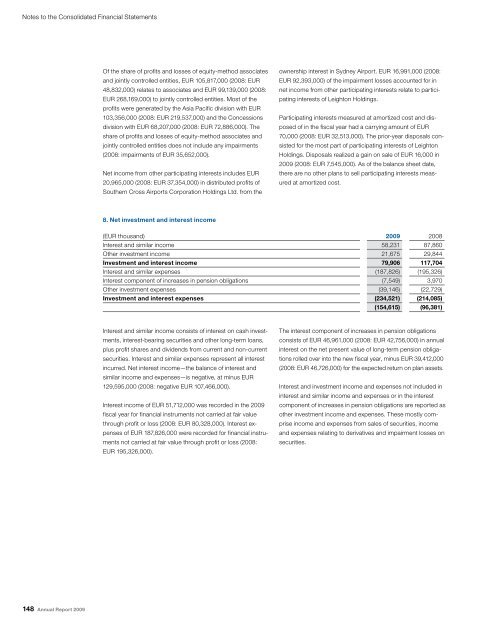

8. Net investment and interest income<br />

Interest and similar income consists of interest on cash investments,<br />

interest-bearing securities and other long-term loans,<br />

plus profit shares and dividends from current and non-current<br />

securities. Interest and similar expenses represent all interest<br />

incurred. Net interest income—the balance of interest and<br />

similar income and expenses—is negative, at minus EUR<br />

129,595,000 (2008: negative EUR 107,466,000).<br />

Interest income of EUR 51,712,000 was recorded in the 2009<br />

fiscal year for financial instruments not carried at fair value<br />

through profit or loss (2008: EUR 80,328,000). Interest expenses<br />

of EUR 187,826,000 were recorded for financial instruments<br />

not carried at fair value through profit or loss (2008:<br />

EUR 195,326,000).<br />

ownership interest in Sydney Airport. EUR 16,991,000 (2008:<br />

EUR 92,393,000) of the impairment losses accounted for in<br />

net income from other participating interests relate to participating<br />

interests of Leighton Holdings.<br />

Participating interests measured at amortized cost and dis-<br />

posed of in the fiscal year had a carrying amount of EUR<br />

70,000 (2008: EUR 32,513,000). The prior-year disposals consisted<br />

for the most part of participating interests of Leighton<br />

Holdings. Disposals realized a gain on sale of EUR 16,000 in<br />

2009 (2008: EUR 7,545,000). As of the balance sheet date,<br />

there are no other plans to sell participating interests measured<br />

at amortized cost.<br />

(EUR thousand) 2009 2008<br />

Interest and similar income 58,231 87,860<br />

Other investment income 21,675 29,844<br />

Investment and interest income 79,906 117,704<br />

Interest and similar expenses (187,826) (195,326)<br />

Interest component of increases in pension obligations (7,549) 3,970<br />

Other investment expenses (39,146) (22,729)<br />

Investment and interest expenses (234,521) (214,085)<br />

(154,615) (96,381)<br />

The interest component of increases in pension obligations<br />

consists of EUR 46,961,000 (2008: EUR 42,756,000) in annual<br />

interest on the net present value of long-term pension obligations<br />

rolled over into the new fiscal year, minus EUR 39,412,000<br />

(2008: EUR 46,726,000) for the expected return on plan assets.<br />

Interest and investment income and expenses not included in<br />

interest and similar income and expenses or in the interest<br />

component of increases in pension obligations are reported as<br />

other investment income and expenses. These mostly comprise<br />

income and expenses from sales of securities, income<br />

and expenses relating to derivatives and impairment losses on<br />

securities.