ONE ROOF

ONE ROOF

ONE ROOF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements<br />

190 Annual Report 2009<br />

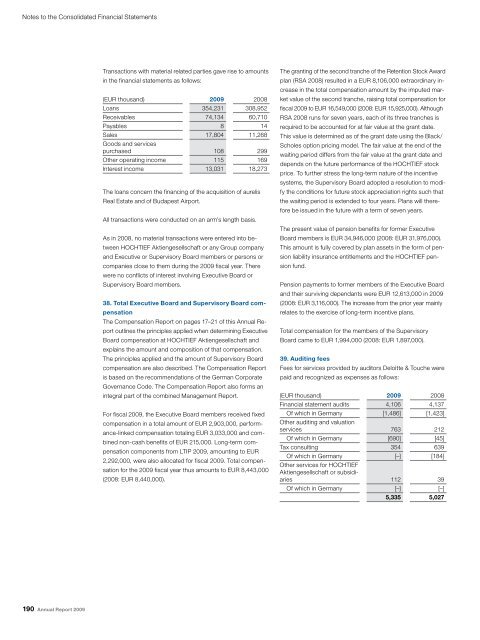

Transactions with material related parties gave rise to amounts<br />

in the financial statements as follows:<br />

(EUR thousand) 2009 2008<br />

Loans 354,231 308,952<br />

Receivables 74,134 60,710<br />

Payables 8 14<br />

Sales 17,804 11,268<br />

Goods and services<br />

purchased 108 299<br />

Other operating income 115 169<br />

Interest income 13,031 18,273<br />

The loans concern the financing of the acquisition of aurelis<br />

Real Estate and of Budapest Airport.<br />

All transactions were conducted on an arm’s length basis.<br />

As in 2008, no material transactions were entered into be-<br />

tween HOCHTIEF Aktiengesellschaft or any Group company<br />

and Executive or Supervisory Board members or persons or<br />

companies close to them during the 2009 fiscal year. There<br />

were no conflicts of interest involving Executive Board or<br />

Supervisory Board members.<br />

38. Total Executive Board and Supervisory Board com-<br />

pensation<br />

The Compensation Report on pages 17–21 of this Annual Report<br />

outlines the principles applied when determining Executive<br />

Board compensation at HOCHTIEF Aktiengesellschaft and<br />

explains the amount and composition of that compensation.<br />

The principles applied and the amount of Supervisory Board<br />

compensation are also described. The Compensation Report<br />

is based on the recommendations of the German Corporate<br />

Governance Code. The Compensation Report also forms an<br />

integral part of the combined Management Report.<br />

For fiscal 2009, the Executive Board members received fixed<br />

compensation in a total amount of EUR 2,903,000, performance-linked<br />

compensation totaling EUR 3,033,000 and combined<br />

non-cash benefits of EUR 215,000. Long-term compensation<br />

components from LTIP 2009, amounting to EUR<br />

2,292,000, were also allocated for fiscal 2009. Total compensation<br />

for the 2009 fiscal year thus amounts to EUR 8,443,000<br />

(2008: EUR 8,440,000).<br />

The granting of the second tranche of the Retention Stock Award<br />

plan (RSA 2008) resulted in a EUR 8,106,000 extraordinary increase<br />

in the total compensation amount by the imputed market<br />

value of the second tranche, raising total compensation for<br />

fiscal 2009 to EUR 16,549,000 (2008: EUR 15,925,000). Although<br />

RSA 2008 runs for seven years, each of its three tranches is<br />

required to be accounted for at fair value at the grant date.<br />

This value is determined as of the grant date using the Black/<br />

Scholes option pricing model. The fair value at the end of the<br />

waiting period differs from the fair value at the grant date and<br />

depends on the future performance of the HOCHTIEF stock<br />

price. To further stress the long-term nature of the incentive<br />

systems, the Supervisory Board adopted a resolution to modify<br />

the conditions for future stock appreciation rights such that<br />

the waiting period is extended to four years. Plans will therefore<br />

be issued in the future with a term of seven years.<br />

The present value of pension benefits for former Executive<br />

Board members is EUR 34,946,000 (2008: EUR 31,976,000).<br />

This amount is fully covered by plan assets in the form of pension<br />

liability insurance entitlements and the HOCHTIEF pension<br />

fund.<br />

Pension payments to former members of the Executive Board<br />

and their surviving dependants were EUR 12,613,000 in 2009<br />

(2008: EUR 3,116,000). The increase from the prior year mainly<br />

relates to the exercise of long-term incentive plans.<br />

Total compensation for the members of the Supervisory<br />

Board came to EUR 1,994,000 (2008: EUR 1,897,000).<br />

39. Auditing fees<br />

Fees for services provided by auditors Deloitte & Touche were<br />

paid and recognized as expenses as follows:<br />

(EUR thousand) 2009 2008<br />

Financial statement audits 4,106 4,137<br />

Of which in Germany [1,486] [1,423]<br />

Other auditing and valuation<br />

services 763 212<br />

Of which in Germany [690] [45]<br />

Tax consulting 354 639<br />

Of which in Germany<br />

Other services for HOCHTIEF<br />

Aktiengesellschaft or subsidi-<br />

[–] [184]<br />

aries 112 39<br />

Of which in Germany [–] [–]<br />

5,335 5,027