ONE ROOF

ONE ROOF

ONE ROOF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

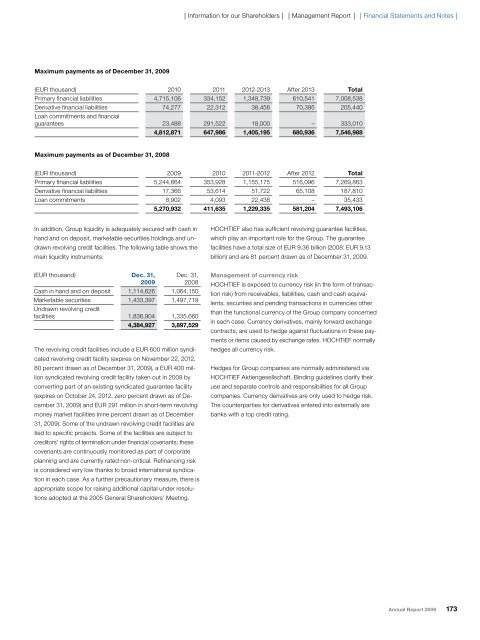

Maximum payments as of December 31, 2009<br />

In addition, Group liquidity is adequately secured with cash in<br />

hand and on deposit, marketable securities holdings and undrawn<br />

revolving credit facilities. The following table shows the<br />

main liquidity instruments:<br />

The revolving credit facilities include a EUR 600 million syndi-<br />

cated revolving credit facility (expires on November 22, 2012,<br />

80 percent drawn as of December 31, 2009), a EUR 400 million<br />

syndicated revolving credit facility taken out in 2009 by<br />

converting part of an existing syndicated guarantee facility<br />

(expires on October 24, 2012, zero percent drawn as of December<br />

31, 2009) and EUR 291 million in short-term revolving<br />

money market facilities (nine percent drawn as of December<br />

31, 2009). Some of the undrawn revolving credit facilities are<br />

tied to specific projects. Some of the facilities are subject to<br />

creditors’ rights of termination under financial covenants; these<br />

covenants are continuously monitored as part of corporate<br />

planning and are currently rated non-critical. Refinancing risk<br />

is considered very low thanks to broad international syndication<br />

in each case. As a further precautionary measure, there is<br />

appropriate scope for raising additional capital under resolutions<br />

adopted at the 2005 General Shareholders’ Meeting.<br />

❘ Information for our Shareholders ❘ ❘ Management Report ❘ ❘ Financial Statements and Notes ❘<br />

(EUR thousand) 2010 2011 2012-2013 After 2013 Total<br />

Primary financial liabilities 4,715,106 334,152 1,348,739 610,541 7,008,538<br />

Derivative financial liabilities 74,277 22,312 38,456 70,395 205,440<br />

Loan commitments and financial<br />

guarantees 23,488 291,522 18,000 – 333,010<br />

4,812,871 647,986 1,405,195 680,936 7,546,988<br />

Maximum payments as of December 31, 2008<br />

(EUR thousand) 2009 2010 2011-2012 After 2012 Total<br />

Primary financial liabilities 5,244,664 353,928 1,155,175 516,096 7,269,863<br />

Derivative financial liabilities 17,366 53,614 51,722 65,108 187,810<br />

Loan commitments 8,902 4,093 22,438 – 35,433<br />

(EUR thousand) Dec. 31,<br />

2009<br />

5,270,932 411,635 1,229,335 581,204 7,493,106<br />

Dec. 31,<br />

2008<br />

Cash in hand and on deposit 1,114,626 1,064,150<br />

Marketable securities 1,433,397 1,497,719<br />

Undrawn revolving credit<br />

facilities 1,836,904 1,335,660<br />

4,384,927 3,897,529<br />

HOCHTIEF also has sufficient revolving guarantee facilities,<br />

which play an important role for the Group. The guarantee<br />

facilities have a total size of EUR 9.36 billion (2008: EUR 9.13<br />

billion) and are 81 percent drawn as of December 31, 2009.<br />

Management of currency risk<br />

HOCHTIEF is exposed to currency risk (in the form of transaction<br />

risk) from receivables, liabilities, cash and cash equivalents,<br />

securities and pending transactions in currencies other<br />

than the functional currency of the Group company concerned<br />

in each case. Currency derivatives, mainly forward exchange<br />

contracts, are used to hedge against fluctuations in these payments<br />

or items caused by exchange rates. HOCHTIEF normally<br />

hedges all currency risk.<br />

Hedges for Group companies are normally administered via<br />

HOCHTIEF Aktiengesellschaft. Binding guidelines clarify their<br />

use and separate controls and responsibilities for all Group<br />

companies. Currency derivatives are only used to hedge risk.<br />

The counterparties for derivatives entered into externally are<br />

banks with a top credit rating.<br />

Annual Report 2009 173