ONE ROOF

ONE ROOF

ONE ROOF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements<br />

176 Annual Report 2009<br />

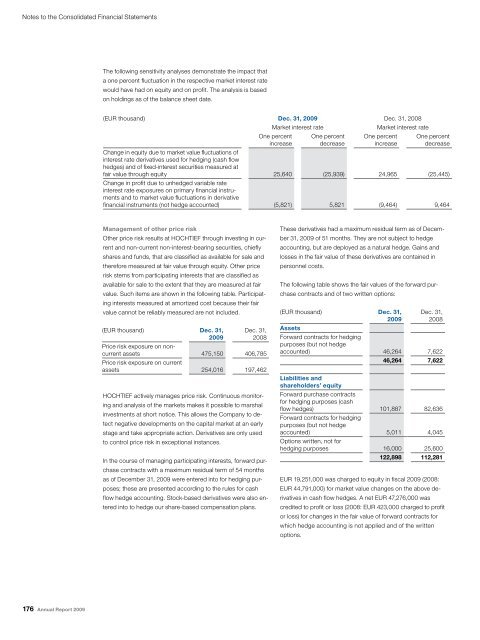

The following sensitivity analyses demonstrate the impact that<br />

a one percent fluctuation in the respective market interest rate<br />

would have had on equity and on profit. The analysis is based<br />

on holdings as of the balance sheet date.<br />

(EUR thousand) Dec. 31, 2009 Dec. 31, 2008<br />

Management of other price risk<br />

Other price risk results at HOCHTIEF through investing in current<br />

and non-current non-interest-bearing securities, chiefly<br />

shares and funds, that are classified as available for sale and<br />

therefore measured at fair value through equity. Other price<br />

risk stems from participating interests that are classified as<br />

available for sale to the extent that they are measured at fair<br />

value. Such items are shown in the following table. Participating<br />

interests measured at amortized cost because their fair<br />

value cannot be reliably measured are not included.<br />

HOCHTIEF actively manages price risk. Continuous monitor-<br />

ing and analysis of the markets makes it possible to marshal<br />

investments at short notice. This allows the Company to detect<br />

negative developments on the capital market at an early<br />

stage and take appropriate action. Derivatives are only used<br />

to control price risk in exceptional instances.<br />

In the course of managing participating interests, forward pur-<br />

chase contracts with a maximum residual term of 54 months<br />

as of December 31, 2009 were entered into for hedging purposes;<br />

these are presented according to the rules for cash<br />

flow hedge accounting. Stock-based derivatives were also entered<br />

into to hedge our share-based compensation plans.<br />

Market interest rate Market interest rate<br />

One percent<br />

increase<br />

These derivatives had a maximum residual term as of December<br />

31, 2009 of 51 months. They are not subject to hedge<br />

accounting, but are deployed as a natural hedge. Gains and<br />

losses in the fair value of these derivatives are contained in<br />

personnel costs.<br />

The following table shows the fair values of the forward pur-<br />

chase contracts and of two written options:<br />

(EUR thousand) Dec. 31,<br />

2009<br />

Assets<br />

EUR 19,251,000 was charged to equity in fiscal 2009 (2008:<br />

EUR 44,791,000) for market value changes on the above derivatives<br />

in cash flow hedges. A net EUR 47,276,000 was<br />

credited to profit or loss (2008: EUR 423,000 charged to profit<br />

or loss) for changes in the fair value of forward contracts for<br />

which hedge accounting is not applied and of the written<br />

options.<br />

One percent<br />

decrease<br />

One percent<br />

increase<br />

One percent<br />

decrease<br />

Change in equity due to market value fluctuations of<br />

interest rate derivatives used for hedging (cash flow<br />

hedges) and of fixed-interest securities meas ured at<br />

fair value through equity 25,640 (25,939) 24,965 (25,445)<br />

Change in profit due to unhedged variable rate<br />

interest rate exposures on primary financial instruments<br />

and to market value fluctuations in derivative<br />

financial instruments (not hedge accounted) (5,821) 5,821 (9,464) 9,464<br />

(EUR thousand) Dec. 31,<br />

2009<br />

Dec. 31,<br />

2008<br />

Price risk exposure on noncurrent<br />

assets<br />

Price risk exposure on current<br />

475,150 406,785<br />

assets 254,016 197,462<br />

Dec. 31,<br />

2008<br />

Forward contracts for hedging<br />

purposes (but not hedge<br />

accounted) 46,264 7,622<br />

46,264 7,622<br />

Liabilities and<br />

sharehold ers’ equity<br />

Forward purchase contracts<br />

for hedging purposes (cash<br />

flow hedges)<br />

Forward contracts for hedging<br />

purposes (but not hedge<br />

101,887 82,636<br />

accounted)<br />

Options written, not for<br />

5,011 4,045<br />

hedging purposes 16,000 25,600<br />

122,898 112,281