ONE ROOF

ONE ROOF

ONE ROOF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements<br />

168 Annual Report 2009<br />

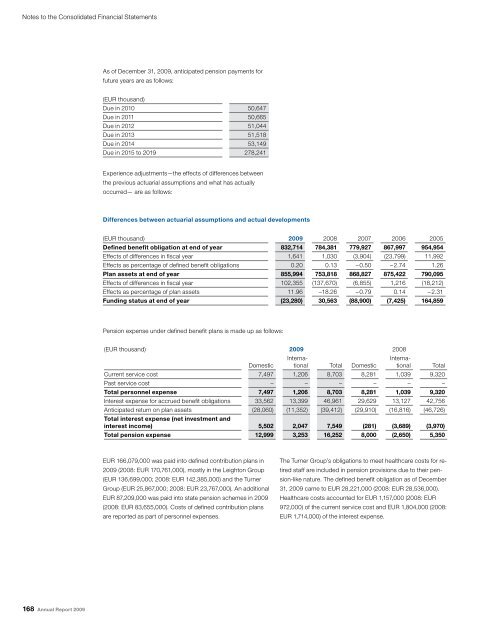

As of December 31, 2009, anticipated pension payments for<br />

future years are as follows:<br />

(EUR thousand)<br />

Due in 2010 50,647<br />

Due in 2011 50,665<br />

Due in 2012 51,044<br />

Due in 2013 51,518<br />

Due in 2014 53,149<br />

Due in 2015 to 2019 278,241<br />

Experience adjustments—the effects of differences between<br />

the previous actuarial assumptions and what has actually<br />

occurred— are as follows:<br />

Differences between actuarial assumptions and actual developments<br />

(EUR thousand) 2009 2008 2007 2006 2005<br />

Defined benefit obligation at end of year 832,714 784,381 779,927 867,997 954,954<br />

Effects of differences in fiscal year 1,641 1,030 (3,904) (23,799) 11,992<br />

Effects as percent age of defined benefit obligations 0.20 0.13 – 0.50 – 2.74 1.26<br />

Plan assets at end of year 855,994 753,818 868,827 875,422 790,095<br />

Effects of differences in fiscal year 102,355 (137,670) (6,855) 1,216 (18,212)<br />

Effects as percent age of plan assets 11.96 –18.26 – 0.79 0.14 – 2.31<br />

Funding status at end of year (23,280) 30,563 (88,900) (7,425) 164,859<br />

Pension expense under defined benefit plans is made up as follows:<br />

(EUR thousand) 2009 2008<br />

D o m e s t i c<br />

EUR 166,079,000 was paid into defined contribution plans in<br />

2009 (2008: EUR 170,761,000), mostly in the Leighton Group<br />

(EUR 136,699,000; 2008: EUR 142,385,000) and the Turner<br />

Group (EUR 25,867,000; 2008: EUR 23,767,000). An additional<br />

EUR 87,209,000 was paid into state pension schemes in 2009<br />

(2008: EUR 83,655,000). Costs of defined contribution plans<br />

are reported as part of personnel expenses.<br />

International<br />

Total D o m e s t i c<br />

International<br />

Total<br />

Current service cost 7,497 1,206 8,703 8,281 1,039 9,320<br />

Past service cost – – – – – –<br />

Total personnel expense 7,497 1,206 8,703 8,281 1,039 9,320<br />

Interest expense for accrued benefit obligations 33,562 13,399 46,961 29,629 13,127 42,756<br />

Anticipated return on plan assets (28,060) (11,352) (39,412) (29,910) (16,816) (46,726)<br />

Total interest expense (net investment and<br />

interest income) 5,502 2,047 7,549 (281) (3,689) (3,970)<br />

Total pension expense 12,999 3,253 16,252 8,000 (2,650) 5,350<br />

The Turner Group’s obligations to meet healthcare costs for retired<br />

staff are included in pension provisions due to their pension-like<br />

nature. The defined benefit obligation as of December<br />

31, 2009 came to EUR 28,221,000 (2008: EUR 28,536,000).<br />

Healthcare costs accounted for EUR 1,157,000 (2008: EUR<br />

972,000) of the current service cost and EUR 1,804,000 (2008:<br />

EUR 1,714,000) of the interest expense.