ONE ROOF

ONE ROOF

ONE ROOF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

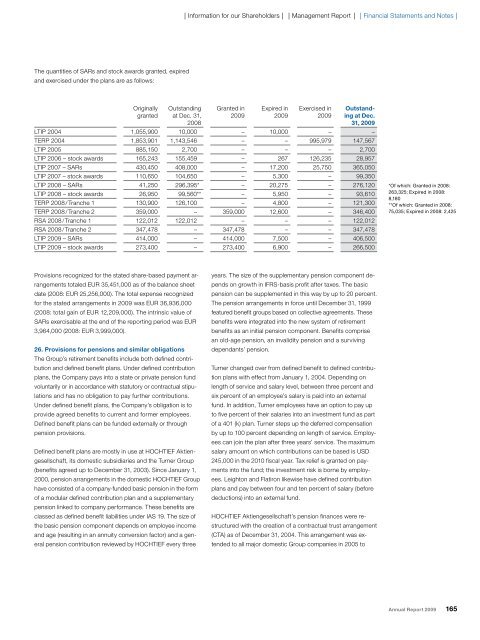

The quantities of SARs and stock awards granted, expired<br />

and exercised under the plans are as follows:<br />

Originally<br />

granted<br />

Provisions recognized for the stated share-based payment ar-<br />

rangements totaled EUR 35,451,000 as of the balance sheet<br />

date (2008: EUR 25,256,000). The total expense recognized<br />

for the stated arrangements in 2009 was EUR 36,936,000<br />

(2008: total gain of EUR 12,209,000). The intrinsic value of<br />

SARs exercisable at the end of the reporting period was EUR<br />

3,964,000 (2008: EUR 3,999,000).<br />

26. Provisions for pensions and similar obligations<br />

The Group’s retirement benefits include both defined contribution<br />

and defined benefit plans. Under defined contribution<br />

plans, the Company pays into a state or private pension fund<br />

voluntarily or in accordance with statutory or contractual stipulations<br />

and has no obligation to pay further contributions.<br />

Under defined benefit plans, the Company’s obligation is to<br />

provide agreed benefits to current and former employees.<br />

Defined benefit plans can be funded externally or through<br />

pension provisions.<br />

Defined benefit plans are mostly in use at HOCHTIEF Aktien-<br />

gesellschaft, its domestic subsidiaries and the Turner Group<br />

(benefits agreed up to December 31, 2003). Since January 1,<br />

2000, pension arrangements in the domestic HOCHTIEF Group<br />

have consisted of a company-funded basic pension in the form<br />

of a modular defined contribution plan and a supplementary<br />

pension linked to company performance. These benefits are<br />

classed as defined benefit liabilities under IAS 19. The size of<br />

the basic pension component depends on employee income<br />

and age (resulting in an annuity conversion factor) and a general<br />

pension contribution reviewed by HOCHTIEF every three<br />

❘ Information for our Shareholders ❘ ❘ Management Report ❘ ❘ Financial Statements and Notes ❘<br />

Outstanding<br />

at Dec. 31,<br />

2008<br />

Granted in<br />

2009<br />

years. The size of the supplementary pension component depends<br />

on growth in IFRS-basis profit after taxes. The basic<br />

pension can be supplemented in this way by up to 20 percent.<br />

The pension arrangements in force until December 31, 1999<br />

featured benefit groups based on collective agreements. These<br />

benefits were integrated into the new system of retirement<br />

benefits as an initial pension component. Benefits comprise<br />

an old-age pension, an invalidity pension and a surviving<br />

dependants’ pension.<br />

Expired in<br />

2009<br />

Exercised in<br />

2009<br />

Outstanding<br />

at Dec.<br />

31, 2009<br />

LTIP 2004 1,055,900 10,000 – 10,000 – –<br />

TERP 2004 1,853,901 1,143,546 – – 995,979 147,567<br />

LTIP 2005 885,150 2,700 – – – 2,700<br />

LTIP 2006 – stock awards 165,243 155,459 – 267 126,235 28,957<br />

LTIP 2007 – SARs 430,450 408,000 – 17,200 25,750 365,050<br />

LTIP 2007 – stock awards 110,650 104,650 – 5,300 – 99,350<br />

LTIP 2008 – SARs 41,250 296,395* – 20,275 – 276,120<br />

LTIP 2008 – stock awards 26,950 99,560** – 5,950 – 93,610<br />

TERP 2008 / Tranche 1 130,900 126,100 – 4,800 – 121,300<br />

TERP 2008 / Tranche 2 359,000 – 359,000 12,600 – 346,400<br />

RSA 2008 / Tranche 1 122,012 122,012 – – – 122,012<br />

RSA 2008 / Tranche 2 347,478 – 347,478 – – 347,478<br />

LTIP 2009 – SARs 414,000 – 414,000 7,500 – 406,500<br />

LTIP 2009 – stock awards 273,400 – 273,400 6,900 – 266,500<br />

Turner changed over from defined benefit to defined contribu-<br />

tion plans with effect from January 1, 2004. Depending on<br />

length of service and salary level, between three percent and<br />

six percent of an employee’s salary is paid into an external<br />

fund. In addition, Turner employees have an option to pay up<br />

to five percent of their salaries into an investment fund as part<br />

of a 401 (k) plan. Turner steps up the deferred compensation<br />

by up to 100 percent depending on length of service. Employees<br />

can join the plan after three years’ service. The maximum<br />

salary amount on which contributions can be based is USD<br />

245,000 in the 2010 fiscal year. Tax relief is granted on payments<br />

into the fund; the investment risk is borne by employees.<br />

Leighton and Flatiron likewise have defined contribution<br />

plans and pay between four and ten percent of salary (before<br />

deductions) into an external fund.<br />

HOCHTIEF Aktiengesellschaft’s pension finances were re-<br />

structured with the creation of a contractual trust arrangement<br />

(CTA) as of December 31, 2004. This arrangement was extended<br />

to all major domestic Group companies in 2005 to<br />

*Of which: Granted in 2008:<br />

263,325; Expired in 2008:<br />

8,180<br />

**Of which: Granted in 2008:<br />

75,035; Expired in 2008: 2,425<br />

Annual Report 2009 165