ONE ROOF

ONE ROOF

ONE ROOF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

HOCHTIEF Group performance<br />

The HOCHTIEF Group generated a 13.8 percent return<br />

on net assets in fiscal 2009 (versus 13.1 percent in 2008).<br />

This places us well above our target of equaling cost of<br />

capital.<br />

The fiscal 2008 figures have been restated as a result<br />

of HOCHTIEF electing early application of IFRIC 15.*<br />

This ensures comparability with the figures for the year<br />

under review. In comparison with the accounting policies<br />

applied in that year, RONA for 2008 is reduced<br />

from 13.5 percent to 13.1 percent. Prior-year value created<br />

falls from EUR 186.6 million to EUR 164.5 million.<br />

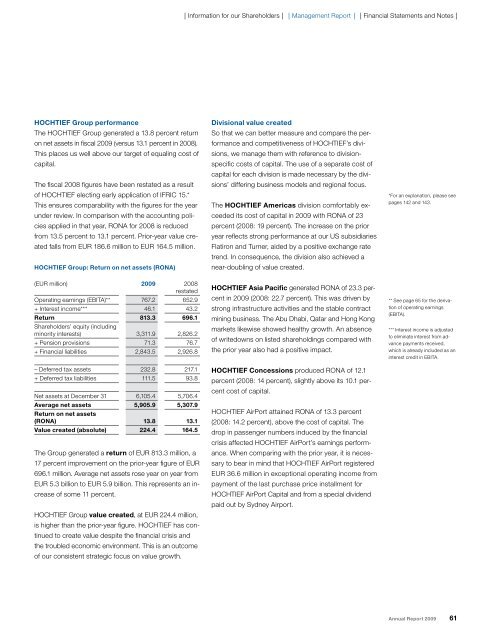

HOCHTIEF Group: Return on net assets (RONA)<br />

(EUR million) 2009 2008<br />

restated<br />

Operating earnings (EBITA)** 767.2 652.9<br />

+ Interest income*** 46.1 43.2<br />

Return<br />

Shareholders’ equity (including<br />

813.3 696.1<br />

minority interests) 3,311.9 2,826.2<br />

+ Pension provisions 71.3 76.7<br />

+ Financial liabilities 2,843.5 2,926.8<br />

– Deferred tax assets 232.8 217.1<br />

+ Deferred tax liabilities 111.5 93.8<br />

Net assets at December 31 6,105.4 5,706.4<br />

Average net assets<br />

Return on net assets<br />

5,905.9 5,307.9<br />

(RONA) 13.8 13.1<br />

Value created (absolute) 224.4 164.5<br />

The Group generated a return of EUR 813.3 million, a<br />

17 percent improvement on the prior-year figure of EUR<br />

696.1 million. Average net assets rose year on year from<br />

EUR 5.3 billion to EUR 5.9 billion. This represents an increase<br />

of some 11 percent.<br />

HOCHTIEF Group value created, at EUR 224.4 million,<br />

is higher than the prior-year figure. HOCHTIEF has con-<br />

tinued to create value despite the financial crisis and<br />

the troubled economic environment. This is an outcome<br />

of our consistent strategic focus on value growth.<br />

❘ Information for our Shareholders ❘ ❘ Management Report ❘ ❘ Financial Statements and Notes ❘<br />

Divisional value created<br />

So that we can better measure and compare the performance<br />

and competitiveness of HOCHTIEF’s divisions,<br />

we manage them with reference to divisionspecific<br />

costs of capital. The use of a separate cost of<br />

capital for each division is made necessary by the divisions’<br />

differing business models and regional focus.<br />

The HOCHTIEF Americas division comfortably ex-<br />

ceeded its cost of capital in 2009 with RONA of 23<br />

percent (2008: 19 percent). The increase on the prior<br />

year reflects strong performance at our US subsidiaries<br />

Flatiron and Turner, aided by a positive exchange rate<br />

trend. In consequence, the division also achieved a<br />

near-doubling of value created.<br />

HOCHTIEF Asia Pacific generated RONA of 23.3 per-<br />

cent in 2009 (2008: 22.7 percent). This was driven by<br />

strong infrastructure activities and the stable contract<br />

mining business. The Abu Dhabi, Qatar and Hong Kong<br />

markets likewise showed healthy growth. An absence<br />

of writedowns on listed shareholdings compared with<br />

the prior year also had a positive impact.<br />

HOCHTIEF Concessions produced RONA of 12.1<br />

percent (2008: 14 percent), slightly above its 10.1 percent<br />

cost of capital.<br />

HOCHTIEF AirPort attained RONA of 13.3 percent<br />

(2008: 14.2 percent), above the cost of capital. The<br />

drop in passenger numbers induced by the financial<br />

crisis affected HOCHTIEF AirPort’s earnings performance.<br />

When comparing with the prior year, it is necessary<br />

to bear in mind that HOCHTIEF AirPort registered<br />

EUR 36.6 million in exceptional operating income from<br />

payment of the last purchase price installment for<br />

HOCHTIEF AirPort Capital and from a special dividend<br />

paid out by Sydney Airport.<br />

*For an explanation, please see<br />

pages 142 and 143.<br />

** See page 65 for the derivation<br />

of operating earnings<br />

(EBITA).<br />

*** Interest income is adjusted<br />

to eliminate interest from advance<br />

payments received,<br />

which is already included as an<br />

interest credit in EBITA.<br />

Annual Report 2009 61