ONE ROOF

ONE ROOF

ONE ROOF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

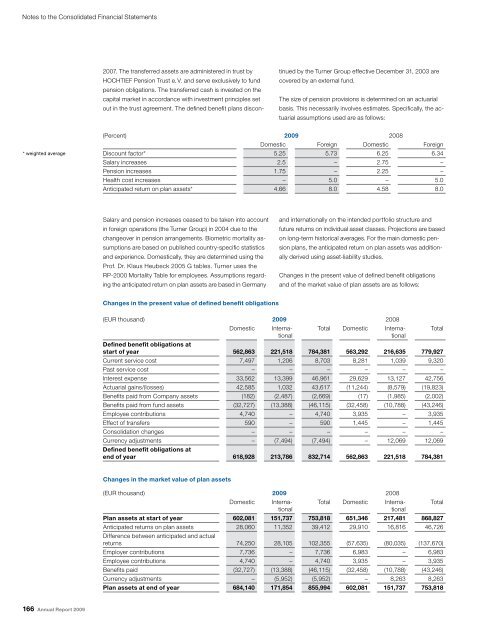

Notes to the Consolidated Financial Statements<br />

* weighted average<br />

166 Annual Report 2009<br />

2007. The transferred assets are administered in trust by<br />

HOCHTIEF Pension Trust e. V. and serve exclusively to fund<br />

pension obligations. The transferred cash is invested on the<br />

capital market in accordance with investment principles set<br />

out in the trust agreement. The defined benefit plans discon-<br />

Changes in the present value of defined benefit obligations<br />

(EUR thousand) 2009 2008<br />

Domestic International<br />

Total Domestic International<br />

Defined benefit obligations at<br />

start of year 562,863 221,518 784,381 563,292 216,635 779,927<br />

Current service cost 7,497 1,206 8,703 8,281 1,039 9,320<br />

Past service cost – – – – – –<br />

Interest expense 33,562 13,399 46,961 29,629 13,127 42,756<br />

Actuarial gains/(losses) 42,585 1,032 43,617 (11,244) (8,579) (19,823)<br />

Benefits paid from Company assets (182) (2,487) (2,669) (17) (1,985) (2,002)<br />

Benefits paid from fund assets (32,727) (13,388) (46,115) (32,458) (10,788) (43,246)<br />

Employee contributions 4,740 – 4,740 3,935 – 3,935<br />

Effect of transfers 590 – 590 1,445 – 1,445<br />

Consolidation changes – – – – – –<br />

Currency adjustments<br />

Defined benefit obligations at<br />

– (7,494) (7,494) – 12,069 12,069<br />

end of year 618,928 213,786 832,714 562,863 221,518 784,381<br />

Changes in the market value of plan assets<br />

(EUR thousand) 2009 2008<br />

Domestic International<br />

tinued by the Turner Group effective December 31, 2003 are<br />

covered by an external fund.<br />

The size of pension provisions is determined on an actuarial<br />

basis. This necessarily involves estimates. Specifically, the actuarial<br />

assumptions used are as follows:<br />

(Percent) 2009 2008<br />

Domestic Foreign Domestic Foreign<br />

Discount factor* 5.25 5.73 6.25 6.34<br />

Salary increases 2.5 – 2.75 –<br />

Pension increases 1.75 – 2.25 –<br />

Health cost increases – 5.0 – 5.0<br />

Anticipated return on plan assets* 4.66 8.0 4.58 8.0<br />

Salary and pension increases ceased to be taken into account<br />

in foreign operations (the Turner Group) in 2004 due to the<br />

changeover in pension arrangements. Biometric mortality assumptions<br />

are based on published country-specific statistics<br />

and experience. Domestically, they are determined using the<br />

Prof. Dr. Klaus Heubeck 2005 G tables. Turner uses the<br />

RP-2000 Mortality Table for employees. Assumptions regarding<br />

the anticipated return on plan assets are based in Germany<br />

and internationally on the intended portfolio structure and<br />

future returns on individual asset classes. Projections are based<br />

on long-term historical averages. For the main domestic pen-<br />

sion plans, the anticipated return on plan assets was addition-<br />

ally derived using asset-liability studies.<br />

Changes in the present value of defined benefit obligations<br />

and of the market value of plan assets are as follows:<br />

Total Domestic International<br />

Plan assets at start of year 602,081 151,737 753,818 651,346 217,481 868,827<br />

Anticipated returns on plan assets<br />

Difference between anticipated and actual<br />

28,060 11,352 39,412 29,910 16,816 46,726<br />

returns 74,250 28,105 102,355 (57,635) (80,035) (137,670)<br />

Employer contributions 7,736 – 7,736 6,983 – 6,983<br />

Employee contributions 4,740 – 4,740 3,935 – 3,935<br />

Benefits paid (32,727) (13,388) (46,115) (32,458) (10,788) (43,246)<br />

Currency adjustments – (5,952) (5,952) – 8,263 8,263<br />

Plan assets at end of year 684,140 171,854 855,994 602,081 151,737 753,818<br />

Total<br />

Total