ONE ROOF

ONE ROOF

ONE ROOF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements<br />

170 Annual Report 2009<br />

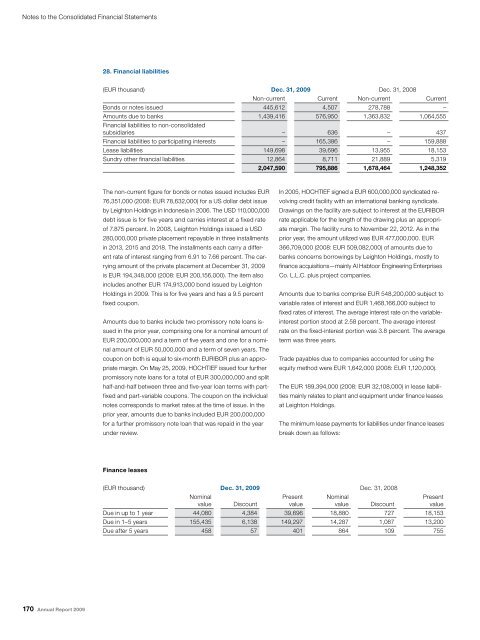

28. Financial liabilities<br />

(EUR thousand) Dec. 31, 2009 Dec. 31, 2008<br />

The non-current figure for bonds or notes issued includes EUR<br />

76,351,000 (2008: EUR 78,632,000) for a US dollar debt issue<br />

by Leighton Holdings in Indonesia in 2006. The USD 110,000,000<br />

debt issue is for five years and carries interest at a fixed rate<br />

of 7.875 percent. In 2008, Leighton Holdings issued a USD<br />

280,000,000 private placement repayable in three installments<br />

in 2013, 2015 and 2018. The installments each carry a different<br />

rate of interest ranging from 6.91 to 7.66 percent. The carrying<br />

amount of the private placement at December 31, 2009<br />

is EUR 194,348,000 (2008: EUR 200,156,000). The item also<br />

includes another EUR 174,913,000 bond issued by Leighton<br />

Holdings in 2009. This is for five years and has a 9.5 percent<br />

fixed coupon.<br />

Amounts due to banks include two promissory note loans is-<br />

sued in the prior year, comprising one for a nominal amount of<br />

EUR 200,000,000 and a term of five years and one for a nominal<br />

amount of EUR 50,000,000 and a term of seven years. The<br />

coupon on both is equal to six-month EURIBOR plus an appropriate<br />

margin. On May 25, 2009, HOCHTIEF issued four further<br />

promissory note loans for a total of EUR 300,000,000 and split<br />

half-and-half between three and five-year loan terms with partfixed<br />

and part-variable coupons. The coupon on the individual<br />

notes corresponds to market rates at the time of issue. In the<br />

prior year, amounts due to banks included EUR 200,000,000<br />

for a further promissory note loan that was repaid in the year<br />

under review.<br />

Finance leases<br />

In 2005, HOCHTIEF signed a EUR 600,000,000 syndicated revolving<br />

credit facility with an international banking syndicate.<br />

Drawings on the facility are subject to interest at the EURIBOR<br />

rate applicable for the length of the drawing plus an appropriate<br />

margin. The facility runs to November 22, 2012. As in the<br />

prior year, the amount utilized was EUR 477,000,000. EUR<br />

366,709,000 (2008: EUR 509,082,000) of amounts due to<br />

banks concerns borrowings by Leighton Holdings, mostly to<br />

finance acquisitions—mainly Al Habtoor Engineering Enterprises<br />

Co. L.L.C. plus project companies.<br />

Amounts due to banks comprise EUR 548,200,000 subject to<br />

variable rates of interest and EUR 1,468,166,000 subject to<br />

fixed rates of interest. The average interest rate on the variableinterest<br />

portion stood at 2.58 percent. The average interest<br />

rate on the fixed-interest portion was 3.8 percent. The average<br />

term was three years.<br />

Trade payables due to companies accounted for using the<br />

equity method were EUR 1,642,000 (2008: EUR 1,120,000).<br />

The EUR 189,394,000 (2008: EUR 32,108,000) in lease liabili-<br />

ties mainly relates to plant and equipment under finance leases<br />

at Leighton Holdings.<br />

The minimum lease payments for liabilities under finance leases<br />

break down as follows:<br />

(EUR thousand) Dec. 31, 2009 Dec. 31, 2008<br />

Nominal<br />

value Discount<br />

Non-current Current Non-current Current<br />

Bonds or notes issued 445,612 4,507 278,788 –<br />

Amounts due to banks 1,439,416 576,950 1,363,832 1,064,555<br />

Financial liabilities to non-consolidated<br />

subsidiaries – 636 – 437<br />

Financial liabilities to participating interests – 165,386 – 159,888<br />

Lease liabilities 149,698 39,696 13,955 18,153<br />

Sundry other financial liabilities 12,864 8,711 21,889 5,319<br />

2,047,590 795,886 1,678,464 1,248,352<br />

Present<br />

value<br />

Nominal<br />

value Discount<br />

Present<br />

value<br />

Due in up to 1 year 44,080 4,384 39,696 18,880 727 18,153<br />

Due in 1–5 years 155,435 6,138 149,297 14,287 1,087 13,200<br />

Due after 5 years 458 57 401 864 109 755