ONE ROOF

ONE ROOF

ONE ROOF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

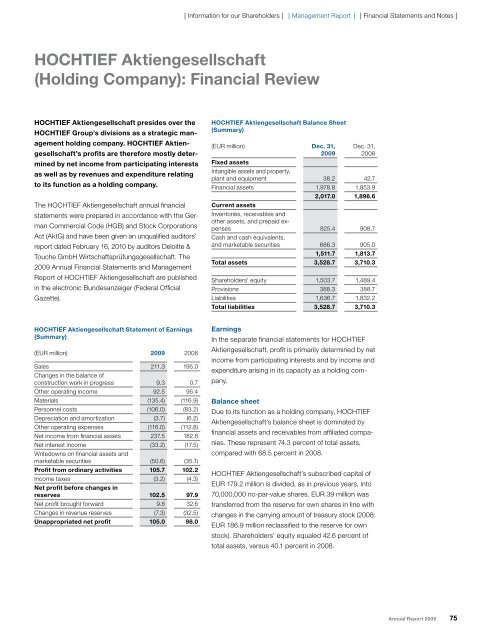

HOCHTIEF Aktiengesellschaft Statement of Earnings<br />

(Summary)<br />

(EUR million) 2009 2008<br />

Sales<br />

Changes in the balance of<br />

211.3 195.0<br />

construction work in progress 9.3 0.7<br />

Other operating income 92.5 95.4<br />

Materials (135.4) (116.9)<br />

Personnel costs (106.0) (83.2)<br />

Depreciation and amortization (3.7) (6.2)<br />

Other operating expenses (116.0) (112.8)<br />

Net income from financial assets 237.5 182.8<br />

Net interest income<br />

Writedowns on financial assets and<br />

(33.2) (17.5)<br />

marketable securities (50.6) (35.1)<br />

Profit from ordinary activities 105.7 102.2<br />

Income taxes<br />

Net profit before changes in<br />

(3.2) (4.3)<br />

reserves 102.5 97.9<br />

Net profit brought forward 9.8 32.6<br />

Changes in revenue reserves (7.3) (32.5)<br />

Unappropriated net profit 105.0 98.0<br />

❘ Information for our Shareholders ❘ ❘ Management Report ❘ ❘ Financial Statements and Notes ❘<br />

HOCHTIEF Aktiengesellschaft<br />

(Holding Company): Financial Review<br />

HOCHTIEF Aktiengesellschaft presides over the<br />

HOCHTIEF Group’s divisions as a strategic management<br />

holding company. HOCHTIEF Aktiengesellschaft’s<br />

profits are therefore mostly determined<br />

by net income from participating interests<br />

as well as by revenues and expenditure relating<br />

to its function as a holding company.<br />

The HOCHTIEF Aktiengesellschaft annual financial<br />

statements were prepared in accordance with the German<br />

Commercial Code (HGB) and Stock Corporations<br />

Act (AktG) and have been given an unqualified auditors’<br />

report dated February 16, 2010 by auditors Deloitte &<br />

Touche GmbH Wirt schafts prüfungsgesellschaft. The<br />

2009 Annual Financial Statements and Management<br />

Report of HOCHTIEF Aktien gesellschaft are published<br />

in the electronic Bundes anzeiger (Federal Official<br />

G a z e t t e ).<br />

HOCHTIEF Aktiengesellschaft Balance Sheet<br />

(Summary)<br />

(EUR million) Dec. 31,<br />

2009<br />

Fixed assets<br />

Dec. 31,<br />

2008<br />

Intangible assets and property,<br />

plant and equipment 38.2 42.7<br />

Financial assets 1,978.8 1,853.9<br />

Current assets<br />

Inventories, receivables and<br />

other assets, and prepaid ex-<br />

2,017.0 1,896.6<br />

penses<br />

Cash and cash equivalents,<br />

825.4 908.7<br />

and marketable securities 686.3 905.0<br />

1,511.7 1,813.7<br />

Total assets 3,528.7 3,710.3<br />

Shareholders’ equity 1,503.7 1,489.4<br />

Provisions 388.3 388.7<br />

Liabilities 1,636.7 1,832.2<br />

Total liabilities 3,528.7 3,710.3<br />

Earnings<br />

In the separate financial statements for HOCHTIEF<br />

Aktiengesellschaft, profit is primarily determined by net<br />

income from participating interests and by income and<br />

expenditure arising in its capacity as a holding company.<br />

Balance sheet<br />

Due to its function as a holding company, HOCHTIEF<br />

Aktiengesellschaft’s balance sheet is dominated by<br />

financial assets and receivables from affiliated compa-<br />

nies. These represent 74.3 percent of total assets,<br />

compared with 68.5 percent in 2008.<br />

HOCHTIEF Aktiengesellschaft’s subscribed capital of<br />

EUR 179.2 million is divided, as in previous years, into<br />

70,000,000 no-par-value shares. EUR 39 million was<br />

transferred from the reserve for own shares in line with<br />

changes in the carrying amount of treasury stock (2008:<br />

EUR 186.9 million reclassified to the reserve for own<br />

stock). Shareholders’ equity equaled 42.6 percent of<br />

total assets, versus 40.1 percent in 2008.<br />

Annual Report 2009 75