ONE ROOF

ONE ROOF

ONE ROOF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The impairments in trade receivables mostly consist of im-<br />

paired contracting-related claims as is typical for the industry.<br />

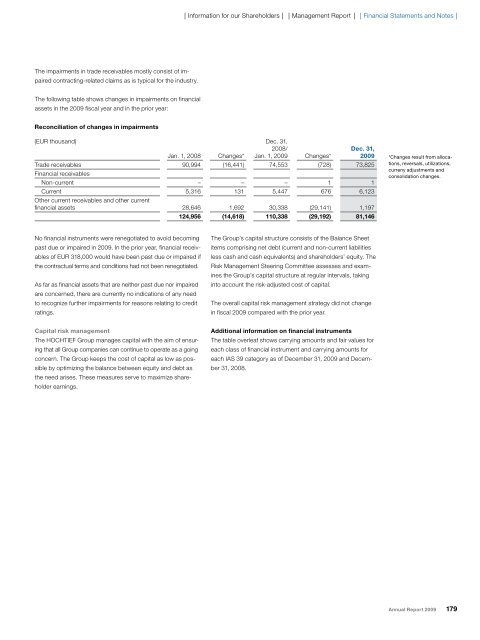

The following table shows changes in impairments on financial<br />

assets in the 2009 fiscal year and in the prior year:<br />

Reconciliation of changes in impairments<br />

No financial instruments were renegotiated to avoid becoming<br />

past due or impaired in 2009. In the prior year, financial receivables<br />

of EUR 318,000 would have been past due or impaired if<br />

the contractual terms and conditions had not been renegotiated.<br />

As far as financial assets that are neither past due nor impaired<br />

are concerned, there are currently no indications of any need<br />

to recognize further impairments for reasons relating to credit<br />

ratings.<br />

Capital risk management<br />

The HOCHTIEF Group manages capital with the aim of ensuring<br />

that all Group companies can continue to operate as a going<br />

concern. The Group keeps the cost of capital as low as possible<br />

by optimizing the balance between equity and debt as<br />

the need arises. These measures serve to maximize shareholder<br />

earnings.<br />

❘ Information for our Shareholders ❘ ❘ Management Report ❘ ❘ Financial Statements and Notes ❘<br />

(EUR thousand)<br />

Dec. 31,<br />

2008/<br />

Dec. 31,<br />

Jan. 1, 2008 Changes* Jan. 1, 2009 Changes* 2009<br />

Trade receivables<br />

Financial receivables<br />

90,994 (16,441) 74,553 (728) 73,825<br />

Non-current – – – 1 1<br />

Current<br />

Other current receivables and other current<br />

5,316 131 5,447 676 6,123<br />

financial assets 28,646 1,692 30,338 (29,141) 1,197<br />

124,956 (14,618) 110,338 (29,192) 81,146<br />

The Group’s capital structure consists of the Balance Sheet<br />

items comprising net debt (current and non-current liabilities<br />

less cash and cash equivalents) and shareholders’ equity. The<br />

Risk Management Steering Committee assesses and examines<br />

the Group’s capital structure at regular intervals, taking<br />

into account the risk-adjusted cost of capital.<br />

The overall capital risk management strategy did not change<br />

in fiscal 2009 compared with the prior year.<br />

Additional information on financial instruments<br />

The table overleaf shows carrying amounts and fair values for<br />

each class of financial instrument and carrying amounts for<br />

each IAS 39 category as of December 31, 2009 and December<br />

31, 2008.<br />

*Changes result from allocations,<br />

reversals, utilizations,<br />

curreny adjustments and<br />

consolidation changes.<br />

Annual Report 2009 179