ONE ROOF

ONE ROOF

ONE ROOF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements<br />

136 Annual Report 2009<br />

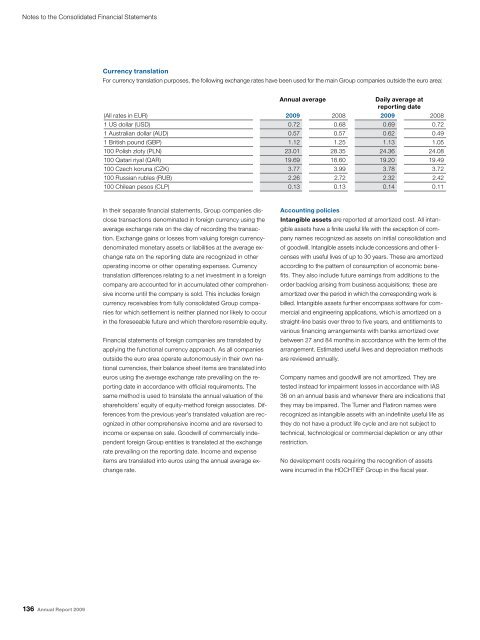

Currency translation<br />

For currency translation purposes, the following exchange rates have been used for the main Group companies outside the euro area:<br />

In their separate financial statements, Group companies dis-<br />

close transactions denominated in foreign currency using the<br />

average exchange rate on the day of recording the transaction.<br />

Exchange gains or losses from valuing foreign currencydenominated<br />

monetary assets or liabilities at the average exchange<br />

rate on the reporting date are recognized in other<br />

operating income or other operating expenses. Currency<br />

translation differences relating to a net investment in a foreign<br />

company are accounted for in accumulated other comprehensive<br />

income until the company is sold. This includes foreign<br />

currency receivables from fully consolidated Group companies<br />

for which settlement is neither planned nor likely to occur<br />

in the foreseeable future and which therefore resemble equity.<br />

Financial statements of foreign companies are translated by<br />

applying the functional currency approach. As all companies<br />

outside the euro area operate autonomously in their own national<br />

currencies, their balance sheet items are translated into<br />

euros using the average exchange rate prevailing on the reporting<br />

date in accordance with official requirements. The<br />

same method is used to translate the annual valuation of the<br />

shareholders’ equity of equity-method foreign associates. Differences<br />

from the previous year’s translated valuation are recognized<br />

in other comprehensive income and are reversed to<br />

income or expense on sale. Goodwill of commercially independent<br />

foreign Group entities is translated at the exchange<br />

rate prevailing on the reporting date. Income and expense<br />

items are translated into euros using the annual average exchange<br />

rate.<br />

Annual average Daily average at<br />

reporting date<br />

(All rates in EUR) 2009 2008 2009 2008<br />

1 US dollar (USD) 0.72 0.68 0.69 0.72<br />

1 Australian dollar (AUD) 0.57 0.57 0.62 0.49<br />

1 British pound (GBP) 1.12 1.25 1.13 1.05<br />

100 Polish zloty (PLN) 23.01 28.35 24.36 24.08<br />

100 Qatari riyal (QAR) 19.69 18.60 19.20 19.49<br />

100 Czech koruna (CZK) 3.77 3.99 3.78 3.72<br />

100 Russian rubles (RUB) 2.26 2.72 2.32 2.42<br />

100 Chilean pesos (CLP) 0.13 0.13 0.14 0.11<br />

Accounting policies<br />

Intangible assets are reported at amortized cost. All intangible<br />

assets have a finite useful life with the exception of company<br />

names recognized as assets on initial consolidation and<br />

of goodwill. Intangible assets include concessions and other licenses<br />

with useful lives of up to 30 years. These are amortized<br />

according to the pattern of consumption of economic benefits.<br />

They also include future earnings from additions to the<br />

order backlog arising from business acquisitions; these are<br />

amortized over the period in which the corresponding work is<br />

billed. Intangible assets further encompass software for commercial<br />

and engineering applications, which is amortized on a<br />

straight-line basis over three to five years, and entitlements to<br />

various financing arrangements with banks amortized over<br />

between 27 and 84 months in accordance with the term of the<br />

arrangement. Estimated useful lives and depreciation methods<br />

are reviewed annually.<br />

Company names and goodwill are not amortized. They are<br />

tested instead for impairment losses in accordance with IAS<br />

36 on an annual basis and whenever there are indications that<br />

they may be impaired. The Turner and Flatiron names were<br />

recognized as intangible assets with an indefinite useful life as<br />

they do not have a product life cycle and are not subject to<br />

technical, technological or commercial depletion or any other<br />

restriction.<br />

No development costs requiring the recognition of assets<br />

were incurred in the HOCHTIEF Group in the fiscal year.