ONE ROOF

ONE ROOF

ONE ROOF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements<br />

*The 2008 figure includes a reversal<br />

in other comprehensive<br />

income of adjustments arising<br />

from the limit in IAS 19.58.<br />

162 Annual Report 2009<br />

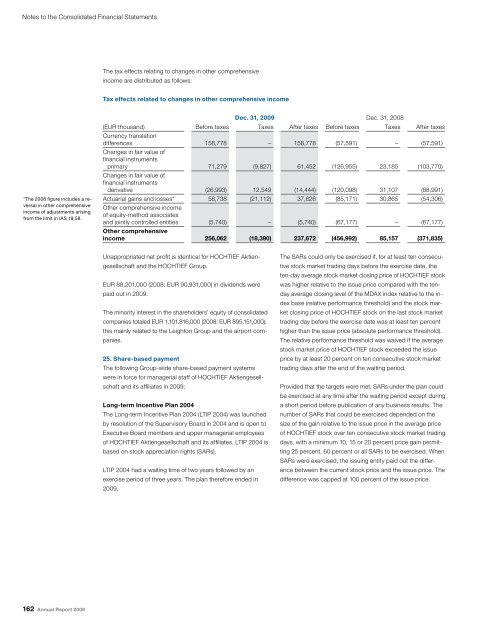

The tax effects relating to changes in other comprehensive<br />

income are distributed as follows:<br />

Tax effects related to changes in other comprehensive income<br />

Unappropriated net profit is identical for HOCHTIEF Aktien-<br />

gesellschaft and the HOCHTIEF Group.<br />

EUR 88,201,000 (2008: EUR 90,931,000) in dividends were<br />

paid out in 2009.<br />

The minority interest in the shareholders’ equity of consolidated<br />

companies totaled EUR 1,101,816,000 (2008: EUR 895,151,000);<br />

this mainly related to the Leighton Group and the airport companies.<br />

25. Share-based payment<br />

The following Group-wide share-based payment systems<br />

were in force for managerial staff of HOCHTIEF Aktiengesellschaft<br />

and its affiliates in 2009:<br />

Long-term Incentive Plan 2004<br />

The Long-term Incentive Plan 2004 (LTIP 2004) was launched<br />

by resolution of the Supervisory Board in 2004 and is open to<br />

Executive Board members and upper managerial employees<br />

of HOCHTIEF Aktiengesellschaft and its affiliates. LTIP 2004 is<br />

based on stock appreciation rights (SARs).<br />

LTIP 2004 had a waiting time of two years followed by an<br />

exercise period of three years. The plan therefore ended in<br />

2009.<br />

Dec. 31, 2009 Dec. 31, 2008<br />

(EUR thousand) Before taxes Taxes After taxes Before taxes Taxes After taxes<br />

Currency translation<br />

differences<br />

Changes in fair value of<br />

financial instruments<br />

158,778 – 158,778 (57,591) – (57,591)<br />

primary<br />

Changes in fair value of<br />

financial instruments<br />

71,279 (9,827) 61,452 (126,955) 23,185 (103,770)<br />

derivative (26,993) 12,549 (14,444) (120,098) 31,107 (88,991)<br />

Actuarial gains and losses*<br />

Other comprehensive income<br />

of equity-method associates<br />

58,738 (21,112) 37,626 (85,171) 30,865 (54,306)<br />

and jointly controlled entities<br />

Other comprehensive<br />

(5,740) – (5,740) (67,177) – (67,177)<br />

income 256,062 (18,390) 237,672 (456,992) 85,157 (371,835)<br />

The SARs could only be exercised if, for at least ten consecutive<br />

stock market trading days before the exercise date, the<br />

ten-day average stock market closing price of HOCHTIEF stock<br />

was higher relative to the issue price compared with the tenday<br />

average closing level of the MDAX index relative to the index<br />

base (relative performance threshold) and the stock market<br />

closing price of HOCHTIEF stock on the last stock market<br />

trading day before the exercise date was at least ten percent<br />

higher than the issue price (absolute performance threshold).<br />

The relative performance threshold was waived if the average<br />

stock market price of HOCHTIEF stock exceeded the issue<br />

price by at least 20 percent on ten consecutive stock market<br />

trading days after the end of the waiting period.<br />

Provided that the targets were met, SARs under the plan could<br />

be exercised at any time after the waiting period except during<br />

a short period before publication of any business results. The<br />

number of SARs that could be exercised depended on the<br />

size of the gain relative to the issue price in the average price<br />

of HOCHTIEF stock over ten consecutive stock market trading<br />

days, with a minimum 10, 15 or 20 percent price gain permitting<br />

25 percent, 60 percent or all SARs to be exercised. When<br />

SARs were exercised, the issuing entity paid out the difference<br />

between the current stock price and the issue price. The<br />

difference was capped at 100 percent of the issue price.