ONE ROOF

ONE ROOF

ONE ROOF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements<br />

174 Annual Report 2009<br />

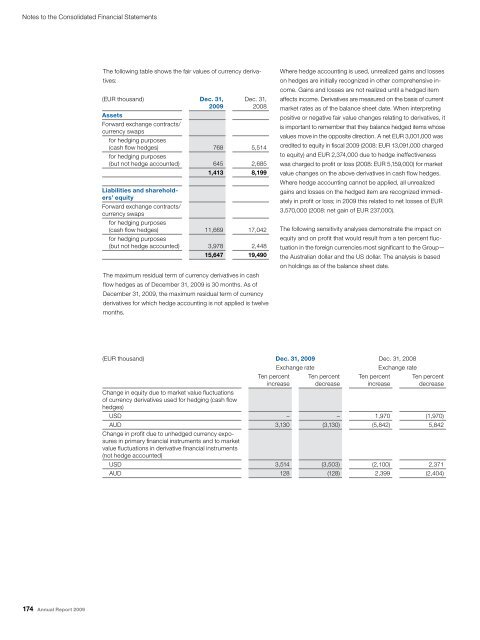

The following table shows the fair values of currency deriva-<br />

tives:<br />

(EUR thousand) Dec. 31,<br />

2009<br />

Dec. 31,<br />

2008<br />

Assets<br />

Forward exchange contracts/<br />

currency swaps<br />

for hedging purposes<br />

(cash flow hedges)<br />

for hedging purposes<br />

768 5,514<br />

(but not hedge accounted) 645 2,685<br />

1,413 8,199<br />

Liabilities and shareholders’<br />

equity<br />

Forward exchange contracts/<br />

currency swaps<br />

for hedging purposes<br />

(cash flow hedges)<br />

for hedging purposes<br />

11,669 17,042<br />

(but not hedge accounted) 3,978 2,448<br />

15,647 19,490<br />

The maximum residual term of currency derivatives in cash<br />

flow hedges as of December 31, 2009 is 30 months. As of<br />

December 31, 2009, the maximum residual term of currency<br />

derivatives for which hedge accounting is not applied is twelve<br />

months.<br />

Where hedge accounting is used, unrealized gains and losses<br />

on hedges are initially recognized in other comprehensive income.<br />

Gains and losses are not realized until a hedged item<br />

affects income. Derivatives are measured on the basis of current<br />

market rates as of the balance sheet date. When interpreting<br />

positive or negative fair value changes relating to derivatives, it<br />

is important to remember that they balance hedged items whose<br />

values move in the opposite direction. A net EUR 3,001,000 was<br />

credited to equity in fiscal 2009 (2008: EUR 13,091,000 charged<br />

to equity) and EUR 2,374,000 due to hedge ineffectiveness<br />

was charged to profit or loss (2008: EUR 5,159,000) for market<br />

value changes on the above derivatives in cash flow hedges.<br />

Where hedge accounting cannot be applied, all unrealized<br />

gains and losses on the hedged item are recognized immediately<br />

in profit or loss; in 2009 this related to net losses of EUR<br />

3,570,000 (2008: net gain of EUR 237,000).<br />

The following sensitivity analyses demonstrate the impact on<br />

equity and on profit that would result from a ten percent fluctuation<br />

in the foreign currencies most significant to the Group—<br />

the Australian dollar and the US dollar. The analysis is based<br />

on holdings as of the balance sheet date.<br />

(EUR thousand) Dec. 31, 2009 Dec. 31, 2008<br />

Ten percent<br />

increase<br />

Exchange rate Exchange rate<br />

Ten percent<br />

decrease<br />

Ten percent<br />

increase<br />

Ten percent<br />

decrease<br />

Change in equity due to market value fluctuations<br />

of currency derivatives used for hedging (cash flow<br />

hedges)<br />

USD – – 1,970 (1,970)<br />

AUD<br />

Change in profit due to unhedged currency exposures<br />

in primary financial instruments and to market<br />

value fluctuations in derivative financial instruments<br />

(not hedge accounted)<br />

3,130 (3,130) (5,842) 5,842<br />

USD 3,514 (3,503) (2,100) 2,371<br />

AUD 128 (128) 2,399 (2,404)