ONE ROOF

ONE ROOF

ONE ROOF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

with the goal of improving an airport’s operating effi<br />

ciency and passenger comfort. Total passenger num<br />

bers served across our airport portfolio stood at 88.7<br />

million in fiscal 2009.<br />

We continually build on our airport operation expertise,<br />

creating substantial added value for the airports we operate.<br />

As an investor, we aim to develop our airport<br />

holdings into profitable transportation and commerce<br />

hubs that are ready for the challenges of the future.<br />

Our many years’ experience in operating and managing<br />

airports of various sizes along with our financing<br />

expertise and potential are key elements in meeting this<br />

goal.<br />

Despite the fall in passenger numbers at several of the<br />

airport holdings due to the global economic crisis, airports<br />

continue to be a dependable longterm choice<br />

for institutional investors seeking strong returns with<br />

little volatility. Experience shows that airports recover<br />

relatively quickly from crises.<br />

Roads<br />

The roads segment is managed by the subsidiary<br />

HOCHTIEF PPP Solutions. The portfolio comprises<br />

seven roads with a total length of more than 750 kilometers,<br />

including two tunnels. Some 600 kilometers<br />

are accounted for by just two Greek public-private<br />

partnership (PPP) road projects—Maliakos-Kleidi and<br />

Elefsina-Patras-Tsakona. Other projects we are involved<br />

in include the Vespucio Norte Express highway<br />

and the San Cristóbal toll tunnel in Chile, as well as a<br />

section of the Austrian A5 North Highway near Vienna.<br />

In Germany, our portfolio includes a section of the A4<br />

highway in Thuringia and the Herren Tunnel in Lübeck.<br />

Unlike in the airport segment, we do not aim to hold<br />

our stakes in road projects for the entire duration of the<br />

concession. The business model allows for interests to<br />

be reduced after the rampup phase, since roads only<br />

offer limited potential for optimization once they have<br />

been built and opened.<br />

Social infrastructure<br />

Projects in the social infrastructure segment are also<br />

combined under HOCHTIEF PPP Solutions. They currently<br />

include 91 schools in Germany, the UK and Ire<br />

❘ Information for our Shareholders ❘ ❘ Management Report ❘ ❘ Financial Statements and Notes ❘<br />

land as well as two city halls, a community center, and<br />

a barracks in Germany.<br />

In contrast to the airport and roads segments, HOCHTIEF’s<br />

interests in social infrastructure projects in Germany<br />

are largely majority holdings.<br />

Infrastructure ventures<br />

Infrastructure ventures so far comprise two geothermal<br />

projects in the construction phase. The plants are to be<br />

sold to investors in 2010. In addition to providing the<br />

deep boreholes, HOCHTIEF PPP Solutions also offers<br />

to develop geothermal power plants right through to<br />

turnkey hand over. This also includes financing through<br />

borrowing.<br />

Portfolio valuation<br />

Our main subsidiaries and associates are regularly<br />

valued using the discounted cash flow (DCF) method.<br />

The calculation is based on cash flows* between proj<br />

ect companies and HOCHTIEF. Future cash flows,<br />

which comprise capital paid in and withdrawn such as<br />

dividends, interest and fees, are discounted by applying<br />

a risk-adjusted discount rate. Only projects that<br />

have reached financial close are included in the valuation.<br />

Owing to the short duration of geothermal projects,<br />

they are not included in the portfolio valuation.<br />

For airport holdings, HOCHTIEF applies a discount rate<br />

of 13 percent. The placement price obtained on establishment<br />

of the investment partnership in 2005 showed<br />

this to be in line with market rates. For this reason, and<br />

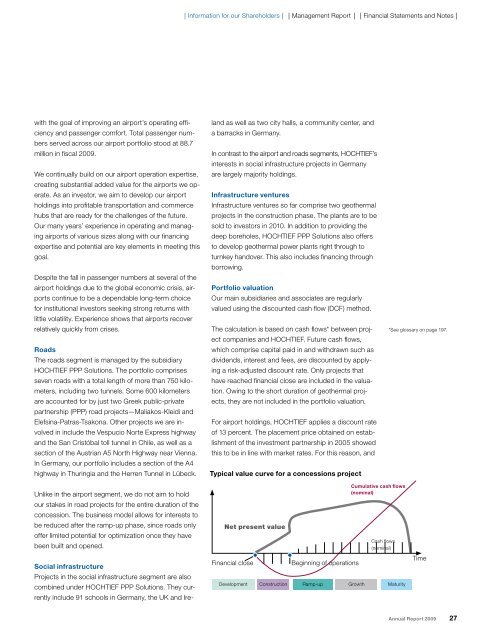

Typical value curve for a concessions project<br />

Net present value<br />

Financial close<br />

Beginning of operations<br />

Cumulative cash flows<br />

(nominal)<br />

Cash flows<br />

(nominal)<br />

Development Construction Rampup Growth Maturity<br />

*See glossary on page 197.<br />

Time<br />

Annual Report 2009 27