ONE ROOF

ONE ROOF

ONE ROOF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

22 Annual Report 2009<br />

HOCHTIEF Stock<br />

• Above-average recovery for HOCHTIEF stock<br />

• HOCHTIEF stock at EUR 53.55 at close of year<br />

• HOCHTIEF again listed in Dow Jones<br />

Sustainability Indexes<br />

• Proposed dividend of EUR 1.50 per share<br />

Stock market<br />

In the first three months of 2009, stock market prices<br />

fell further, owing to the ongoing recession and the<br />

negative prospects for the global economy. Following<br />

on from initial action taken at the end of 2008, governments<br />

and central banks continued their efforts to<br />

support the economy in 2009 and initiated further<br />

economic stimulus measures and rescue packages.<br />

Furthermore, central banks around the world kept to<br />

expansionary monetary policies and repeatedly cut<br />

prime rates, in some countries to historical lows. This<br />

helped to ease the global economic and financial crisis.<br />

From mid-March 2009, increasingly positive business<br />

figures and global economic data gave rise to improvements<br />

on the stock markets. By the end of 2009, stock<br />

markets around the world recorded significant increases<br />

against their lows in March, driven by expectations of a<br />

recovery in the global economy.<br />

By the end of December, the German stock index DAX<br />

rose to its annual high of 6,011 points, an increase of<br />

around 64 percent compared with its low of 3,666<br />

points in March. The DAX closed the year at 5,957<br />

points, which was 23.9 percent higher than its closing<br />

value on December 31, 2008.<br />

The international stock markets showed a similar pic-<br />

ture. The US S&P 500 climbed by 23.5 percent during<br />

the year (65 percent compared with its low in March),<br />

the Euro STOXX 50 by 21.1 percent and the Australian<br />

ASX All Ordinaries by 33.5 percent (64 percent and 57<br />

percent respectively compared with their lows in March<br />

2009).<br />

The Euro STOXX Construction & Materials Index,<br />

which reflects the share price performance of the biggest<br />

companies in the construction industry, rose by<br />

29.7 percent compared with the start of the year. It therefore<br />

outperformed the Euro STOXX 50, after falling with<br />

the market by 23.8 percent between the start of the<br />

year and the beginning of March. This development in<br />

part reflects the fact that notably the European construction<br />

industry benefited from state programs designed<br />

to stimulate the economy in 2009.<br />

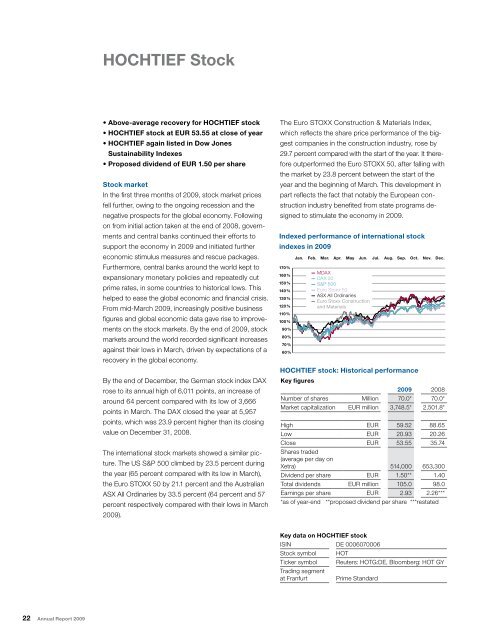

Indexed performance of international stock<br />

indexes in 2009<br />

170<br />

%<br />

160<br />

%<br />

150<br />

%<br />

140<br />

%<br />

130<br />

%<br />

120<br />

%<br />

110<br />

%<br />

100<br />

%<br />

90 090 %<br />

80 080 %<br />

70 070 %<br />

060 %<br />

60<br />

Jan. Feb. Mar. Apr. May Jun. Jul. Aug. Sep. Oct. Nov. Dec.<br />

HOCHTIEF stock: Historical performance<br />

Key figures<br />

— MDAX<br />

— DAX 30<br />

— S&P 500<br />

— Euro Stoxx 50<br />

— ASX All Ordinaries<br />

— Euro Stoxx Construction<br />

and Materials<br />

2009 2008<br />

Number of shares Million 70.0* 70.0*<br />

Market capitalization EUR million 3,748.5* 2,501.8*<br />

High EUR 59.52 88.65<br />

Low EUR 20.93 20.26<br />

Close EUR 53.55 35.74<br />

Shares traded<br />

(average per day on<br />

Xetra) 514,000 653,300<br />

Dividend per share EUR 1.50** 1.40<br />

Total dividends EUR million 105.0 98.0<br />

Earnings per share EUR 2.93 2.26***<br />

*as of year-end **proposed dividend per share ***restated<br />

Key data on HOCHTIEF stock<br />

ISIN DE 0006070006<br />

Stock symbol HOT<br />

Ticker symbol<br />

Trading segment<br />

Reuters: HOTG:DE, Bloomberg: HOT GY<br />

at Franfurt Prime Standard