to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

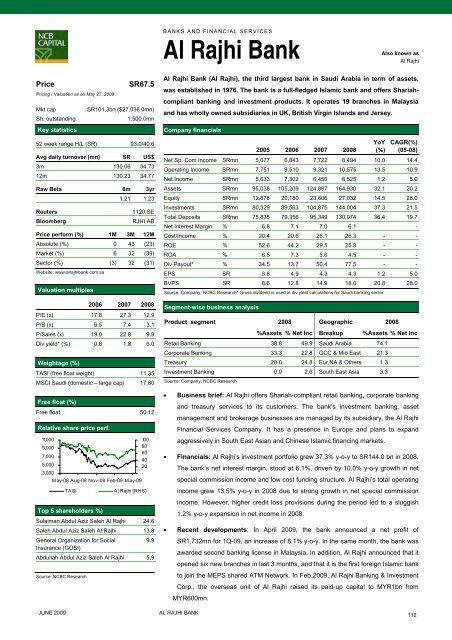

BANKS AND FINANCIAL SERVICESAl Rajhi BankAlso known asAl RajhiPricePricing / Valuation as on May 27, 2009Mkt capSh. outstandingKey statisticsSR67.5SR101.3bn ($27,036.0mn)1,500.0mn52 week range H/L (SR) 93.0/40.6Avg daily turnover (mn) SR US$3m 130.06 34.7312m 130.23 34.77Raw Beta 6m 3yr1.21 1.23ReutersBloomberg1120.SERJHI ABPrice perform (%) 1M 3M 12MAbsolute (%) 0 43 (23)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) (3) 32 (31)Website: www.alrajhibank.<strong>com</strong>.saValuation multiples2006 2007 2008P/E (x) 17.8 27.3 12.9P/B (x) 6.5 7.4 3.1P/Sales (x) 19.0 22.8 9.9Div yield* (%) 0.8 1.8 6.0Weightage (%)TASI (free float weight) 11.35MSCI Saudi (domestic – large cap) 17.80Free float (%)Free float 50.12Relative share price perf.11,0009,0007,0005,0003,000M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASITop 5 shareholders %)10080604020-Al Rajhi (RHS)Sulaiman Abdul Aziz Saleh Al Rajhi 24.6Saleh Abdul Aziz Saleh Al Rajhi 13.8General Organization for Social9.9Insurance (GOSI)Abdullah Abdul Aziz Saleh Al Rajhi 5.9Source: NCBC ResearchAl Rajhi Bank (Al Rajhi), <strong>the</strong> third largest bank in Saudi Arabia in term of assets,was established in 1976. The bank is a full-fledged Islamic bank and offers Shariah<strong>com</strong>pliantbanking and investment products. It operates 19 branches in Malaysiaand has wholly owned subsidiaries in UK, British Virgin Islands and Jersey.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Sp. Com In<strong>com</strong>e SRmn 5,677 6,843 7,722 8,494 10.0 14.4Operating In<strong>com</strong>e SRmn 7,751 9,510 9,321 10,575 13.5 10.9Net In<strong>com</strong>e SRmn 5,633 7,302 6,450 6,525 1.2 5.0Assets SRmn 95,038 105,209 124,887 164,930 32.1 20.2Equity SRmn 12,878 20,180 23,606 27,032 14.5 28.0Investments SRmn 80,329 89,563 104,875 144,004 37.3 21.5Total Deposits SRmn 75,835 79,356 95,349 130,074 36.4 19.7Net Interest Margin % 6.8 7.1 7.0 6.1 -Cost/In<strong>com</strong>e % 20.4 20.6 26.1 26.3 - -ROE % 52.6 44.2 29.5 25.8 - -ROA % 6.5 7.3 5.6 4.5 - -Div Payout* % 34.5 13.7 50.4 77.5 - -EPS SR 3.8 4.9 4.3 4.3 1.2 5.0BVPS SR 8.6 12.8 14.9 18.0 20.8 28.0Source: Company, NCBC Research* Gross dividend is used in div yield calculations for Saudi banking sec<strong>to</strong>rSegment-wise business analysisProduct segment 2008 Geographic 2008%Assets % Net Inc Breakup %Assets % Net IncRetail Banking 38.8 49.9 Saudi Arabia 74.1Corporate Banking 33.3 22.8 GCC & Mid East 21.3Treasury 28.0 24.8 Eur,NA & O<strong>the</strong>rs 1.3Investment Banking 0.0 2.6 South East Asia 3.3Source: Company, NCBC Research• Business brief: Al Rajhi offers Shariah-<strong>com</strong>pliant retail banking, corporate bankingand treasury services <strong>to</strong> its cus<strong>to</strong>mers. The bank’s investment banking, assetmanagement and brokerage businesses are managed by its subsidiary, <strong>the</strong> Al RajhiFinancial Services Company. It has a presence in Europe and plans <strong>to</strong> expandaggressively in South East Asian and Chinese Islamic financing markets.• Financials: Al Rajhi’s investment portfolio grew 37.3% y-o-y <strong>to</strong> SR144.0 bn in 2008.The bank’s net interest margin, s<strong>to</strong>od at 6.1%, driven by 10.0% y-o-y growth in netspecial <strong>com</strong>mission in<strong>com</strong>e and low cost funding structure. Al Rajhi’s <strong>to</strong>tal operatingin<strong>com</strong>e grew 13.5% y-o-y in 2008 due <strong>to</strong> strong growth in net special <strong>com</strong>missionin<strong>com</strong>e. However, higher credit loss provisions during <strong>the</strong> period led <strong>to</strong> a sluggish1.2% y-o-y expansion in net in<strong>com</strong>e in 2008.• Recent developments: In April 2009, <strong>the</strong> bank announced a net profit ofSR1,732mn for 1Q-09, an increase of 8.1% y-o-y. In <strong>the</strong> same month, <strong>the</strong> bank wasawarded second banking license in Malaysia. In addition, Al Rajhi announced that i<strong>to</strong>pened six new branches in last 3 months, and that it is <strong>the</strong> first foreign Islamic bank<strong>to</strong> join <strong>the</strong> MEPS shared ATM Network. In Feb 2009, Al Rajhi Banking & InvestmentCorp., <strong>the</strong> overseas unit of Al Rajhi raised its paid-up capital <strong>to</strong> MYR1bn fromMYR600mn.JUNE 2009AL RAJHI BANK112