to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

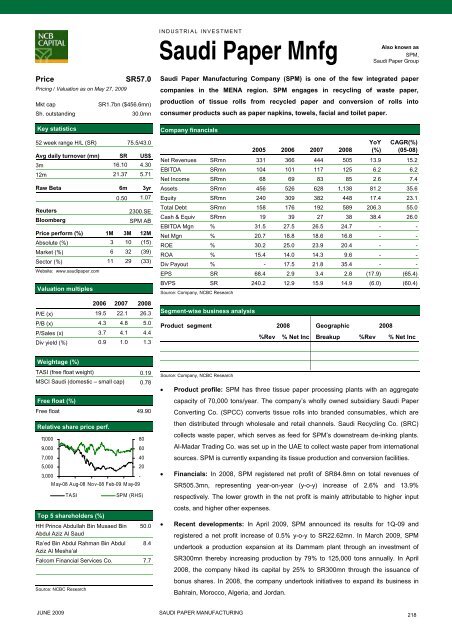

INDUSTRIAL INVESTMENTSaudi Paper MnfgAlso known asSPM,Saudi Paper GroupPriceSR57.0Pricing / Valuation as on May 27, 2009Mkt capSR1.7bn ($456.6mn)Sh. outstanding30.0mnKey statistics52 week range H/L (SR) 75.5/43.0Avg daily turnover (mn) SR US$3m 16.10 4.3012m 21.37 5.71Raw Beta 6m 3yr0.50 1.07Reuters2300.SEBloombergSPM ABPrice perform (%) 1M 3M 12MAbsolute (%) 3 10 (15)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) 11 29 (33)Website: www.saudipaper.<strong>com</strong>Valuation multiples2006 2007 2008P/E (x) 19.5 22.1 26.3P/B (x) 4.3 4.8 5.0P/Sales (x) 3.7 4.1 4.4Div yield (%) 0.9 1.0 1.3Saudi Paper Manufacturing Company (SPM) is one of <strong>the</strong> few integrated paper<strong>com</strong>panies in <strong>the</strong> MENA region. SPM engages in recycling of waste paper,production of tissue rolls from recycled paper and conversion of rolls in<strong>to</strong>consumer products such as paper napkins, <strong>to</strong>wels, facial and <strong>to</strong>ilet paper.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Revenues SRmn 331 366 444 505 13.9 15.2EBITDA SRmn 104 101 117 125 6.2 6.2Net In<strong>com</strong>e SRmn 68 69 83 85 2.6 7.4Assets SRmn 456 526 628 1,138 81.2 35.6Equity SRmn 240 309 382 448 17.4 23.1Total Debt SRmn 158 176 192 589 206.3 55.0Cash & Equiv SRmn 19 39 27 38 38.4 26.0EBITDA Mgn % 31.5 27.5 26.5 24.7 - -Net Mgn % 20.7 18.8 18.6 16.8 - -ROE % 30.2 25.0 23.9 20.4 - -ROA % 15.4 14.0 14.3 9.6 - -Div Payout % - 17.5 21.8 35.4 - -EPS SR 68.4 2.9 3.4 2.8 (17.9) (65.4)BVPS SR 240.2 12.9 15.9 14.9 (6.0) (60.4)Source: Company, NCBC ResearchSegment-wise business analysisProduct segment 2008 Geographic 2008%Rev % Net Inc Breakup %Rev % Net IncWeightage (%)TASI (free float weight) 0.19MSCI Saudi (domestic – small cap) 0.78Free float (%)Free float 49.90Relative share price perf.11,0009,0007,0005,0003,000M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASITop 5 shareholders (%)80604020-SPM (RHS)HH Prince Abdullah Bin Musaed Bin 50.0Abdul Aziz Al SaudRa’ed Bin Abdul Rahman Bin Abdul 8.4Aziz Al Mesha’alFal<strong>com</strong> Financial Services Co. 7.7Source: NCBC ResearchSource: Company, NCBC Research• Product profile: SPM has three tissue paper processing plants with an aggregatecapacity of 70,000 <strong>to</strong>ns/year. The <strong>com</strong>pany’s wholly owned subsidiary Saudi PaperConverting Co. (SPCC) converts tissue rolls in<strong>to</strong> branded consumables, which are<strong>the</strong>n distributed through wholesale and retail channels. Saudi Recycling Co. (SRC)collects waste paper, which serves as feed for SPM’s downstream de-inking plants.Al-Madar Trading Co. was set up in <strong>the</strong> UAE <strong>to</strong> collect waste paper from internationalsources. SPM is currently expanding its tissue production and conversion facilities.• Financials: In 2008, SPM registered net profit of SR84.8mn on <strong>to</strong>tal revenues ofSR505.3mn, representing year-on-year (y-o-y) increase of 2.6% and 13.9%respectively. The lower growth in <strong>the</strong> net profit is mainly attributable <strong>to</strong> higher inputcosts, and higher o<strong>the</strong>r expenses.• Recent developments: In April 2009, SPM announced its results for 1Q-09 andregistered a net profit increase of 0.5% y-o-y <strong>to</strong> SR22.62mn. In March 2009, SPMunder<strong>to</strong>ok a production expansion at its Dammam plant through an investment ofSR300mn <strong>the</strong>reby increasing production by 79% <strong>to</strong> 125,000 <strong>to</strong>ns annually. In April2008, <strong>the</strong> <strong>com</strong>pany hiked its capital by 25% <strong>to</strong> SR300mn through <strong>the</strong> issuance ofbonus shares. In 2008, <strong>the</strong> <strong>com</strong>pany under<strong>to</strong>ok initiatives <strong>to</strong> expand its business inBahrain, Morocco, Algeria, and Jordan.JUNE 2009SAUDI PAPER MANUFACTURING218