to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

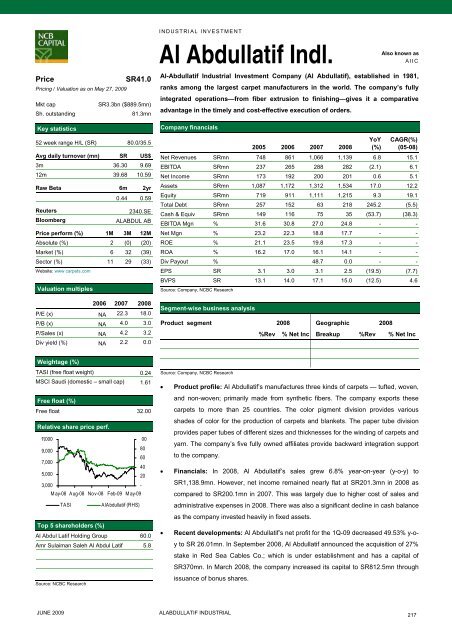

PriceSR41.0Pricing / Valuation as on May 27, 2009Mkt capSR3.3bn ($889.5mn)Sh. outstanding81.3mnKey statistics52 week range H/L (SR) 80.0/35.5Avg daily turnover (mn) SR US$3m 36.30 9.6912m 39.68 10.59Raw Beta 6m 2yr0.44 0.59Reuters2340.SEBloombergALABDUL ABPrice perform (%) 1M 3M 12MAbsolute (%) 2 (0) (20)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) 11 29 (33)Website: www carpets.<strong>com</strong>Valuation multiples2006 2007 2008P/E (x) NA 22.3 18.0P/B (x) NA 4.0 3.0P/Sales (x) NA 4.2 3.2Div yield (%) NA 2.2 0.0INDUSTRIAL INVESTMENTAl Abdullatif Indl.Also known asAIICAl-Abdullatif Industrial Investment Company (Al Abdullatif), established in 1981,ranks among <strong>the</strong> largest carpet manufacturers in <strong>the</strong> world. The <strong>com</strong>pany’s fullyintegrated operations—from fiber extrusion <strong>to</strong> finishing—gives it a <strong>com</strong>parativeadvantage in <strong>the</strong> timely and cost-effective execution of orders.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Revenues SRmn 748 861 1,066 1,139 6.8 15.1EBITDA SRmn 237 265 288 282 (2.1) 6.1Net In<strong>com</strong>e SRmn 173 192 200 201 0.6 5.1Assets SRmn 1,087 1,172 1,312 1,534 17.0 12.2Equity SRmn 719 911 1,111 1,215 9.3 19.1Total Debt SRmn 257 152 63 218 245.2 (5.5)Cash & Equiv SRmn 149 116 75 35 (53.7) (38.3)EBITDA Mgn % 31.6 30.8 27.0 24.8 - -Net Mgn % 23.2 22.3 18.8 17.7 - -ROE % 21.1 23.5 19.8 17.3 - -ROA % 16.2 17.0 16.1 14.1 - -Div Payout % 48.7 0.0 - -EPS SR 3.1 3.0 3.1 2.5 (19.5) (7.7)BVPS SR 13.1 14.0 17.1 15.0 (12.5) 4.6Source: Company, NCBC ResearchSegment-wise business analysisProduct segment 2008 Geographic 2008%Rev % Net Inc Breakup %Rev % Net IncWeightage (%)TASI (free float weight) 0.24MSCI Saudi (domestic – small cap) 1.61Free float (%)Free float 32.00Relative share price perf.11,000009,00080607,000405,000203,000-M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASIAlAbdullatif (RHS)Top 5 shareholders (%)Al Abdul Latif Holding Group 60.0Amr Sulaiman Saleh Al Abdul Latif 5.8Source: NCBC ResearchSource: Company, NCBC Research• Product profile: Al Abdullatif’s manufactures three kinds of carpets — tufted, woven,and non-woven; primarily made from syn<strong>the</strong>tic fibers. The <strong>com</strong>pany exports <strong>the</strong>secarpets <strong>to</strong> more than 25 countries. The color pigment division provides variousshades of color for <strong>the</strong> production of carpets and blankets. The paper tube divisionprovides paper tubes of different sizes and thicknesses for <strong>the</strong> winding of carpets andyarn. The <strong>com</strong>pany’s five fully owned affiliates provide backward integration support<strong>to</strong> <strong>the</strong> <strong>com</strong>pany.• Financials: In 2008, Al Abdullatif’s sales grew 6.8% year-on-year (y-o-y) <strong>to</strong>SR1,138.9mn. However, net in<strong>com</strong>e remained nearly flat at SR201.3mn in 2008 as<strong>com</strong>pared <strong>to</strong> SR200.1mn in 2007. This was largely due <strong>to</strong> higher cost of sales andadministrative expenses in 2008. There was also a significant decline in cash balanceas <strong>the</strong> <strong>com</strong>pany invested heavily in fixed assets.• Recent developments: Al Abdullatif’s net profit for <strong>the</strong> 1Q-09 decreased 49.53% y-oy<strong>to</strong> SR 26.01mn. In September 2008, Al Abdullatif announced <strong>the</strong> acquisition of 27%stake in Red Sea Cables Co.; which is under establishment and has a capital ofSR370mn. In March 2008, <strong>the</strong> <strong>com</strong>pany increased its capital <strong>to</strong> SR812.5mn throughissuance of bonus shares.JUNE 2009ALABDULLATIF INDUSTRIAL217