to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

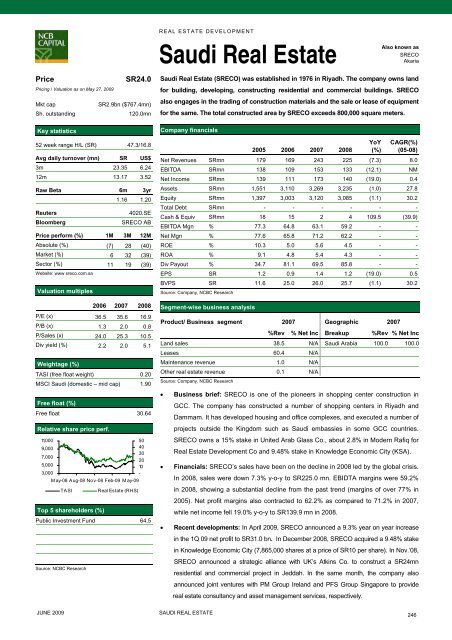

REAL ESTATE DEVELOPMENTSaudi Real EstateAlso known asSRECOAkariaPricePricing / Valuation as on May 27, 2009Mkt capSh. outstandingKey statisticsSR24.0SR2.9bn ($767.4mn)120.0mn52 week range H/L (SR) 47.3/16.8Avg daily turnover (mn) SR US$3m 23.35 6.2412m 13.17 3.52Raw Beta 6m 3yr1.16 1.20ReutersBloomberg4020.SESRECO ABPrice perform (%) 1M 3M 12MAbsolute (%) (7) 28 (40)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) 11 19 (39)Website: www sreco.<strong>com</strong>.saValuation multiples2006 2007 2008P/E (x) 36.5 35.6 16.9P/B (x) 1.3 2.0 0.8P/Sales (x) 24.0 25.3 10.5Div yield (%) 2.2 2.0 5.1Weightage (%)TASI (free float weight) 0.20MSCI Saudi (domestic – mid cap) 1.90Free float (%)Free float 30.64Relative share price perf.11,0009,0007,0005,0003,000M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASITop 5 shareholders (%)Real Estate (RHS)5040302010-Public Investment Fund 64.5Source: NCBC ResearchSaudi Real Estate (SRECO) was established in 1976 in Riyadh. The <strong>com</strong>pany owns landfor building, developing, constructing residential and <strong>com</strong>mercial buildings. SRECOalso engages in <strong>the</strong> trading of construction materials and <strong>the</strong> sale or lease of equipmentfor <strong>the</strong> same. The <strong>to</strong>tal constructed area by SRECO exceeds 800,000 square meters.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Revenues SRmn 179 169 243 225 (7.3) 8.0EBITDA SRmn 138 109 153 133 (12.1) NMNet In<strong>com</strong>e SRmn 139 111 173 140 (19.0) 0.4Assets SRmn 1,551 3,110 3,269 3,235 (1.0) 27.8Equity SRmn 1,397 3,003 3,120 3,085 (1.1) 30.2Total Debt SRmn - - - - - -Cash & Equiv SRmn 18 15 2 4 109.5 (39.9)EBITDA Mgn % 77.3 64.8 63.1 59.2 - -Net Mgn % 77.6 65.8 71.2 62.2 - -ROE % 10.3 5.0 5.6 4.5 - -ROA % 9.1 4.8 5.4 4.3 - -Div Payout % 34.7 81.1 69.5 85.8 - -EPS SR 1.2 0.9 1.4 1.2 (19.0) 0.5BVPS SR 11.6 25.0 26.0 25.7 (1.1) 30.2Source: Company, NCBC ResearchSegment-wise business analysisProduct/ Business segment 2007 Geographic 2007%Rev % Net Inc Breakup %Rev % Net IncLand sales 38.5 N/A Saudi Arabia 100.0 100.0Leases 60.4 N/AMaintenance revenue 1.0 N/AO<strong>the</strong>r real estate revenue 0.1 N/ASource: Company, NCBC Research• Business brief: SRECO is one of <strong>the</strong> pioneers in shopping center construction inGCC. The <strong>com</strong>pany has constructed a number of shopping centers in Riyadh andDammam. It has developed housing and office <strong>com</strong>plexes, and executed a number ofprojects outside <strong>the</strong> Kingdom such as Saudi embassies in some GCC countries.SRECO owns a 15% stake in United Arab Glass Co., about 2.8% in Modern Rafiq forReal Estate Development Co and 9.48% stake in Knowledge Economic City (KSA).• Financials: SRECO’s sales have been on <strong>the</strong> decline in 2008 led by <strong>the</strong> global crisis.In 2008, sales were down 7.3% y-o-y <strong>to</strong> SR225.0 mn. EBIDTA margins were 59.2%in 2008, showing a substantial decline from <strong>the</strong> past trend (margins of over 77% in2005). Net profit margins also contracted <strong>to</strong> 62.2% as <strong>com</strong>pared <strong>to</strong> 71.2% in 2007,while net in<strong>com</strong>e fell 19.0% y-o-y <strong>to</strong> SR139.9 mn in 2008.• Recent developments: In April 2009, SRECO announced a 9.3% year on year increasein <strong>the</strong> 1Q 09 net profit <strong>to</strong> SR31.0 bn. In December 2008, SRECO acquired a 9.48% stakein Knowledge Economic City (7,865,000 shares at a price of SR10 per share). In Nov.’08,SRECO announced a strategic alliance with UK’s Atkins Co. <strong>to</strong> construct a SR24mnresidential and <strong>com</strong>mercial project in Jeddah. In <strong>the</strong> same month, <strong>the</strong> <strong>com</strong>pany alsoannounced joint ventures with PM Group Ireland and PFS Group Singapore <strong>to</strong> providereal estate consultancy and asset management services, respectively.JUNE 2009SAUDI REAL ESTATE246