to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

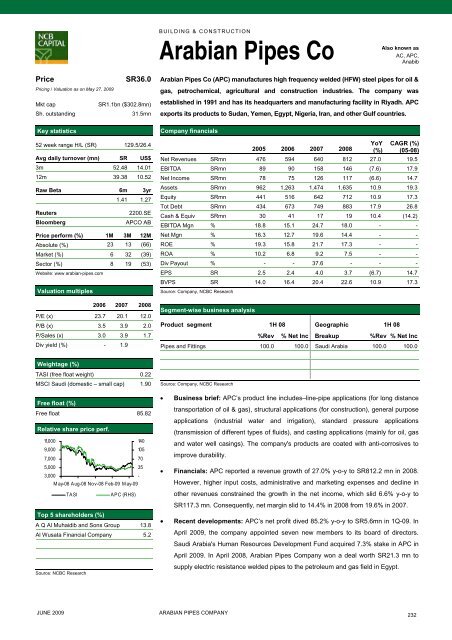

BUILDING & CONSTRUCTIONArabian Pipes CoAlso known asAC, APC,AnabibPriceSR36.0Pricing / Valuation as on May 27, 2009Mkt capSR1.1bn ($302.8mn)Sh. outstanding31.5mnKey statistics52 week range H/L (SR) 129.5/26.4Avg daily turnover (mn) SR US$3m 52.48 14.0112m 39.38 10.52Raw Beta 6m 3yr1.41 1.27Reuters2200.SEBloombergAPCO ABPrice perform (%) 1M 3M 12MAbsolute (%) 23 13 (66)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) 8 19 (53)Website: www arabian-pipes.<strong>com</strong>Valuation multiples2006 2007 2008P/E (x) 23.7 20.1 12.0P/B (x) 3.5 3.9 2.0P/Sales (x) 3.0 3.9 1.7Div yield (%) - 1.9Arabian Pipes Co (APC) manufactures high frequency welded (HFW) steel pipes for oil &gas, petrochemical, agricultural and construction industries. The <strong>com</strong>pany wasestablished in 1991 and has its headquarters and manufacturing facility in Riyadh. APCexports its products <strong>to</strong> Sudan, Yemen, Egypt, Nigeria, Iran, and o<strong>the</strong>r Gulf countries.Company financials2005 2006 2007 2008YoY CAGR (%)(%) (05-08)Net Revenues SRmn 476 594 640 812 27.0 19.5EBITDA SRmn 89 90 158 146 (7.6) 17.9Net In<strong>com</strong>e SRmn 78 75 126 117 (6.6) 14.7Assets SRmn 962 1,263 1,474 1,635 10.9 19.3Equity SRmn 441 516 642 712 10.9 17.3Tot Debt SRmn 434 673 749 883 17.9 26.8Cash & Equiv SRmn 30 41 17 19 10.4 (14.2)EBITDA Mgn % 18.8 15.1 24.7 18.0 - -Net Mgn % 16.3 12.7 19.6 14.4 - -ROE % 19.3 15.8 21.7 17.3 - -ROA % 10.2 6.8 9.2 7.5 - -Div Payout % - - 37.6 - - -EPS SR 2.5 2.4 4.0 3.7 (6.7) 14.7BVPS SR 14.0 16.4 20.4 22.6 10.9 17.3Source: Company, NCBC ResearchSegment-wise business analysisProduct segment 1H 08 Geographic 1H 08%Rev % Net Inc Breakup %Rev % Net IncPipes and Fittings 100.0 100.0 Saudi Arabia 100.0 100.0Weightage (%)TASI (free float weight) 0.22MSCI Saudi (domestic – small cap) 1.90Free float (%)Free float 85.82Relative share price perf.11,0001409,0001057,000705,000353,000-M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASIAPC (RHS)Top 5 shareholders (%)A Q Al Muhaidib and Sons Group 13.8Al Wusata Financial Company 5.2Source: NCBC ResearchSource: Company, NCBC Research• Business brief: APC’s product line includes–line-pipe applications (for long distancetransportation of oil & gas), structural applications (for construction), general purposeapplications (industrial water and irrigation), standard pressure applications(transmission of different types of fluids), and casting applications (mainly for oil, gasand water well casings). The <strong>com</strong>pany's products are coated with anti-corrosives <strong>to</strong>improve durability.• Financials: APC <strong>report</strong>ed a revenue growth of 27.0% y-o-y <strong>to</strong> SR812.2 mn in 2008.However, higher input costs, administrative and marketing expenses and decline ino<strong>the</strong>r revenues constrained <strong>the</strong> growth in <strong>the</strong> net in<strong>com</strong>e, which slid 6.6% y-o-y <strong>to</strong>SR117.3 mn. Consequently, net margin slid <strong>to</strong> 14.4% in 2008 from 19.6% in 2007.• Recent developments: APC’s net profit dived 85.2% y-o-y <strong>to</strong> SR5.6mn in 1Q-09. InApril 2009, <strong>the</strong> <strong>com</strong>pany appointed seven new members <strong>to</strong> its board of direc<strong>to</strong>rs.Saudi Arabia's Human Resources Development Fund acquired 7.3% stake in APC inApril 2009. In April 2008, Arabian Pipes Company won a deal worth SR21.3 mn <strong>to</strong>supply electric resistance welded pipes <strong>to</strong> <strong>the</strong> petroleum and gas field in Egypt.JUNE 2009ARABIAN PIPES COMPANY232