to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

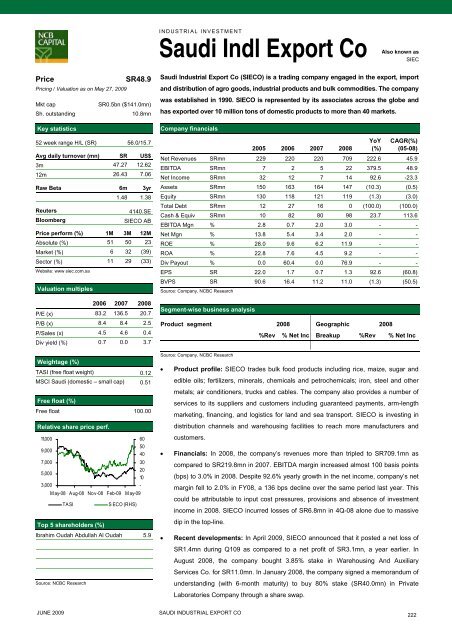

INDUSTRIAL INVESTMENTAlsoSaudi Indl Export Coknown asSIECPricePricing / Valuation as on May 27, 2009Mkt capSh. outstandingKey statisticsSR48.9SR0.5bn ($141.0mn)10.8mn52 week range H/L (SR) 56.0/15.7Avg daily turnover (mn) SR US$3m 47.27 12.6212m 26.43 7.06Raw Beta 6m 3yr1.48 1.38ReutersBloomberg4140.SESIECO ABPrice perform (%) 1M 3M 12MAbsolute (%) 51 50 23Market (%) 6 32 (39)Sec<strong>to</strong>r (%) 11 29 (33)Website: www siec.<strong>com</strong>.saValuation multiples2006 2007 2008P/E (x) 83.2 136.5 20.7P/B (x) 8.4 8.4 2.5P/Sales (x) 4.5 4.6 0.4Div yield (%) 0.7 0.0 3.7Weightage (%)TASI (free float weight) 0.12MSCI Saudi (domestic – small cap) 0.51Free float (%)Free float 100.00Relative share price perf.11,0009,0007,0005,0003,000M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASITop 5 shareholders (%)S ECO (RHS)605040302010-Ibrahim Oudah Abdullah Al Oudah 5.9Source: NCBC ResearchSaudi Industrial Export Co (SIECO) is a trading <strong>com</strong>pany engaged in <strong>the</strong> export, importand distribution of agro goods, industrial products and bulk <strong>com</strong>modities. The <strong>com</strong>panywas established in 1990. SIECO is represented by its associates across <strong>the</strong> globe andhas exported over 10 million <strong>to</strong>ns of domestic products <strong>to</strong> more than 40 markets.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Revenues SRmn 229 220 220 709 222.6 45.9EBITDA SRmn 7 2 5 22 379.5 48.9Net In<strong>com</strong>e SRmn 32 12 7 14 92.6 -23.3Assets SRmn 150 163 164 147 (10.3) (0.5)Equity SRmn 130 118 121 119 (1.3) (3.0)Total Debt SRmn 12 27 16 0 (100.0) (100.0)Cash & Equiv SRmn 10 82 80 98 23.7 113.6EBITDA Mgn % 2.8 0.7 2.0 3.0 - -Net Mgn % 13.8 5.4 3.4 2.0 - -ROE % 28.0 9.6 6.2 11.9 - -ROA % 22.8 7.6 4.5 9.2 - -Div Payout % 0.0 60.4 0.0 76.9 - -EPS SR 22.0 1.7 0.7 1.3 92.6 (60.8)BVPS SR 90.6 16.4 11.2 11.0 (1.3) (50.5)Source: Company, NCBC ResearchSegment-wise business analysisProduct segment 2008 Geographic 2008%Rev % Net Inc Breakup %Rev % Net IncSource: Company, NCBC Research• Product profile: SIECO trades bulk food products including rice, maize, sugar andedible oils; fertilizers, minerals, chemicals and petrochemicals; iron, steel and o<strong>the</strong>rmetals; air conditioners, trucks and cables. The <strong>com</strong>pany also provides a number ofservices <strong>to</strong> its suppliers and cus<strong>to</strong>mers including guaranteed payments, arm-lengthmarketing, financing, and logistics for land and sea transport. SIECO is investing indistribution channels and warehousing facilities <strong>to</strong> reach more manufacturers andcus<strong>to</strong>mers.• Financials: In 2008, <strong>the</strong> <strong>com</strong>pany’s revenues more than tripled <strong>to</strong> SR709.1mn as<strong>com</strong>pared <strong>to</strong> SR219.8mn in 2007. EBITDA margin increased almost 100 basis points(bps) <strong>to</strong> 3.0% in 2008. Despite 92.6% yearly growth in <strong>the</strong> net in<strong>com</strong>e, <strong>com</strong>pany’s netmargin fell <strong>to</strong> 2.0% in FY08, a 136 bps decline over <strong>the</strong> same period last year. Thiscould be attributable <strong>to</strong> input cost pressures, provisions and absence of investmentin<strong>com</strong>e in 2008. SIECO incurred losses of SR6.8mn in 4Q-08 alone due <strong>to</strong> massivedip in <strong>the</strong> <strong>to</strong>p-line.• Recent developments: In April 2009, SIECO announced that it posted a net loss ofSR1.4mn during Q109 as <strong>com</strong>pared <strong>to</strong> a net profit of SR3.1mn, a year earlier. InAugust 2008, <strong>the</strong> <strong>com</strong>pany bought 3.85% stake in Warehousing And AuxiliaryServices Co. for SR11.0mn. In January 2008, <strong>the</strong> <strong>com</strong>pany signed a memorandum ofunderstanding (with 6-month maturity) <strong>to</strong> buy 80% stake (SR40.0mn) in PrivateLabora<strong>to</strong>ries Company through a share swap.JUNE 2009SAUDI INDUSTRIAL EXPORT CO222