to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

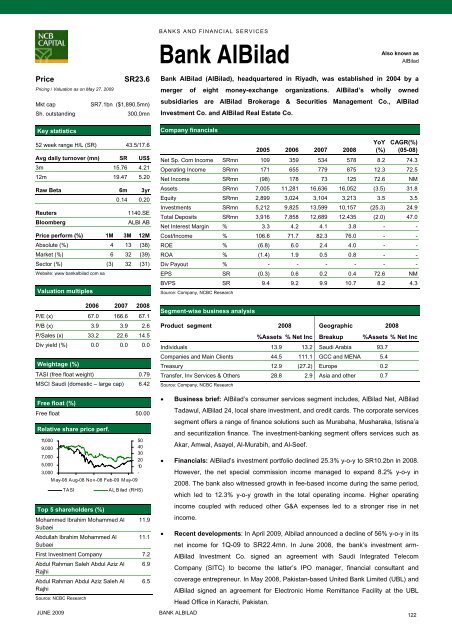

BANKS AND FINANCIAL SERVICESBank AlBiladAlso known asAlBiladPricePricing / Valuation as on May 27, 2009Mkt capSh. outstandingKey statisticsJUNE 2009SR23.6SR7.1bn ($1,890.5mn)300.0mn52 week range H/L (SR) 43.5/17.6Avg daily turnover (mn) SR US$3m 15.76 4.2112m 19.47 5.20Raw Beta 6m 3yr0.14 0.20ReutersBloomberg1140.SEALBI ABPrice perform (%) 1M 3M 12MAbsolute (%) 4 13 (38)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) (3) 32 (31)Website: www bankalbilad <strong>com</strong> saValuation multiples2006 2007 2008P/E (x) 67.0 166.6 67.1P/B (x) 3.9 3.9 2.6P/Sales (x) 33.2 22.6 14.5Div yield (%) 0.0 0.0 0.0Weightage (%)TASI (free float weight) 0.79MSCI Saudi (domestic – large cap) 6.42Free float (%)Free float 50.00Relative share price perf.11,0009,0007,0005,0003,000M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASITop 5 shareholders (%)5040302010-AL Bilad (RHS)Mohammed Ibrahim Mohammed Al 11.9SubaeiAbdullah Ibrahim Mohammed Al 11.1SubaeiFirst Investment Company 7.2Abdul Rahman Saleh Abdul Aziz Al 6.9RajhiAbdul Rahman Abdul Aziz Saleh Al 6.5RajhiSource: NCBC ResearchBank AlBilad (AlBilad), headquartered in Riyadh, was established in 2004 by amerger of eight money-exchange organizations. AlBilad’s wholly ownedsubsidiaries are AlBilad Brokerage & Securities Management Co., AlBiladInvestment Co. and AlBilad Real Estate Co.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Sp. Com In<strong>com</strong>e SRmn 109 359 534 578 8.2 74.3Operating In<strong>com</strong>e SRmn 171 655 779 875 12.3 72.5Net In<strong>com</strong>e SRmn (98) 178 73 125 72.6 NMAssets SRmn 7,005 11,281 16,636 16,052 (3.5) 31.8Equity SRmn 2,899 3,024 3,104 3,213 3.5 3.5Investments SRmn 5,212 9,825 13,599 10,157 (25.3) 24.9Total Deposits SRmn 3,916 7,858 12,689 12,435 (2.0) 47.0Net Interest Margin % 3.3 4.2 4.1 3.8 - -Cost/In<strong>com</strong>e % 106.6 71.7 82.3 76.0 - -ROE % (6.8) 6.0 2.4 4.0 - -ROA % (1.4) 1.9 0.5 0.8 - -Div Payout % - - - - - -EPS SR (0.3) 0.6 0.2 0.4 72.6 NMBVPS SR 9.4 9.2 9.9 10.7 8.2 4.3Source: Company, NCBC ResearchSegment-wise business analysisProduct segment 2008 Geographic 2008%Assets % Net Inc Breakup %Assets % Net IncIndividuals 13.9 13.2 Saudi Arabia 93.7Companies and Main Clients 44.5 111.1 GCC and MENA 5.4Treasury 12.9 (27.2) Europe 0.2Transfer, Inv Services & O<strong>the</strong>rs 28.8 2.9 Asia and o<strong>the</strong>r 0.7Source: Company, NCBC Research• Business brief: AlBilad’s consumer services segment includes, AlBilad Net, AlBiladTadawul, AlBilad 24, local share investment, and credit cards. The corporate servicessegment offers a range of finance solutions such as Murabaha, Musharaka, Istisna’aand securitization finance. The investment-banking segment offers services such asAkar, Amwal, Asayel, Al-Murabih, and Al-Seef.• Financials: AlBilad’s investment portfolio declined 25.3% y-o-y <strong>to</strong> SR10.2bn in 2008.However, <strong>the</strong> net special <strong>com</strong>mission in<strong>com</strong>e managed <strong>to</strong> expand 8.2% y-o-y in2008. The bank also witnessed growth in fee-based in<strong>com</strong>e during <strong>the</strong> same period,which led <strong>to</strong> 12.3% y-o-y growth in <strong>the</strong> <strong>to</strong>tal operating in<strong>com</strong>e. Higher operatingin<strong>com</strong>e coupled with reduced o<strong>the</strong>r G&A expenses led <strong>to</strong> a stronger rise in netin<strong>com</strong>e.• Recent developments: In April 2009, Albilad announced a decline of 56% y-o-y in itsnet in<strong>com</strong>e for 1Q-09 <strong>to</strong> SR22.4mn. In June 2008, <strong>the</strong> bank’s investment arm-AlBilad Investment Co. signed an agreement with Saudi Integrated Tele<strong>com</strong>Company (SITC) <strong>to</strong> be<strong>com</strong>e <strong>the</strong> latter’s IPO manager, financial consultant andcoverage entrepreneur. In May 2008, Pakistan-based United Bank Limited (UBL) andAlBilad signed an agreement for Electronic Home Remittance Facility at <strong>the</strong> UBLHead Office in Karachi, Pakistan.BANK ALBILAD122