to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

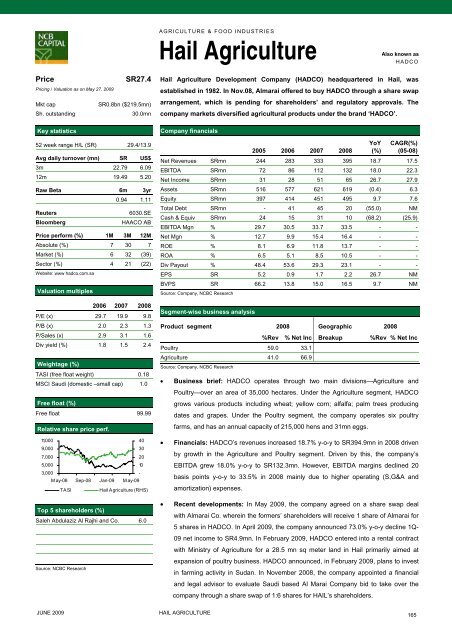

AGRICULTURE & FOOD INDUSTRIESHail AgricultureAlso known asHADCOPriceSR27.4Pricing / Valuation as on May 27, 2009Mkt capSR0.8bn ($219.5mn)Sh. outstanding30.0mnKey statistics52 week range H/L (SR) 29.4/13.9Avg daily turnover (mn) SR US$3m 22.79 6.0912m 19.49 5.20Raw Beta 6m 3yr0.94 1.11Reuters6030.SEBloombergHAACO ABPrice perform (%) 1M 3M 12MAbsolute (%) 7 30 7Market (%) 6 32 (39)Sec<strong>to</strong>r (%) 4 21 (22)Website: www hadco.<strong>com</strong>.saValuation multiples2006 2007 2008P/E (x) 29.7 19.9 9.8P/B (x) 2.0 2.3 1.3P/Sales (x) 2.9 3.1 1.6Div yield (%) 1.8 1.5 2.4Weightage (%)TASI (free float weight) 0.18MSCI Saudi (domestic –small cap) 1.0Free float (%)Free float 99.99Relative share price perf.11,000409,000307,000205,000103,000-M ay-08 Sep-08 Jan-09 M ay-09TASIHail Agriculture (RHS)Top 5 shareholders (%)Saleh Abdulaziz Al Rajhi and Co. 6.0Source: NCBC ResearchHail Agriculture Development Company (HADCO) headquartered in Hail, wasestablished in 1982. In Nov.08, Almarai offered <strong>to</strong> buy HADCO through a share swaparrangement, which is pending for shareholders’ and regula<strong>to</strong>ry approvals. The<strong>com</strong>pany markets diversified agricultural products under <strong>the</strong> brand ‘HADCO’.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Revenues SRmn 244 283 333 395 18.7 17.5EBITDA SRmn 72 86 112 132 18.0 22.3Net In<strong>com</strong>e SRmn 31 28 51 65 26.7 27.9Assets SRmn 516 577 621 619 (0.4) 6.3Equity SRmn 397 414 451 495 9.7 7.6Total Debt SRmn - 41 45 20 (55.0) NMCash & Equiv SRmn 24 15 31 10 (68.2) (25.9)EBITDA Mgn % 29.7 30.5 33.7 33.5 - -Net Mgn % 12.7 9.9 15.4 16.4 - -ROE % 8.1 6.9 11.8 13.7 - -ROA % 6.5 5.1 8.5 10.5 - -Div Payout % 48.4 53.6 29.3 23.1 - -EPS SR 5.2 0.9 1.7 2.2 26.7 NMBVPS SR 66.2 13.8 15.0 16.5 9.7 NMSource: Company, NCBC ResearchSegment-wise business analysisProduct segment 2008 Geographic 2008%Rev % Net Inc Breakup %Rev % Net IncPoultry 59.0 33.1Agriculture 41.0 66.9Source: Company, NCBC Research• Business brief: HADCO operates through two main divisions—Agriculture andPoultry—over an area of 35,000 hectares. Under <strong>the</strong> Agriculture segment, HADCOgrows various products including wheat; yellow corn; alfalfa; palm trees producingdates and grapes. Under <strong>the</strong> Poultry segment, <strong>the</strong> <strong>com</strong>pany operates six poultryfarms, and has an annual capacity of 215,000 hens and 31mn eggs.• Financials: HADCO’s revenues increased 18.7% y-o-y <strong>to</strong> SR394.9mn in 2008 drivenby growth in <strong>the</strong> Agriculture and Poultry segment. Driven by this, <strong>the</strong> <strong>com</strong>pany’sEBITDA grew 18.0% y-o-y <strong>to</strong> SR132.3mn. However, EBITDA margins declined 20basis points y-o-y <strong>to</strong> 33.5% in 2008 mainly due <strong>to</strong> higher operating (S,G&A andamortization) expenses.• Recent developments: In May 2009, <strong>the</strong> <strong>com</strong>pany agreed on a share swap dealwith Almarai Co. wherein <strong>the</strong> formers’ shareholders will receive 1 share of Almarai for5 shares in HADCO. In April 2009, <strong>the</strong> <strong>com</strong>pany announced 73.0% y-o-y decline 1Q-09 net in<strong>com</strong>e <strong>to</strong> SR4.9mn. In February 2009, HADCO entered in<strong>to</strong> a rental contractwith Ministry of Agriculture for a 28.5 mn sq meter land in Hail primarily aimed atexpansion of poultry business. HADCO announced, in February 2009, plans <strong>to</strong> investin farming activity in Sudan. In November 2008, <strong>the</strong> <strong>com</strong>pany appointed a financialand legal advisor <strong>to</strong> evaluate Saudi based Al Marai Company bid <strong>to</strong> take over <strong>the</strong><strong>com</strong>pany through a share swap of 1:6 shares for HAIL’s shareholders.JUNE 2009HAIL AGRICULTURE165