to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

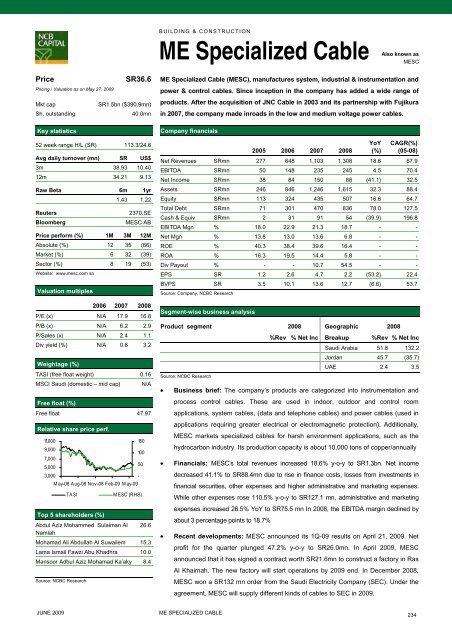

BUILDING & CONSTRUCTIONME Specialized CableAlsoknown asMESCPricePricing / Valuation as on May 27, 2009Mkt capSh. outstandingKey statisticsSR36.6SR1.5bn ($390.9mn)40.0mn52 week range H/L (SR) 113.3/24.6Avg daily turnover (mn) SR US$3m 38.93 10.4012m 34.21 9.13Raw Beta 6m 1yr1.43 1.22ReutersBloomberg2370.SEMESC ABPrice perform (%) 1M 3M 12MAbsolute (%) 12 35 (66)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) 8 19 (53)Website: www.mesc.<strong>com</strong> saValuation multiples2006 2007 2008P/E (x) N/A 17.9 16.8P/B (x) N/A 6.2 2.9P/Sales (x) N/A 2.4 1.1Div yield (%) N/A 0.6 3.2Weightage (%)TASI (free float weight) 0.16MSCI Saudi (domestic – mid cap) N/AFree float (%)Free float 47.97Relative share price perf.11,0009,0007,0005,0003,000M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASITop 5 shareholders (%)15010050-MESC (RHS)Abdul Aziz Mohammed Sulaiman Al 26.6NamlahMohamad Ali Abdullah Al Suwailem 15.3Lama Ismail Fawzi Abu Khadhra 10.0Mansoor Adbul Aziz Mohamad Ka’aky 8.4Source: NCBC ResearchME Specialized Cable (MESC), manufactures system, industrial & instrumentation andpower & control cables. Since inception in <strong>the</strong> <strong>com</strong>pany has added a wide range ofproducts. After <strong>the</strong> acquisition of JNC Cable in 2003 and its partnership with Fujikurain 2007, <strong>the</strong> <strong>com</strong>pany made inroads in <strong>the</strong> low and medium voltage power cables.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Revenues SRmn 277 648 1,103 1,308 18.6 67.9EBITDA SRmn 50 148 235 245 4.5 70.4Net In<strong>com</strong>e SRmn 38 84 150 88 (41.1) 32.5Assets SRmn 246 846 1,246 1,615 32.3 88.4Equity SRmn 113 324 435 507 16.6 64.7Total Debt SRmn 71 301 470 836 78.0 127.5Cash & Equiv SRmn 2 31 91 54 (39.9) 196.8EBITDA Mgn % 18.0 22.9 21.3 18.7 - -Net Mgn % 13.8 13.0 13.6 6.8 - -ROE % 40.3 38.4 39.6 16.4 - -ROA % 16.3 19.5 14.4 5.8 - -Div Payout % - - 10.7 54.5 - -EPS SR 1.2 2.6 4.7 2.2 (53.2) 22.4BVPS SR 3.5 10.1 13.6 12.7 (6.6) 53.7Source: Company, NCBC ResearchSegment-wise business analysisProduct segment 2008 Geographic 2008Source: NCBC Research%Rev % Net Inc Breakup %Rev % Net IncSaudi Arabia 51.8 132.2Jordan 45.7 (35.7)UAE 2.4 3.5• Business brief: The <strong>com</strong>pany’s products are categorized in<strong>to</strong> instrumentation andprocess control cables. These are used in indoor, outdoor and control roomapplications, system cables, (data and telephone cables) and power cables (used inapplications requiring greater electrical or electromagnetic protection). Additionally,MESC markets specialized cables for harsh environment applications, such as <strong>the</strong>hydrocarbon industry. Its production capacity is about 10,000 <strong>to</strong>ns of copper/annually• Financials: MESC’s <strong>to</strong>tal revenues increased 18.6% y-o-y <strong>to</strong> SR1.3bn. Net in<strong>com</strong>edecreased 41.1% <strong>to</strong> SR88.4mn due <strong>to</strong> rise in finance costs, losses from investments infinancial securities, o<strong>the</strong>r expenses and higher administrative and marketing expenses.While o<strong>the</strong>r expenses rose 110.5% y-o-y <strong>to</strong> SR127.1 mn, administrative and marketingexpenses increased 26.5% YoY <strong>to</strong> SR75.5 mn In 2008, <strong>the</strong> EBITDA margin declined byabout 3 percentage points <strong>to</strong> 18.7%• Recent developments: MESC announced its 1Q-09 results on April 21, 2009. Netprofit for <strong>the</strong> quarter plunged 47.2% y-o-y <strong>to</strong> SR26.0mn. In April 2009, MESCannounced that it has signed a contract worth SR21.6mn <strong>to</strong> construct a fac<strong>to</strong>ry in RasAl Khaimah. The new fac<strong>to</strong>ry will start operations by 2009 end. In December 2008,MESC won a SR132 mn order from <strong>the</strong> Saudi Electricity Company (SEC). Under <strong>the</strong>agreement, MESC will supply different kinds of cables <strong>to</strong> SEC in 2009.JUNE 2009ME SPECIALIZED CABLE234