to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

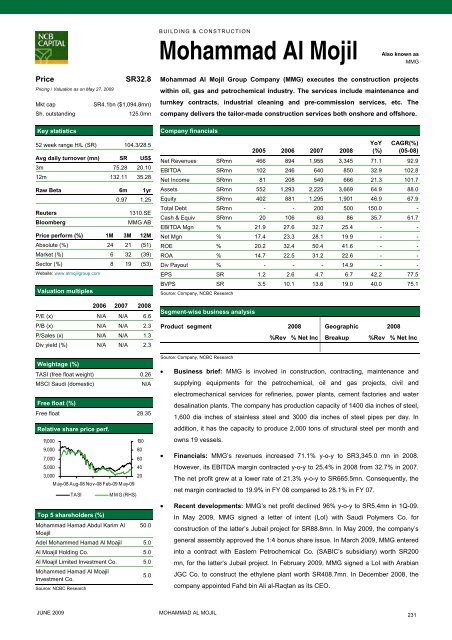

BUILDING & CONSTRUCTIONMohammad Al MojilAlso known asMMGPricePricing / Valuation as on May 27, 2009Mkt capSh. outstandingKey statisticsSR32.8SR4.1bn ($1,094.8mn)125.0mn52 week range H/L (SR) 104.3/28.5Avg daily turnover (mn) SR US$3m 75.28 20.1012m 132.11 35.28Raw Beta 6m 1yr0.97 1.25ReutersBloomberg1310.SEMMG ABPrice perform (%) 1M 3M 12MAbsolute (%) 24 21 (51)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) 8 19 (53)Website: www almojilgroup.<strong>com</strong>Valuation multiples2006 2007 2008P/E (x) N/A N/A 6.6P/B (x) N/A N/A 2.3P/Sales (x) N/A N/A 1.3Div yield (%) N/A N/A 2.3Weightage (%)TASI (free float weight) 0.26MSCI Saudi (domestic)N/AFree float (%)Free float 28.35Relative share price perf.11,0009,0007,0005,0003,000M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASITop 5 shareholders (%)MMG (RHS)100Mohammad Hamad Abdul Karim Al 50.0MoajilAdel Mohammed Hamad Al Moajil 5.0Al Moajil Holding Co. 5.0Al Moajil Limited Investment Co. 5.0Mohammed Hamad Al MoajilInvestment Co.5.0Source: NCBC Research80604020Mohammad Al Mojil Group Company (MMG) executes <strong>the</strong> construction projectswithin oil, gas and petrochemical industry. The services include maintenance andturnkey contracts, industrial cleaning and pre-<strong>com</strong>mission services, etc. The<strong>com</strong>pany delivers <strong>the</strong> tailor-made construction services both onshore and offshore.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Revenues SRmn 466 894 1,955 3,345 71.1 92.9EBITDA SRmn 102 246 640 850 32.9 102.8Net In<strong>com</strong>e SRmn 81 208 549 666 21.3 101.7Assets SRmn 552 1,293 2,225 3,669 64.9 88.0Equity SRmn 402 881 1,295 1,901 46.9 67.9Total Debt SRmn - - 200 500 150.0 -Cash & Equiv SRmn 20 106 63 86 35.7 61.7EBITDA Mgn % 21.9 27.6 32.7 25.4 - -Net Mgn % 17.4 23.3 28.1 19.9 - -ROE % 20.2 32.4 50.4 41.6 - -ROA % 14.7 22.5 31.2 22.6 - -Div Payout % - - - 14.9 - -EPS SR 1.2 2.6 4.7 6.7 42.2 77.5BVPS SR 3.5 10.1 13.6 19.0 40.0 75.1Source: Company, NCBC ResearchSegment-wise business analysisProduct segment 2008 Geographic 2008Source: Company, NCBC Research%Rev % Net Inc Breakup %Rev % Net Inc• Business brief: MMG is involved in construction, contracting, maintenance andsupplying equipments for <strong>the</strong> petrochemical, oil and gas projects, civil andelectromechanical services for refineries, power plants, cement fac<strong>to</strong>ries and waterdesalination plants. The <strong>com</strong>pany has production capacity of 1400 dia inches of steel,1,600 dia inches of stainless steel and 3000 dia inches of steel pipes per day. Inaddition, it has <strong>the</strong> capacity <strong>to</strong> produce 2,000 <strong>to</strong>ns of structural steel per month andowns 19 vessels.• Financials: MMG’s revenues increased 71.1% y-o-y <strong>to</strong> SR3,345.0 mn in 2008.However, its EBITDA margin contracted y-o-y <strong>to</strong> 25.4% in 2008 from 32.7% in 2007.The net profit grew at a lower rate of 21.3% y-o-y <strong>to</strong> SR665.5mn. Consequently, <strong>the</strong>net margin contracted <strong>to</strong> 19.9% in FY 08 <strong>com</strong>pared <strong>to</strong> 28.1% in FY 07.• Recent developments: MMG’s net profit declined 96% y-o-y <strong>to</strong> SR5.4mn in 1Q-09.In May 2009, MMG signed a letter of intent (LoI) with Saudi Polymers Co. forconstruction of <strong>the</strong> latter’s Jubail project for SR88.8mn. In May 2009, <strong>the</strong> <strong>com</strong>pany’sgeneral assembly approved <strong>the</strong> 1:4 bonus share issue. In March 2009, MMG enteredin<strong>to</strong> a contract with Eastern Petrochemical Co. (SABIC’s subsidiary) worth SR200mn, for <strong>the</strong> latter’s Jubail project. In February 2009, MMG signed a LoI with ArabianJGC Co. <strong>to</strong> construct <strong>the</strong> ethylene plant worth SR408.7mn. In December 2008, <strong>the</strong><strong>com</strong>pany appointed Fahd bin Ali al-Raqtan as its CEO.JUNE 2009MOHAMMAD AL MOJIL231