to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

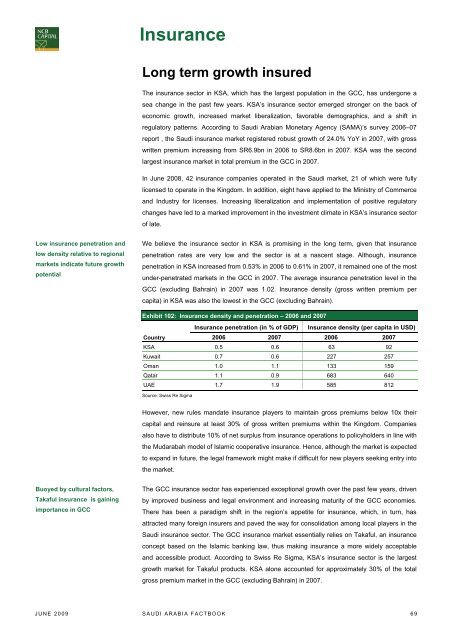

InsuranceLong term growth insuredThe insurance sec<strong>to</strong>r in KSA, which has <strong>the</strong> largest population in <strong>the</strong> GCC, has undergone asea change in <strong>the</strong> past few years. KSA’s insurance sec<strong>to</strong>r emerged stronger on <strong>the</strong> back ofeconomic growth, increased market liberalization, favorable demographics, and a shift inregula<strong>to</strong>ry patterns. According <strong>to</strong> Saudi Arabian Monetary Agency (SAMA)’s survey 2006–07<strong>report</strong> , <strong>the</strong> Saudi insurance market registered robust growth of 24.0% YoY in 2007, with grosswritten premium increasing from SR6.9bn in 2006 <strong>to</strong> SR8.6bn in 2007. KSA was <strong>the</strong> secondlargest insurance market in <strong>to</strong>tal premium in <strong>the</strong> GCC in 2007.In June 2008, 42 insurance <strong>com</strong>panies operated in <strong>the</strong> Saudi market, 21 of which were fullylicensed <strong>to</strong> operate in <strong>the</strong> Kingdom. In addition, eight have applied <strong>to</strong> <strong>the</strong> Ministry of Commerceand Industry for licenses. Increasing liberalization and implementation of positive regula<strong>to</strong>rychanges have led <strong>to</strong> a marked improvement in <strong>the</strong> investment climate in KSA’s insurance sec<strong>to</strong>rof late.Low insurance penetration andlow density relative <strong>to</strong> regionalmarkets indicate future growthpotentialWe believe <strong>the</strong> insurance sec<strong>to</strong>r in KSA is promising in <strong>the</strong> long term, given that insurancepenetration rates are very low and <strong>the</strong> sec<strong>to</strong>r is at a nascent stage. Although, insurancepenetration in KSA increased from 0.53% in 2006 <strong>to</strong> 0.61% in 2007, it remained one of <strong>the</strong> mostunder-penetrated markets in <strong>the</strong> GCC in 2007. The average insurance penetration level in <strong>the</strong>GCC (excluding Bahrain) in 2007 was 1.02. Insurance density (gross written premium percapita) in KSA was also <strong>the</strong> lowest in <strong>the</strong> GCC (excluding Bahrain).Exhibit 102: Insurance density and penetration – 2006 and 2007Insurance penetration (in % of GDP) Insurance density (per capita in USD)Country 2006 2007 2006 2007KSA 0.5 0.6 63 92Kuwait 0.7 0.6 227 257Oman 1.0 1.1 133 159Qatar 1.1 0.9 683 640UAE 1.7 1.9 585 812Source: Swiss Re SigmaHowever, new rules mandate insurance players <strong>to</strong> maintain gross premiums below 10x <strong>the</strong>ircapital and reinsure at least 30% of gross written premiums within <strong>the</strong> Kingdom. Companiesalso have <strong>to</strong> distribute 10% of net surplus from insurance operations <strong>to</strong> policyholders in line with<strong>the</strong> Mudarabah model of Islamic cooperative insurance. Hence, although <strong>the</strong> market is expected<strong>to</strong> expand in future, <strong>the</strong> legal framework might make if difficult for new players seeking entry in<strong>to</strong><strong>the</strong> market.Buoyed by cultural fac<strong>to</strong>rs,Takaful insurance is gainingimportance in GCCThe GCC insurance sec<strong>to</strong>r has experienced exceptional growth over <strong>the</strong> past few years, drivenby improved business and legal environment and increasing maturity of <strong>the</strong> GCC economies.There has been a paradigm shift in <strong>the</strong> region’s appetite for insurance, which, in turn, hasattracted many foreign insurers and paved <strong>the</strong> way for consolidation among local players in <strong>the</strong>Saudi insurance sec<strong>to</strong>r. The GCC insurance market essentially relies on Takaful, an insuranceconcept based on <strong>the</strong> Islamic banking law, thus making insurance a more widely acceptableand accessible product. According <strong>to</strong> Swiss Re Sigma, KSA’s insurance sec<strong>to</strong>r is <strong>the</strong> largestgrowth market for Takaful products. KSA alone accounted for approximately 30% of <strong>the</strong> <strong>to</strong>talgross premium market in <strong>the</strong> GCC (excluding Bahrain) in 2007.JUNE 2009 SAUDI ARABIA FACTBOOK 69