to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

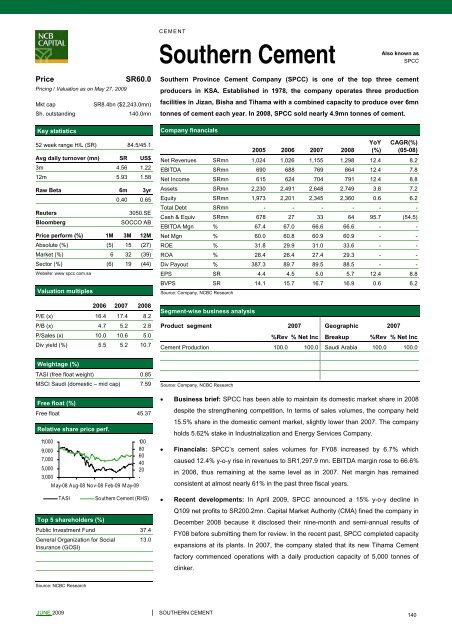

CEMENTSou<strong>the</strong>rn CementAlso known asSPCCPriceSR60.0Pricing / Valuation as on May 27, 2009Mkt capSR8.4bn ($2,243.0mn)Sh. outstanding140.0mnKey statistics52 week range H/L (SR) 84.5/45.1Avg daily turnover (mn) SR US$3m 4.56 1.2212m 5.93 1.58Raw Beta 6m 3yr0.40 0.65Reuters3050.SEBloombergSOCCO ABPrice perform (%) 1M 3M 12MAbsolute (%) (5) 15 (27)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) (6) 19 (44)Website: www spcc <strong>com</strong>.saValuation multiples2006 2007 2008P/E (x) 16.4 17.4 8.2P/B (x) 4.7 5.2 2.8P/Sales (x) 10.0 10.6 5.0Div yield (%) 5.5 5.2 10.7Sou<strong>the</strong>rn Province Cement Company (SPCC) is one of <strong>the</strong> <strong>to</strong>p three cementproducers in KSA. Established in 1978, <strong>the</strong> <strong>com</strong>pany operates three productionfacilities in Jizan, Bisha and Tihama with a <strong>com</strong>bined capacity <strong>to</strong> produce over 6mn<strong>to</strong>nnes of cement each year. In 2008, SPCC sold nearly 4.9mn <strong>to</strong>nnes of cement.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Revenues SRmn 1,024 1,026 1,155 1,298 12.4 8.2EBITDA SRmn 690 688 769 864 12.4 7.8Net In<strong>com</strong>e SRmn 615 624 704 791 12.4 8.8Assets SRmn 2,230 2,491 2,648 2,749 3.8 7.2Equity SRmn 1,973 2,201 2,345 2,360 0.6 6.2Total Debt SRmn - - - - - -Cash & Equiv SRmn 678 27 33 64 95.7 (54.5)EBITDA Mgn % 67.4 67.0 66.6 66.6 - -Net Mgn % 60.0 60.8 60.9 60.9 - -ROE % 31.8 29.9 31.0 33.6 - -ROA % 28.4 26.4 27.4 29.3 - -Div Payout % 387.3 89.7 89.5 88.5 - -EPS SR 4.4 4.5 5.0 5.7 12.4 8.8BVPS SR 14.1 15.7 16.7 16.9 0.6 6.2Source: Company, NCBC ResearchSegment-wise business analysisProduct segment 2007 Geographic 2007%Rev % Net Inc Breakup %Rev % Net IncCement Production 100.0 100.0 Saudi Arabia 100.0 100.0Weightage (%)TASI (free float weight) 0.85MSCI Saudi (domestic – mid cap) 7.59Free float (%)Free float 45.37Relative share price perf.11,0009,0007,0005,0003,000M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASITop 5 shareholders (%)10080604020-Sou<strong>the</strong>rn Cement (RHS)Public Investment Fund 37.4General Organization for Social 13.0Insurance (GOSI)Source: Company, NCBC Research• Business brief: SPCC has been able <strong>to</strong> maintain its domestic market share in 2008despite <strong>the</strong> streng<strong>the</strong>ning <strong>com</strong>petition. In terms of sales volumes, <strong>the</strong> <strong>com</strong>pany held15.5% share in <strong>the</strong> domestic cement market, slightly lower than 2007. The <strong>com</strong>panyholds 5.62% stake in Industrialization and Energy Services Company.• Financials: SPCC’s cement sales volumes for FY08 increased by 6.7% whichcaused 12.4% y-o-y rise in revenues <strong>to</strong> SR1,297.9 mn. EBITDA margin rose <strong>to</strong> 66.6%in 2008, thus remaining at <strong>the</strong> same level as in 2007. Net margin has remainedconsistent at almost nearly 61% in <strong>the</strong> past three fiscal years.• Recent developments: In April 2009, SPCC announced a 15% y-o-y decline inQ109 net profits <strong>to</strong> SR200.2mn. Capital Market Authority (CMA) fined <strong>the</strong> <strong>com</strong>pany inDecember 2008 because it disclosed <strong>the</strong>ir nine-month and semi-annual results ofFY08 before submitting <strong>the</strong>m for review. In <strong>the</strong> recent past, SPCC <strong><strong>com</strong>plete</strong>d capacityexpansions at its plants. In 2007, <strong>the</strong> <strong>com</strong>pany stated that its new Tihama Cementfac<strong>to</strong>ry <strong>com</strong>menced operations with a daily production capacity of 5,000 <strong>to</strong>nnes ofclinker.Source: NCBC ResearchJUNE 2009SOUTHERN CEMENT140