to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

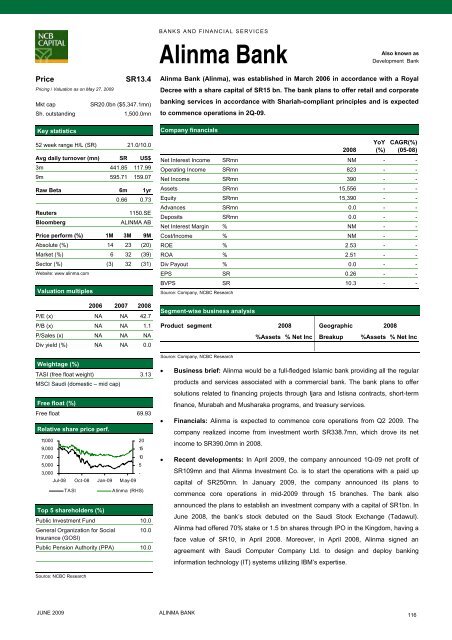

BANKS AND FINANCIAL SERVICESAlinma BankAlso known asDevelopment BankPricePricing / Valuation as on May 27, 2009Mkt capSh. outstandingKey statisticsSR13.4SR20.0bn ($5,347.1mn)1,500.0mn52 week range H/L (SR) 21.0/10.0Avg daily turnover (mn) SR US$3m 441.85 117.999m 595.71 159.07Raw Beta 6m 1yr0.66 0.73ReutersBloomberg1150.SEALINMA ABPrice perform (%) 1M 3M 9MAbsolute (%) 14 23 (20)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) (3) 32 (31)Website: www alinma.<strong>com</strong>Valuation multiples2006 2007 2008P/E (x) NA NA 42.7P/B (x) NA NA 1.1P/Sales (x) NA NA NADiv yield (%) NA NA 0.0Weightage (%)TASI (free float weight) 3.13MSCI Saudi (domestic – mid cap)Free float (%)Free float 69.93Relative share price perf.11,0009,0007,0005,0003,000Jul-08 Oct-08 Jan-09 M ay-09TASITop 5 shareholders (%)2015105-Alinma (RHS)Public Investment Fund 10.0General Organization for Social 10.0Insurance (GOSI)Public Pension Authority (PPA) 10.0Alinma Bank (Alinma), was established in March 2006 in accordance with a RoyalDecree with a share capital of SR15 bn. The bank plans <strong>to</strong> offer retail and corporatebanking services in accordance with Shariah-<strong>com</strong>pliant principles and is expected<strong>to</strong> <strong>com</strong>mence operations in 2Q-09.Company financials2008YoY(%)CAGR(%)(05-08)Net Interest In<strong>com</strong>e SRmn NM - -Operating In<strong>com</strong>e SRmn 823 - -Net In<strong>com</strong>e SRmn 390 - -Assets SRmn 15,556 - -Equity SRmn 15,390 - -Advances SRmn 0.0 - -Deposits SRmn 0.0 - -Net Interest Margin % NM - -Cost/In<strong>com</strong>e % NM - -ROE % 2.53 - -ROA % 2.51 - -Div Payout % 0.0 - -EPS SR 0.26 - -BVPS SR 10.3 - -Source: Company, NCBC ResearchSegment-wise business analysisProduct segment 2008 Geographic 2008Source: Company, NCBC Research%Assets % Net Inc Breakup %Assets % Net Inc• Business brief: Alinma would be a full-fledged Islamic bank providing all <strong>the</strong> regularproducts and services associated with a <strong>com</strong>mercial bank. The bank plans <strong>to</strong> offersolutions related <strong>to</strong> financing projects through Ijara and Istisna contracts, short-termfinance, Murabah and Musharaka programs, and treasury services.• Financials: Alinma is expected <strong>to</strong> <strong>com</strong>mence core operations from Q2 2009. The<strong>com</strong>pany realized in<strong>com</strong>e from investment worth SR338.7mn, which drove its netin<strong>com</strong>e <strong>to</strong> SR390.0mn in 2008.• Recent developments: In April 2009, <strong>the</strong> <strong>com</strong>pany announced 1Q-09 net profit ofSR109mn and that Alinma Investment Co. is <strong>to</strong> start <strong>the</strong> operations with a paid upcapital of SR250mn. In January 2009, <strong>the</strong> <strong>com</strong>pany announced its plans <strong>to</strong><strong>com</strong>mence core operations in mid-2009 through 15 branches. The bank alsoannounced <strong>the</strong> plans <strong>to</strong> establish an investment <strong>com</strong>pany with a capital of SR1bn. InJune 2008, <strong>the</strong> bank’s s<strong>to</strong>ck debuted on <strong>the</strong> Saudi S<strong>to</strong>ck Exchange (Tadawul).Alinma had offered 70% stake or 1.5 bn shares through IPO in <strong>the</strong> Kingdom, having aface value of SR10, in April 2008. Moreover, in April 2008, Alinma signed anagreement with Saudi Computer Company Ltd. <strong>to</strong> design and deploy bankinginformation technology (IT) systems utilizing IBM’s expertise.Source: NCBC ResearchJUNE 2009ALINMA BANK116