to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

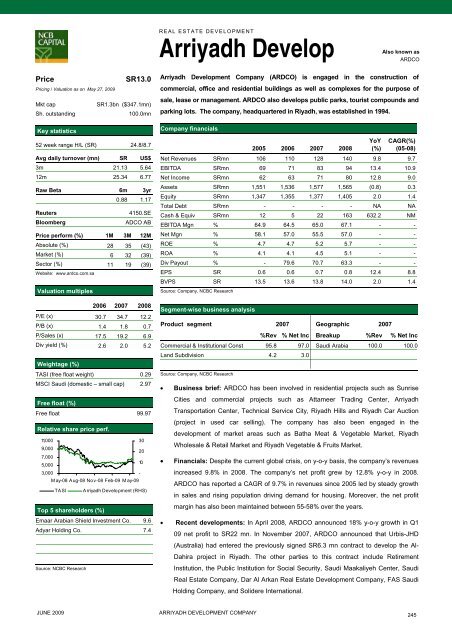

REAL ESTATE DEVELOPMENTArriyadh DevelopAlso known asARDCOPriceSR13.0Pricing / Valuation as on May 27, 2009Mkt capSR1.3bn ($347.1mn)Sh. outstanding100.0mnKey statistics52 week range H/L (SR) 24.8/8.7Avg daily turnover (mn) SR US$3m 21.13 5.6412m 25.34 6.77Raw Beta 6m 3yr0.88 1.17Reuters4150.SEBloombergADCO ABPrice perform (%) 1M 3M 12MAbsolute (%) 28 35 (43)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) 11 19 (39)Website: www.ardco.<strong>com</strong>.saValuation multiples2006 2007 2008P/E (x) 30.7 34.7 12.2P/B (x) 1.4 1.8 0.7P/Sales (x) 17.5 19.2 6.9Div yield (%) 2.6 2.0 5.2Weightage (%)TASI (free float weight) 0.29MSCI Saudi (domestic – small cap) 2.97Free float (%)Free float 99.97Relative share price perf.11,000309,000207,0005,000103,000-M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASI Arriyadh Development (RHS)Top 5 shareholders (%)Emaar Arabian Shield Investment Co. 9.6Adyar Holding Co. 7.4Source: NCBC ResearchArriyadh Development Company (ARDCO) is engaged in <strong>the</strong> construction of<strong>com</strong>mercial, office and residential buildings as well as <strong>com</strong>plexes for <strong>the</strong> purpose ofsale, lease or management. ARDCO also develops public parks, <strong>to</strong>urist <strong>com</strong>pounds andparking lots. The <strong>com</strong>pany, headquartered in Riyadh, was established in 1994.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Revenues SRmn 106 110 128 140 9.8 9.7EBITDA SRmn 69 71 83 94 13.4 10.9Net In<strong>com</strong>e SRmn 62 63 71 80 12.8 9.0Assets SRmn 1,551 1,536 1,577 1,565 (0.8) 0.3Equity SRmn 1,347 1,355 1,377 1,405 2.0 1.4Total Debt SRmn - - - - NA NACash & Equiv SRmn 12 5 22 163 632.2 NMEBITDA Mgn % 64.9 64.5 65.0 67.1 - -Net Mgn % 58.1 57.0 55.5 57.0 - -ROE % 4.7 4.7 5.2 5.7 - -ROA % 4.1 4.1 4.5 5.1 - -Div Payout % - 79.6 70.7 63.3 - -EPS SR 0.6 0.6 0.7 0.8 12.4 8.8BVPS SR 13.5 13.6 13.8 14.0 2.0 1.4Source: Company, NCBC ResearchSegment-wise business analysisProduct segment 2007 Geographic 2007%Rev % Net Inc Breakup %Rev % Net IncCommercial & Institutional Const 95.8 97.0 Saudi Arabia 100.0 100.0Land Subdivision 4.2 3.0Source: Company, NCBC Research• Business brief: ARDCO has been involved in residential projects such as SunriseCities and <strong>com</strong>mercial projects such as Attameer Trading Center, ArriyadhTransportation Center, Technical Service City, Riyadh Hills and Riyadh Car Auction(project in used car selling). The <strong>com</strong>pany has also been engaged in <strong>the</strong>development of market areas such as Batha Meat & Vegetable Market, RiyadhWholesale & Retail Market and Riyadh Vegetable & Fruits Market.• Financials: Despite <strong>the</strong> current global crisis, on y-o-y basis, <strong>the</strong> <strong>com</strong>pany’s revenuesincreased 9.8% in 2008. The <strong>com</strong>pany’s net profit grew by 12.8% y-o-y in 2008.ARDCO has <strong>report</strong>ed a CAGR of 9.7% in revenues since 2005 led by steady growthin sales and rising population driving demand for housing. Moreover, <strong>the</strong> net profitmargin has also been maintained between 55-58% over <strong>the</strong> years.• Recent developments: In April 2008, ARDCO announced 18% y-o-y growth in Q109 net profit <strong>to</strong> SR22 mn. In November 2007, ARDCO announced that Urbis-JHD(Australia) had entered <strong>the</strong> previously signed SR6.3 mn contract <strong>to</strong> develop <strong>the</strong> Al-Dahira project in Riyadh. The o<strong>the</strong>r parties <strong>to</strong> this contract include RetirementInstitution, <strong>the</strong> Public Institution for Social Security, Saudi Maakaliyeh Center, SaudiReal Estate Company, Dar Al Arkan Real Estate Development Company, FAS SaudiHolding Company, and Solidere International.JUNE 2009ARRIYADH DEVELOPMENT COMPANY245