to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

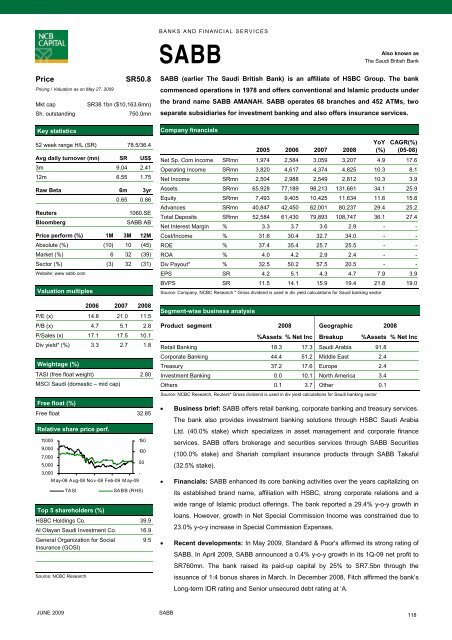

BANKS AND FINANCIAL SERVICESSABBAlso known asThe Saudi British BankPricePricing / Valuation as on May 27, 2009Mkt capSh. outstandingKey statisticsSR50.8SR38.1bn ($10,163.6mn)750.0mn52 week range H/L (SR) 78.5/36.4Avg daily turnover (mn) SR US$3m 9.04 2.4112m 6.55 1.75Raw Beta 6m 3yr0.65 0.86ReutersBloomberg1060.SESABB ABPrice perform (%) 1M 3M 12MAbsolute (%) (10) 10 (45)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) (3) 32 (31)Website: www sabb.<strong>com</strong>Valuation multiples2006 2007 2008P/E (x) 14.8 21.0 11.5P/B (x) 4.7 5.1 2.8P/Sales (x) 17.1 17.5 10.1Div yield* (%) 3.3 2.7 1.8Weightage (%)TASI (free float weight) 2.80MSCI Saudi (domestic – mid cap)Free float (%)Free float 32.85Relative share price perf.11,0009,0007,0005,0003,000M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASITop 5 shareholders (%)15010050-SABB (RHS)HSBC Holdings Co. 39.9Al Olayan Saudi Investment Co. 16.9General Organization for Social 9.5Insurance (GOSI)Source: NCBC ResearchSABB (earlier The Saudi British Bank) is an affiliate of HSBC Group. The bank<strong>com</strong>menced operations in 1978 and offers conventional and Islamic products under<strong>the</strong> brand name SABB AMANAH. SABB operates 68 branches and 452 ATMs, twoseparate subsidiaries for investment banking and also offers insurance services.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Sp. Com In<strong>com</strong>e SRmn 1,974 2,584 3,059 3,207 4.9 17.6Operating In<strong>com</strong>e SRmn 3,820 4,617 4,374 4,825 10.3 8.1Net In<strong>com</strong>e SRmn 2,504 2,988 2,549 2,812 10.3 3.9Assets SRmn 65,928 77,189 98,213 131,661 34.1 25.9Equity SRmn 7,493 9,405 10,425 11,634 11.6 15.8Advances SRmn 40,847 42,450 62,001 80,237 29.4 25.2Total Deposits SRmn 52,584 61,430 79,893 108,747 36.1 27.4Net Interest Margin % 3.3 3.7 3.6 2.9 - -Cost/In<strong>com</strong>e % 31.6 30.4 32.7 34.0 - -ROE % 37.4 35.4 25.7 25.5 - -ROA % 4.0 4.2 2.9 2.4 - -Div Payout* % 32.5 50.2 57.5 20.5 - -EPS SR 4.2 5.1 4.3 4.7 7.9 3.9BVPS SR 11.5 14.1 15.9 19.4 21.8 19.0Source: Company, NCBC Research * Gross dividend is used in div yield calculations for Saudi banking sec<strong>to</strong>rSegment-wise business analysisProduct segment 2008 Geographic 2008%Assets % Net Inc Breakup %Assets % Net IncRetail Banking 18.3 17.3 Saudi Arabia 91.8Corporate Banking 44.4 51.2 Middle East 2.4Treasury 37.2 17.6 Europe 2.4Investment Banking 0.0 10.1 North America 3.4O<strong>the</strong>rs 0.1 3.7 O<strong>the</strong>r 0.1Source: NCBC Research, Reuters* Gross dividend is used in div yield calculations for Saudi banking sec<strong>to</strong>r• Business brief: SABB offers retail banking, corporate banking and treasury services.The bank also provides investment banking solutions through HSBC Saudi ArabiaLtd. (40.0% stake) which specializes in asset management and corporate financeservices. SABB offers brokerage and securities services through SABB Securities(100.0% stake) and Shariah <strong>com</strong>pliant insurance products through SABB Takaful(32.5% stake).• Financials: SABB enhanced its core banking activities over <strong>the</strong> years capitalizing onits established brand name, affiliation with HSBC, strong corporate relations and awide range of Islamic product offerings. The bank <strong>report</strong>ed a 29.4% y-o-y growth inloans. However, growth in Net Special Commission In<strong>com</strong>e was constrained due <strong>to</strong>23.0% y-o-y increase in Special Commission Expenses.• Recent developments: In May 2009, Standard & Poor's affirmed its strong rating ofSABB. In April 2009, SABB announced a 0.4% y-o-y growth in its 1Q-09 net profit <strong>to</strong>SR760mn. The bank raised its paid-up capital by 25% <strong>to</strong> SR7.5bn through <strong>the</strong>issuance of 1:4 bonus shares in March. In December 2008, Fitch affirmed <strong>the</strong> bank’sLong-term IDR rating and Senior unsecured debt rating at ‘A.JUNE 2009SABB118