to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

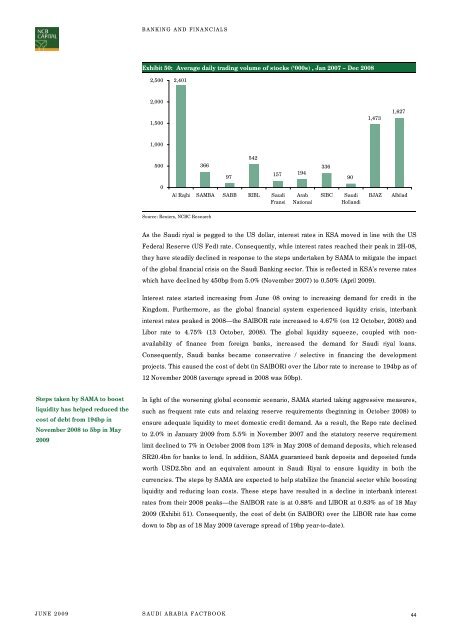

BANKING AND FINANCIALSExhibit 50: Average daily trading volume of s<strong>to</strong>cks (‘000s) , Jan 2007 – Dec 20082,5002,4012,0001,5001,4731,6271,00050036697542157 194336900Al Rajhi SAMBA SABB RIBL SaudiFransiArabNationalSIBCSaudiHollandiBJAZAlbiladSource: Reuters, NCBC ResearchAs <strong>the</strong> Saudi riyal is pegged <strong>to</strong> <strong>the</strong> US dollar, interest rates in KSA moved in line with <strong>the</strong> USFederal Reserve (US Fed) rate. Consequently, while interest rates reached <strong>the</strong>ir peak in 2H-08,<strong>the</strong>y have steadily declined in response <strong>to</strong> <strong>the</strong> steps undertaken by SAMA <strong>to</strong> mitigate <strong>the</strong> impac<strong>to</strong>f <strong>the</strong> global financial crisis on <strong>the</strong> Saudi Banking sec<strong>to</strong>r. This is reflected in KSA’s reverse rateswhich have declined by 450bp from 5.0% (November 2007) <strong>to</strong> 0.50% (April 2009).Interest rates started increasing from June 08 owing <strong>to</strong> increasing demand for credit in <strong>the</strong>Kingdom. Fur<strong>the</strong>rmore, as <strong>the</strong> global financial system experienced liquidity crisis, interbankinterest rates peaked in 2008—<strong>the</strong> SAIBOR rate increased <strong>to</strong> 4.67% (on 12 Oc<strong>to</strong>ber, 2008) andLibor rate <strong>to</strong> 4.75% (13 Oc<strong>to</strong>ber, 2008). The global liquidity squeeze, coupled with nonavailabilityof finance from foreign banks, increased <strong>the</strong> demand for Saudi riyal loans.Consequently, Saudi banks became conservative / selective in financing <strong>the</strong> developmentprojects. This caused <strong>the</strong> cost of debt (in SAIBOR) over <strong>the</strong> Libor rate <strong>to</strong> increase <strong>to</strong> 194bp as of12 November 2008 (average spread in 2008 was 50bp).Steps taken by SAMA <strong>to</strong> boostliquidity has helped reduced <strong>the</strong>cost of debt from 194bp inNovember 2008 <strong>to</strong> 5bp in May2009In light of <strong>the</strong> worsening global economic scenario, SAMA started taking aggressive measures,such as frequent rate cuts and relaxing reserve requirements (beginning in Oc<strong>to</strong>ber 2008) <strong>to</strong>ensure adequate liquidity <strong>to</strong> meet domestic credit demand. As a result, <strong>the</strong> Repo rate declined<strong>to</strong> 2.0% in January 2009 from 5.5% in November 2007 and <strong>the</strong> statu<strong>to</strong>ry reserve requirementlimit declined <strong>to</strong> 7% in Oc<strong>to</strong>ber 2008 from 13% in May 2008 of demand deposits, which releasedSR20.4bn for banks <strong>to</strong> lend. In addition, SAMA guaranteed bank deposits and deposited fundsworth USD2.5bn and an equivalent amount in Saudi Riyal <strong>to</strong> ensure liquidity in both <strong>the</strong>currencies. The steps by SAMA are expected <strong>to</strong> help stabilize <strong>the</strong> financial sec<strong>to</strong>r while boostingliquidity and reducing loan costs. These steps have resulted in a decline in interbank interestrates from <strong>the</strong>ir 2008 peaks—<strong>the</strong> SAIBOR rate is at 0.88% and LIBOR at 0.83% as of 18 May2009 (Exhibit 51). Consequently, <strong>the</strong> cost of debt (in SAIBOR) over <strong>the</strong> LIBOR rate has <strong>com</strong>edown <strong>to</strong> 5bp as of 18 May 2009 (average spread of 19bp year-<strong>to</strong>-date).JUNE 2009SAUDI ARABIA FACTBOOK44