- Page 1 and 2:

NCB Capital Research DepartmentJune

- Page 3 and 4:

KSA ECONOMY AND NATION 5Outlook and

- Page 5 and 6:

KSA: Economy and NationSearching gr

- Page 7 and 8:

OUTLOOK AND DIRECTIONat a CAGR of 5

- Page 9 and 10:

OUTLOOK AND DIRECTIONpropel growth

- Page 11 and 12:

OUTLOOK AND DIRECTIONThe dramatic c

- Page 13 and 14:

OUTLOOK AND DIRECTIONExhibit 7: Sov

- Page 15 and 16:

OUTLOOK AND DIRECTIONStrong hydroca

- Page 17:

OUTLOOK AND DIRECTIONExhibit 13: KS

- Page 20 and 21:

OUTLOOK AND DIRECTIONappropriate po

- Page 22 and 23:

OUTLOOK AND DIRECTIONInternational

- Page 24 and 25:

THIS PAGE IS INTENTIONALLY LEFT BLA

- Page 26 and 27: History and overviewThe leading GCC

- Page 28 and 29: HISTORY AND OVERVIEWExhibit 25: Bre

- Page 30 and 31: HISTORY AND OVERVIEWExhibit 29: Con

- Page 32 and 33: HISTORY AND OVERVIEWMarket regulati

- Page 34 and 35: HISTORY AND OVERVIEWeconomic condit

- Page 36 and 37: HISTORY AND OVERVIEWExhibit 38: Vol

- Page 38 and 39: THIS PAGE IS INTENTIONALLY LEFT BLA

- Page 40 and 41: Banking and FinancialsLeveraging th

- Page 42 and 43: BANKING AND FINANCIALSExhibit 43: R

- Page 44 and 45: BANKING AND FINANCIALSExhibit 50: A

- Page 46 and 47: PetrochemicalsCost advantage fuelli

- Page 48 and 49: PETROCHEMICALSExhibit 55: Compariso

- Page 50 and 51: CEMENTExhibit 60: Sector details% w

- Page 52 and 53: RetailBetting on increasing consume

- Page 54 and 55: RETAILExhibit 69: Revenue of compan

- Page 56 and 57: Energy and UtilitiesPrivatizing is

- Page 58 and 59: ENERGY AND UTILITIES(PIF) and SECO.

- Page 60 and 61: ENERGY AND UTILITIESincrease the ut

- Page 62 and 63: AGRICULTURE AND FOODare Herfy, Al-B

- Page 64 and 65: AGRICULTURE AND FOODExhibit 91: Ave

- Page 66 and 67: TELECOM AND ITline penetration stan

- Page 68 and 69: TELECOM AND ITZain started trading

- Page 70 and 71: INSURANCEExhibit 103: Country wise

- Page 72 and 73: INSURANCE(YoY), despite growth in r

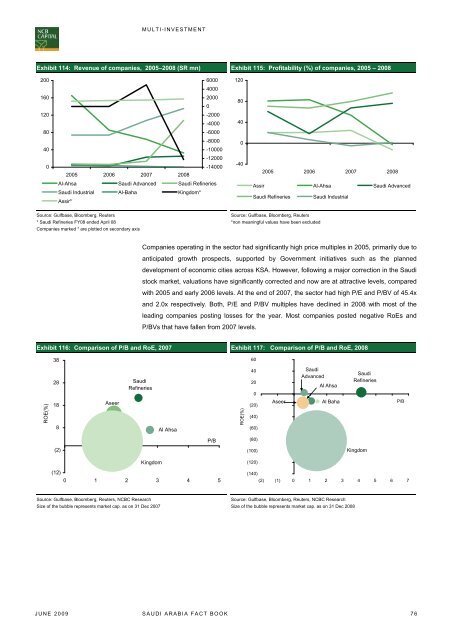

- Page 74 and 75: Multi-investmentLight at the end of

- Page 78 and 79: Industrial InvestmentFacing the imp

- Page 80 and 81: INDUSTRIAL INVESTMENTExhibit 122: R

- Page 82 and 83: Building and ConstructionHealthy pi

- Page 84 and 85: BUILDING AND CONTRUCTIONThe buildin

- Page 86 and 87: BUILDING AND CONTRUCTIONSaudi Aramc

- Page 88 and 89: REAL ESTATE AND DEVELOPMENTExhibit

- Page 90 and 91: REAL ESTATE AND DEVELOPMENTsection

- Page 92 and 93: REAL ESTATE AND DEVELOPMENTExhibit

- Page 94 and 95: TRANSPORTATIONRoad transportRoad tr

- Page 96 and 97: TRANSPORTATIONNational Shipping Com

- Page 98 and 99: TRANSPORTATIONfears, and plunging f

- Page 100 and 101: MEDIA AND PUBLISHINGExhibit 159: Re

- Page 102 and 103: MEDIA AND PUBLISHINGExhibit 166: Av

- Page 104 and 105: HOTEL AND TOURISMSeparately, leisur

- Page 106 and 107: HOTEL AND TOURISMIn 2008, the secto

- Page 108 and 109: THIS PAGE IS INTENTIONALLY LEFT BLA

- Page 110 and 111: THIS PAGE IS INTENTIONALLY LEFT BLA

- Page 112 and 113: BANKS AND FINANCIAL SERVICESAl Rajh

- Page 114 and 115: BANKS AND FINANCIAL SERVICESBanque

- Page 116 and 117: BANKS AND FINANCIAL SERVICESAlinma

- Page 118 and 119: BANKS AND FINANCIAL SERVICESSABBAls

- Page 120 and 121: BANKS AND FINANCIAL SERVICESBank Al

- Page 122 and 123: BANKS AND FINANCIAL SERVICESBank Al

- Page 124 and 125: PETROCHEMICAL INDUSTRIESSaudi Basic

- Page 126 and 127:

PETROCHEMICAL INDUSTRIESSaudi Kayan

- Page 128 and 129:

PETROCHEMICAL INDUSTRIESSaudi Indus

- Page 130 and 131:

PETROCHEMICAL INDUSTRIESRabigh Refi

- Page 132 and 133:

PETROCHEMICAL INDUSTRIESYanbu Natio

- Page 134 and 135:

PETROCHEMICAL INDUSTRIESNama Chemic

- Page 136 and 137:

PETROCHEMICAL INDUSTRIESMethanol Ch

- Page 138 and 139:

CEMENTSaudi CementAlso known asSCCP

- Page 140 and 141:

CEMENTSouthern CementAlso known asS

- Page 142 and 143:

CEMENTYanbu CementAlso known asYCCP

- Page 144 and 145:

PriceSR46.5Pricing / Valuation as o

- Page 146 and 147:

THIS PAGE IS INTENTIONALLY LEFT BLA

- Page 148 and 149:

RETAILJarir Marketing CoAlso known

- Page 150 and 151:

RETAILAldrees PetroleumAlso known a

- Page 152 and 153:

RETAILAhmed H. Fitaihi CoAlsoknown

- Page 154 and 155:

RETAILNational AgricultureAlsoknown

- Page 156 and 157:

THIS PAGE IS INTENTIONALLY LEFT BLA

- Page 158 and 159:

ENERGY AND UTILITIESSaudi ElectricA

- Page 160 and 161:

THIS PAGE IS INTENTIONALLY LEFT BLA

- Page 162 and 163:

AGRICULTURE & FOOD INDUSTRIESSavola

- Page 164 and 165:

AGRICULTURE & FOOD INDUSTRIESNation

- Page 166 and 167:

AGRICULTURE & FOOD INDUSTRIESQassim

- Page 168 and 169:

AGRICULTURE & FOOD INDUSTRIESSaudi

- Page 170 and 171:

AGRICULTURE & FOOD INDUSTRIESFood P

- Page 172 and 173:

AGRICULTURE & FOOD INDUSTRIESHalwan

- Page 174 and 175:

AGRICULTURE & FOOD INDUSTRIESTabuk

- Page 176 and 177:

THIS PAGE IS INTENTIONALLY LEFT BLA

- Page 178 and 179:

TELECOMMUNICATIONSaudi TelecomAlso

- Page 180 and 181:

TELECOMMUNICATIONZain KSAAlso known

- Page 182 and 183:

THIS PAGE IS INTENTIONALLY LEFT BLA

- Page 184 and 185:

INSURANCETawuniyaAlso known asTawun

- Page 186 and 187:

INSURANCESABB TakafulAlso known asS

- Page 188 and 189:

INSURANCEAl Sagr CompanyAlso Known

- Page 190 and 191:

INSURANCEBupa Arabia for Coop InsPr

- Page 192 and 193:

INSURANCESaudi IAIC Co-op.Also know

- Page 194 and 195:

INSURANCESanad InsuranceAlso known

- Page 196 and 197:

INSURANCESaudi Fransi Coop.Also kno

- Page 198 and 199:

PriceSR28.4Pricing / Valuation as o

- Page 200 and 201:

INSURANCESaudi Indian Co.Also known

- Page 202 and 203:

INSURANCESaudi Arabian Co-opAlsokno

- Page 204 and 205:

INSURANCEAllied Co-operativeAlso kn

- Page 206 and 207:

MULTI-INVESTMENTKingdom Holding CoA

- Page 208 and 209:

PriceSR57.5Pricing / Valuation as o

- Page 210 and 211:

PriceSR13.6Pricing / Valuation as o

- Page 212 and 213:

MULTI-INVESTMENTAl-Baha InvestmentA

- Page 214 and 215:

INDUSTRIAL INVESTMENTAlsoSaudi Arab

- Page 216 and 217:

INDUSTRIAL INVESTMENTSaudi Pharma.A

- Page 218 and 219:

INDUSTRIAL INVESTMENTSaudi Paper Mn

- Page 220 and 221:

INDUSTRIAL INVESTMENTAstra Indl Gro

- Page 222 and 223:

INDUSTRIAL INVESTMENTAlsoSaudi Indl

- Page 224 and 225:

INDUSTRIAL INVESTMENTAlso known asF

- Page 226 and 227:

BUILDING & CONSTRUCTIONSA Amiantit

- Page 228 and 229:

BUILDING & CONSTRUCTIONAl-Babtain P

- Page 230 and 231:

BUILDING & CONSTRUCTIONSaudi Cerami

- Page 232 and 233:

BUILDING & CONSTRUCTIONArabian Pipe

- Page 234 and 235:

BUILDING & CONSTRUCTIONME Specializ

- Page 236 and 237:

BUILDING & CONSTRUCTIONSaudi Indust

- Page 238 and 239:

THIS PAGE IS INTENTIONALLY LEFT BLA

- Page 240 and 241:

REAL ESTATE DEVELOPMENTDar Al Arkan

- Page 242 and 243:

REAL ESTATE DEVELOPMENTMakkah Const

- Page 244 and 245:

REAL ESTATE DEVELOPMENTTaiba Holdin

- Page 246 and 247:

REAL ESTATE DEVELOPMENTSaudi Real E

- Page 248 and 249:

TRANSPORTNational ShippingAlso know

- Page 250 and 251:

TRANSPORTUnited InternationalAlso k

- Page 252 and 253:

THIS PAGE IS INTENTIONALLY LEFT BLA

- Page 254 and 255:

MEDIA AND PUBLISHINGSaudi ResearchA

- Page 256 and 257:

MEDIA AND PUBLISHINGTihamaAlso know

- Page 258 and 259:

PricePricing / Valuation as on May

- Page 260:

Kindly send all mailing list reques