to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

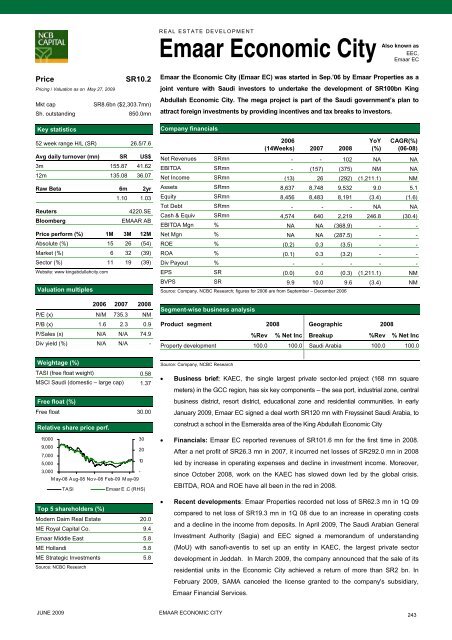

REAL ESTATE DEVELOPMENTAlsoEmaar Economic Cityknown asEEC,Emaar ECPriceSR10.2Pricing / Valuation as on May 27, 2009Mkt capSR8.6bn ($2,303.7mn)Sh. outstanding850.0mnKey statistics52 week range H/L (SR) 26.5/7.6Avg daily turnover (mn) SR US$3m 155.87 41.6212m 135.08 36.07Raw Beta 6m 2yr1.10 1.03Reuters4220.SEBloombergEMAAR ABPrice perform (%) 1M 3M 12MAbsolute (%) 15 26 (54)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) 11 19 (39)Website: www kingabdullahcity.<strong>com</strong>Valuation multiples2006 2007 2008P/E (x) N/M 735.3 NMP/B (x) 1.6 2.3 0.9P/Sales (x) N/A N/A 74.9Div yield (%) N/A N/A -Emaar <strong>the</strong> Economic City (Emaar EC) was started in Sep.’06 by Emaar Properties as ajoint venture with Saudi inves<strong>to</strong>rs <strong>to</strong> undertake <strong>the</strong> development of SR100bn KingAbdullah Economic City. The mega project is part of <strong>the</strong> Saudi government’s plan <strong>to</strong>attract foreign investments by providing incentives and tax breaks <strong>to</strong> inves<strong>to</strong>rs.Company financials2006(14Weeks) 2007 2008YoY(%)CAGR(%)(06-08)Net Revenues SRmn - - 102 NA NAEBITDA SRmn - (157) (375) NM NANet In<strong>com</strong>e SRmn (13) 26 (292) (1,211.1) NMAssets SRmn 8,637 8,748 9,532 9.0 5.1Equity SRmn 8,456 8,483 8,191 (3.4) (1.6)Tot Debt SRmn - - - NA NACash & Equiv SRmn 4,574 640 2,219 246.8 (30.4)EBITDA Mgn % NA NA (368.9) - -Net Mgn % NA NA (287.5) - -ROE % (0.2) 0.3 (3.5) - -ROA % (0.1) 0.3 (3.2) - -Div Payout % - - - - -EPS SR (0.0) 0.0 (0.3) (1,211.1) NMBVPS SR 9.9 10.0 9.6 (3.4) NMSource: Company, NCBC Research; figures for 2006 are from September – December 2006Segment-wise business analysisProduct segment 2008 Geographic 2008%Rev % Net Inc Breakup %Rev % Net IncProperty development 100.0 100.0 Saudi Arabia 100.0 100.0Weightage (%)TASI (free float weight) 0.58MSCI Saudi (domestic – large cap) 1.37Free float (%)Free float 30.00Relative share price perf.11,000309,000207,0005,000103,000-M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASIEmaar E .C (RHS)Top 5 shareholders (%)Modern Daim Real Estate 20.0ME Royal Capital Co. 9.4Emaar Middle East 5.8ME Hollandi 5.8ME Strategic Investments 5.8Source: NCBC ResearchSource: Company, NCBC Research• Business brief: KAEC, <strong>the</strong> single largest private sec<strong>to</strong>r-led project (168 mn squaremeters) in <strong>the</strong> GCC region, has six key <strong>com</strong>ponents – <strong>the</strong> sea port, industrial zone, centralbusiness district, resort district, educational zone and residential <strong>com</strong>munities. In earlyJanuary 2009, Emaar EC signed a deal worth SR120 mn with Freyssinet Saudi Arabia, <strong>to</strong>construct a school in <strong>the</strong> Esmeralda area of <strong>the</strong> King Abdullah Economic City• Financials: Emaar EC <strong>report</strong>ed revenues of SR101.6 mn for <strong>the</strong> first time in 2008.After a net profit of SR26.3 mn in 2007, it incurred net losses of SR292.0 mn in 2008led by increase in operating expenses and decline in investment in<strong>com</strong>e. Moreover,since Oc<strong>to</strong>ber 2008, work on <strong>the</strong> KAEC has slowed down led by <strong>the</strong> global crisis.EBITDA, ROA and ROE have all been in <strong>the</strong> red in 2008.• Recent developments: Emaar Properties recorded net loss of SR62.3 mn in 1Q 09<strong>com</strong>pared <strong>to</strong> net loss of SR19.3 mn in 1Q 08 due <strong>to</strong> an increase in operating costsand a decline in <strong>the</strong> in<strong>com</strong>e from deposits. In April 2009, The Saudi Arabian GeneralInvestment Authority (Sagia) and EEC signed a memorandum of understanding(MoU) with sanofi-aventis <strong>to</strong> set up an entity in KAEC, <strong>the</strong> largest private sec<strong>to</strong>rdevelopment in Jeddah. In March 2009, <strong>the</strong> <strong>com</strong>pany announced that <strong>the</strong> sale of itsresidential units in <strong>the</strong> Economic City achieved a return of more than SR2 bn. InFebruary 2009, SAMA canceled <strong>the</strong> license granted <strong>to</strong> <strong>the</strong> <strong>com</strong>pany's subsidiary,Emaar Financial Services.JUNE 2009EMAAR ECONOMIC CITY243