to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

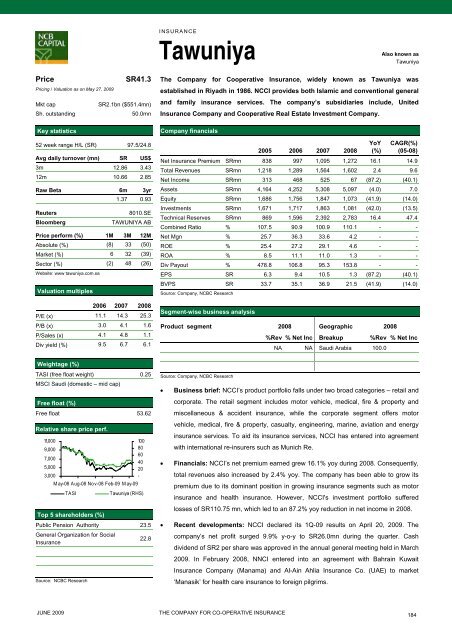

INSURANCETawuniyaAlso known asTawuniyaPricePricing / Valuation as on May 27, 2009Mkt capSh. outstandingKey statisticsSR41.3SR2.1bn ($551.4mn)50.0mn52 week range H/L (SR) 97.5/24.8Avg daily turnover (mn) SR US$3m 12.86 3.4312m 10.66 2.85Raw Beta 6m 3yr1.37 0.93ReutersBloomberg8010.SETAWUNIYA ABPrice perform (%) 1M 3M 12MAbsolute (%) (8) 33 (50)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) (2) 48 (26)Website: www tawuniya.<strong>com</strong>.saValuation multiples2006 2007 2008P/E (x) 11.1 14.3 25.3P/B (x) 3.0 4.1 1.6P/Sales (x) 4.1 4.8 1.1Div yield (%) 9.5 6.7 6.1Weightage (%)TASI (free float weight) 0.25MSCI Saudi (domestic – mid cap)Free float (%)Free float 53.62Relative share price perf.11,0009,0007,0005,0003,000M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASITop 5 shareholders (%)10080604020-Tawuniya (RHS)Public Pension Authority 23.5General Organization for SocialInsuranceSource: NCBC Research22.8The Company for Cooperative Insurance, widely known as Tawuniya wasestablished in Riyadh in 1986. NCCI provides both Islamic and conventional generaland family insurance services. The <strong>com</strong>pany’s subsidiaries include, UnitedInsurance Company and Cooperative Real Estate Investment Company.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Insurance Premium SRmn 838 997 1,095 1,272 16.1 14.9Total Revenues SRmn 1,218 1,289 1,564 1,602 2.4 9.6Net In<strong>com</strong>e SRmn 313 468 525 67 (87.2) (40.1)Assets SRmn 4,164 4,252 5,308 5,097 (4.0) 7.0Equity SRmn 1,686 1,756 1,847 1,073 (41.9) (14.0)Investments SRmn 1,671 1,717 1,863 1,081 (42.0) (13.5)Technical Reserves SRmn 869 1,596 2,392 2,783 16.4 47.4Combined Ratio % 107.5 90.9 100.9 110.1 - -Net Mgn % 25.7 36.3 33.6 4.2 - -ROE % 25.4 27.2 29.1 4.6 - -ROA % 8.5 11.1 11.0 1.3 - -Div Payout % 478.8 106.8 95.3 153.8 - -EPS SR 6.3 9.4 10.5 1.3 (87.2) (40.1)BVPS SR 33.7 35.1 36.9 21.5 (41.9) (14.0)Source: Company, NCBC ResearchSegment-wise business analysisProduct segment 2008 Geographic 2008Source: Company, NCBC Research%Rev % Net Inc Breakup %Rev % Net IncNA NA Saudi Arabia 100.0• Business brief: NCCI’s product portfolio falls under two broad categories – retail andcorporate. The retail segment includes mo<strong>to</strong>r vehicle, medical, fire & property andmiscellaneous & accident insurance, while <strong>the</strong> corporate segment offers mo<strong>to</strong>rvehicle, medical, fire & property, casualty, engineering, marine, aviation and energyinsurance services. To aid its insurance services, NCCI has entered in<strong>to</strong> agreementwith international re-insurers such as Munich Re.• Financials: NCCI’s net premium earned grew 16.1% yoy during 2008. Consequently,<strong>to</strong>tal revenues also increased by 2.4% yoy. The <strong>com</strong>pany has been able <strong>to</strong> grow itspremium due <strong>to</strong> its dominant position in growing insurance segments such as mo<strong>to</strong>rinsurance and health insurance. However, NCCI's investment portfolio sufferedlosses of SR110.75 mn, which led <strong>to</strong> an 87.2% yoy reduction in net in<strong>com</strong>e in 2008.• Recent developments: NCCI declared its 1Q-09 results on April 20, 2009. The<strong>com</strong>pany’s net profit surged 9.9% y-o-y <strong>to</strong> SR26.0mn during <strong>the</strong> quarter. Cashdividend of SR2 per share was approved in <strong>the</strong> annual general meeting held in March2009. In February 2008, NNCI entered in<strong>to</strong> an agreement with Bahrain KuwaitInsurance Company (Manama) and Al-Ain Ahlia Insurance Co. (UAE) <strong>to</strong> market‘Manasik’ for health care insurance <strong>to</strong> foreign pilgrims.JUNE 2009THE COMPANY FOR CO-OPERATIVE INSURANCE184