to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

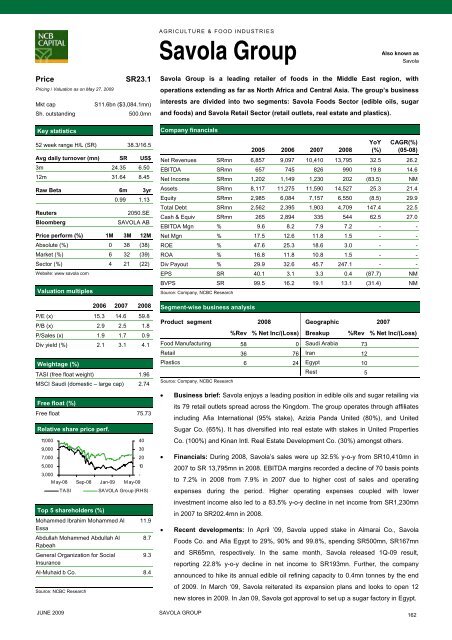

AGRICULTURE & FOOD INDUSTRIESSavola GroupAlso known asSavolaPricePricing / Valuation as on May 27, 2009Mkt capSh. outstandingKey statisticsSR23.1S11.6bn ($3,084.1mn)500.0mn52 week range H/L (SR) 38.3/16.5Avg daily turnover (mn) SR US$3m 24.35 6.5012m 31.64 8.45Raw Beta 6m 3yr0.99 1.13ReutersBloomberg2050.SESAVOLA ABPrice perform (%) 1M 3M 12MAbsolute (%) 0 38 (38)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) 4 21 (22)Website: www savola <strong>com</strong>Valuation multiples2006 2007 2008P/E (x) 15.3 14.6 59.8P/B (x) 2.9 2.5 1.8P/Sales (x) 1.9 1.7 0.9Div yield (%) 2.1 3.1 4.1Weightage (%)TASI (free float weight) 1.96MSCI Saudi (domestic – large cap) 2.74Free float (%)Free float 75.73Relative share price perf.11,0009,0007,0005,0003,000M ay-08 Sep-08 Jan-09 M ay-09TASITop 5 shareholders (%)40302010SAVOLA Group (RHS)Mohammed Ibrahim Mohammed Al 11.9EssaAbdullah Mohammed Abdullah Al 8.7RabeahGeneral Organization for Social 9.3InsuranceAl-Muhaid b Co. 8.4Source: NCBC Research-Savola Group is a leading retailer of foods in <strong>the</strong> Middle East region, withoperations extending as far as North Africa and Central Asia. The group’s businessinterests are divided in<strong>to</strong> two segments: Savola Foods Sec<strong>to</strong>r (edible oils, sugarand foods) and Savola Retail Sec<strong>to</strong>r (retail outlets, real estate and plastics).Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Revenues SRmn 6,857 9,097 10,410 13,795 32.5 26.2EBITDA SRmn 657 745 826 990 19.8 14.6Net In<strong>com</strong>e SRmn 1,202 1,149 1,230 202 (83.5) NMAssets SRmn 8,117 11,275 11,590 14,527 25.3 21.4Equity SRmn 2,985 6,084 7,157 6,550 (8.5) 29.9Total Debt SRmn 2,562 2,395 1,903 4,709 147.4 22.5Cash & Equiv SRmn 265 2,894 335 544 62.5 27.0EBITDA Mgn % 9.6 8.2 7.9 7.2 - -Net Mgn % 17.5 12.6 11.8 1.5 - -ROE % 47.6 25.3 18.6 3.0 - -ROA % 16.8 11.8 10.8 1.5 - -Div Payout % 29.9 32.6 45.7 247.1 - -EPS SR 40.1 3.1 3.3 0.4 (87.7) NMBVPS SR 99.5 16.2 19.1 13.1 (31.4) NMSource: Company, NCBC ResearchSegment-wise business analysisProduct segment 2008 Geographic 2007%Rev % Net Inc/(Loss) Breakup %Rev % Net Inc/(Loss)Food Manufacturing 58 0 Saudi Arabia 73Retail 36 76 Iran 12Plastics 6 24 Egypt 10Rest 5Source: Company, NCBC Research• Business brief: Savola enjoys a leading position in edible oils and sugar retailing viaits 79 retail outlets spread across <strong>the</strong> Kingdom. The group operates through affiliatesincluding Afia International (95% stake), Azizia Panda United (80%), and UnitedSugar Co. (65%). It has diversified in<strong>to</strong> real estate with stakes in United PropertiesCo. (100%) and Kinan Intl. Real Estate Development Co. (30%) amongst o<strong>the</strong>rs.• Financials: During 2008, Savola’s sales were up 32.5% y-o-y from SR10,410mn in2007 <strong>to</strong> SR 13,795mn in 2008. EBITDA margins recorded a decline of 70 basis points<strong>to</strong> 7.2% in 2008 from 7.9% in 2007 due <strong>to</strong> higher cost of sales and operatingexpenses during <strong>the</strong> period. Higher operating expenses coupled with lowerinvestment in<strong>com</strong>e also led <strong>to</strong> a 83.5% y-o-y decline in net in<strong>com</strong>e from SR1,230mnin 2007 <strong>to</strong> SR202.4mn in 2008.• Recent developments: In April ’09, Savola upped stake in Almarai Co., SavolaFoods Co. and Afia Egypt <strong>to</strong> 29%, 90% and 99.8%, spending SR500mn, SR167mnand SR65mn, respectively. In <strong>the</strong> same month, Savola released 1Q-09 result,<strong>report</strong>ing 22.8% y-o-y decline in net in<strong>com</strong>e <strong>to</strong> SR193mn. Fur<strong>the</strong>r, <strong>the</strong> <strong>com</strong>panyannounced <strong>to</strong> hike its annual edible oil refining capacity <strong>to</strong> 0.4mn <strong>to</strong>nnes by <strong>the</strong> endof 2009. In March ‘09, Savola reiterated its expansion plans and looks <strong>to</strong> open 12new s<strong>to</strong>res in 2009. In Jan 09, Savola got approval <strong>to</strong> set up a sugar fac<strong>to</strong>ry in Egypt.JUNE 2009SAVOLA GROUP162