to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

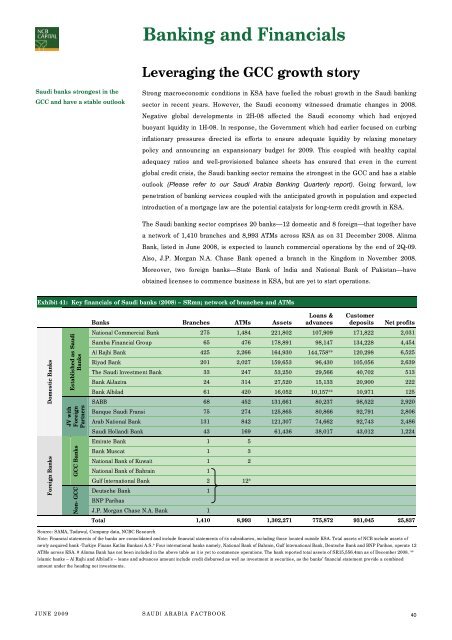

Banking and FinancialsLeveraging <strong>the</strong> GCC growth s<strong>to</strong>rySaudi banks strongest in <strong>the</strong>GCC and have a stable outlookStrong macroeconomic conditions in KSA have fuelled <strong>the</strong> robust growth in <strong>the</strong> Saudi bankingsec<strong>to</strong>r in recent years. However, <strong>the</strong> Saudi economy witnessed dramatic changes in 2008.Negative global developments in 2H-08 affected <strong>the</strong> Saudi economy which had enjoyedbuoyant liquidity in 1H-08. In response, <strong>the</strong> Government which had earlier focused on curbinginflationary pressures directed its efforts <strong>to</strong> ensure adequate liquidity by relaxing monetarypolicy and announcing an expansionary budget for 2009. This coupled with healthy capitaladequacy ratios and well-provisioned balance sheets has ensured that even in <strong>the</strong> currentglobal credit crisis, <strong>the</strong> Saudi banking sec<strong>to</strong>r remains <strong>the</strong> strongest in <strong>the</strong> GCC and has a stableoutlook (Please refer <strong>to</strong> our Saudi Arabia Banking Quarterly <strong>report</strong>). Going forward, lowpenetration of banking services coupled with <strong>the</strong> anticipated growth in population and expectedintroduction of a mortgage law are <strong>the</strong> potential catalysts for long-term credit growth in KSA.The Saudi banking sec<strong>to</strong>r <strong>com</strong>prises 20 banks—12 domestic and 8 foreign—that <strong>to</strong>ge<strong>the</strong>r havea network of 1,410 branches and 8,993 ATMs across KSA as on 31 December 2008. AlinmaBank, listed in June 2008, is expected <strong>to</strong> launch <strong>com</strong>mercial operations by <strong>the</strong> end of 2Q-09.Also, J.P. Morgan N.A. Chase Bank opened a branch in <strong>the</strong> Kingdom in November 2008.Moreover, two foreign banks—State Bank of India and National Bank of Pakistan—haveobtained licenses <strong>to</strong> <strong>com</strong>mence business in KSA, but are yet <strong>to</strong> start operations.Exhibit 41: Key financials of Saudi banks (2008) – SRmn; network of branches and ATMsDomestic BanksForeign BanksEstablished as SaudiBanksJV withForeignPartnersGCC BanksNon- GCCBanks Branches ATMs AssetsLoans &advancesCus<strong>to</strong>merdeposits Net profitsNational Commercial Bank 275 1,484 221,802 107,909 171,822 2,031Samba Financial Group 65 476 178,891 98,147 134,228 4,454Al Rajhi Bank 425 2,266 164,930 144,758** 120,298 6,525Riyad Bank 201 2,027 159,653 96,430 105,056 2,639The Saudi Investment Bank 33 247 53,250 29,566 40,702 513Bank AlJazira 24 314 27,520 15,133 20,900 222Bank Albilad 61 420 16,052 10,157** 10,971 125SABB 68 452 131,661 80,237 98,522 2,920Banque Saudi Fransi 75 274 125,865 80,866 92,791 2,806Arab National Bank 131 842 121,307 74,662 92,743 2,486Saudi Hollandi Bank 43 169 61,436 38,017 43,012 1,224Emirate Bank 1 5Bank Muscat 1 3National Bank of Kuwait 1 2National Bank of Bahrain 1Gulf International Bank 2 12*Deutsche Bank 1BNP ParibasJ.P. Morgan Chase N.A. Bank 1Total 1,410 8,993 1,302,271 775,872 931,045 25,837Source: SAMA, Tadawul, Company data, NCBC ResearchNote: Financial statements of <strong>the</strong> banks are consolidated and include financial statements of its subsidiaries, including those located outside KSA. Total assets of NCB include assets ofnewly acquired bank -Turkiye Finans Katlim Bankasi A.S.* Four international banks namely, National Bank of Bahrain, Gulf International Bank, Deutsche Bank and BNP Paribas, operate 12ATMs across KSA. # Alinma Bank has not been included in <strong>the</strong> above table as it is yet <strong>to</strong> <strong>com</strong>mence operations. The bank <strong>report</strong>ed <strong>to</strong>tal assets of SR15,556.4mn as of December 2008. **Islamic banks – Al Rajhi and Albilad’s – loans and advances amount include credit disbursed as well as investment in securities, as <strong>the</strong> banks’ financial statement provide a <strong>com</strong>binedamount under <strong>the</strong> heading net investments.JUNE 2009SAUDI ARABIA FACTBOOK40