to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

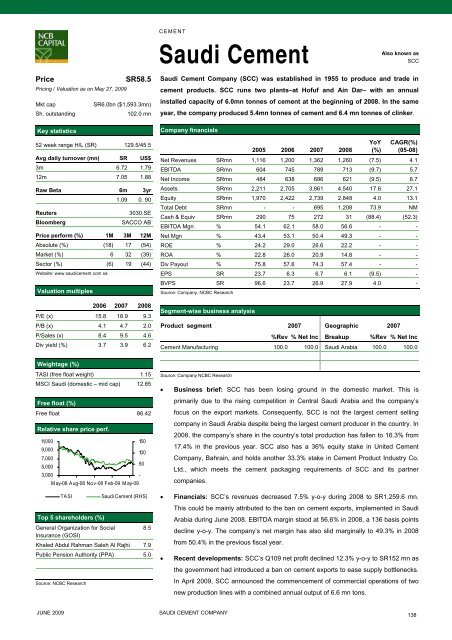

CEMENTSaudi CementAlso known asSCCPriceSR58.5Pricing / Valuation as on May 27, 2009Mkt capSR6.0bn ($1,593.3mn)Sh. outstanding102.0 mnKey statistics52 week range H/L (SR) 129.5/45.5Avg daily turnover (mn) SR US$3m 6.72 1.7912m 7.05 1.88Raw Beta 6m 3yr1.09 0. 90Reuters3030.SEBloombergSACCO ABPrice perform (%) 1M 3M 12MAbsolute (%) (18) 17 (54)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) (6) 19 (44)Website: www saudicement <strong>com</strong> saValuation multiples2006 2007 2008P/E (x) 15.8 18.9 9.3P/B (x) 4.1 4.7 2.0P/Sales (x) 8.4 9.5 4.6Div yield (%) 3.7 3.9 6.2Saudi Cement Company (SCC) was established in 1955 <strong>to</strong> produce and trade incement products. SCC runs two plants–at Hofuf and Ain Dar– with an annualinstalled capacity of 6.0mn <strong>to</strong>nnes of cement at <strong>the</strong> beginning of 2008. In <strong>the</strong> sameyear, <strong>the</strong> <strong>com</strong>pany produced 5.4mn <strong>to</strong>nnes of cement and 6.4 mn <strong>to</strong>nnes of clinker.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Revenues SRmn 1,116 1,200 1,362 1,260 (7.5) 4.1EBITDA SRmn 604 745 789 713 (9.7) 5.7Net In<strong>com</strong>e SRmn 484 638 686 621 (9.5) 8.7Assets SRmn 2,211 2,705 3,861 4,540 17.6 27.1Equity SRmn 1,970 2,422 2,739 2,848 4.0 13.1Total Debt SRmn - - 695 1,208 73.9 NMCash & Equiv SRmn 290 75 272 31 (88.4) (52.3)EBITDA Mgn % 54.1 62.1 58.0 56.6 - -Net Mgn % 43.4 53.1 50.4 49.3 - -ROE % 24.2 29.0 26.6 22.2 - -ROA % 22.8 26.0 20.9 14.8 - -Div Payout % 75.8 57.6 74.3 57.4 - -EPS SR 23.7 6.3 6.7 6.1 (9.5) -BVPS SR 96.6 23.7 26.9 27.9 4.0 -Source: Company, NCBC ResearchSegment-wise business analysisProduct segment 2007 Geographic 2007%Rev % Net Inc Breakup %Rev % Net IncCement Manufacturing 100.0 100.0 Saudi Arabia 100.0 100.0Weightage (%)TASI (free float weight) 1.15MSCI Saudi (domestic – mid cap) 12.85Free float (%)Free float 86.42Relative share price perf.11,0009,0007,0005,0003,000M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASITop 5 shareholders (%)15010050Saudi Cement (RHS)General Organization for Social 8.5Insurance (GOSI)Khaled Abdul Rahman Saleh Al Rajhi 7.9Public Pension Authority (PPA) 5.0Source: NCBC Research-Source: Company NCBC Research• Business brief: SCC has been losing ground in <strong>the</strong> domestic market. This isprimarily due <strong>to</strong> <strong>the</strong> rising <strong>com</strong>petition in Central Saudi Arabia and <strong>the</strong> <strong>com</strong>pany’sfocus on <strong>the</strong> export markets. Consequently, SCC is not <strong>the</strong> largest cement selling<strong>com</strong>pany in Saudi Arabia despite being <strong>the</strong> largest cement producer in <strong>the</strong> country. In2008, <strong>the</strong> <strong>com</strong>pany’s share in <strong>the</strong> country’s <strong>to</strong>tal production has fallen <strong>to</strong> 16.3% from17.4% in <strong>the</strong> previous year. SCC also has a 36% equity stake in United CementCompany, Bahrain, and holds ano<strong>the</strong>r 33.3% stake in Cement Product Industry Co.Ltd., which meets <strong>the</strong> cement packaging requirements of SCC and its partner<strong>com</strong>panies.• Financials: SCC’s revenues decreased 7.5% y-o-y during 2008 <strong>to</strong> SR1,259.6 mn.This could be mainly attributed <strong>to</strong> <strong>the</strong> ban on cement exports, implemented in SaudiArabia during June 2008. EBITDA margin s<strong>to</strong>od at 56.6% in 2008, a 136 basis pointsdecline y-o-y. The <strong>com</strong>pany’s net margin has also slid marginally <strong>to</strong> 49.3% in 2008from 50.4% in <strong>the</strong> previous fiscal year.• Recent developments: SCC’s Q109 net profit declined 12.3% y-o-y <strong>to</strong> SR152 mn as<strong>the</strong> government had introduced a ban on cement exports <strong>to</strong> ease supply bottlenecks.In April 2009, SCC announced <strong>the</strong> <strong>com</strong>mencement of <strong>com</strong>mercial operations of twonew production lines with a <strong>com</strong>bined annual output of 6.6 mn <strong>to</strong>ns.JUNE 2009SAUDI CEMENT COMPANY138