to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

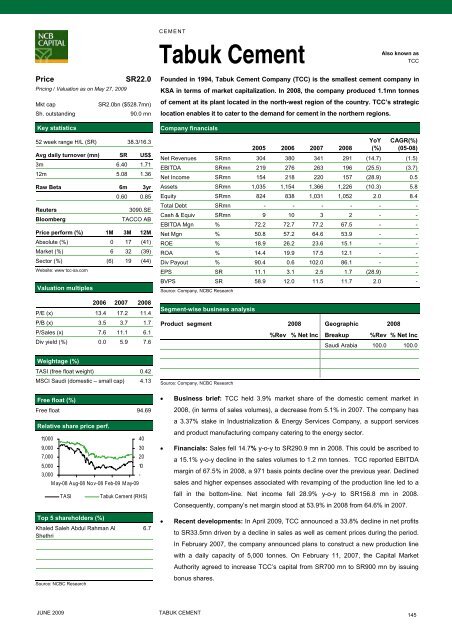

CEMENTTabuk CementAlso known asTCCPriceSR22.0Pricing / Valuation as on May 27, 2009Mkt capSR2.0bn ($528.7mn)Sh. outstanding90.0 mnKey statistics52 week range H/L (SR) 38.3/16.3Avg daily turnover (mn) SR US$3m 6.40 1.7112m 5.08 1.36Raw Beta 6m 3yr0.60 0.85Reuters3090.SEBloombergTACCO ABPrice perform (%) 1M 3M 12MAbsolute (%) 0 17 (41)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) (6) 19 (44)Website: www tcc-sa.<strong>com</strong>Valuation multiples2006 2007 2008P/E (x) 13.4 17.2 11.4P/B (x) 3.5 3.7 1.7P/Sales (x) 7.6 11.1 6.1Div yield (%) 0.0 5.9 7.6Weightage (%)TASI (free float weight) 0.42MSCI Saudi (domestic – small cap) 4.13Free float (%)Free float 94.69Relative share price perf.11,000409,000307,000205,000103,000-M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASITabuk Cement (RHS)Founded in 1994, Tabuk Cement Company (TCC) is <strong>the</strong> smallest cement <strong>com</strong>pany inKSA in terms of market capitalization. In 2008, <strong>the</strong> <strong>com</strong>pany produced 1.1mn <strong>to</strong>nnesof cement at its plant located in <strong>the</strong> north-west region of <strong>the</strong> country. TCC’s strategiclocation enables it <strong>to</strong> cater <strong>to</strong> <strong>the</strong> demand for cement in <strong>the</strong> nor<strong>the</strong>rn regions.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Revenues SRmn 304 380 341 291 (14.7) (1.5)EBITDA SRmn 219 276 263 196 (25.5) (3.7)Net In<strong>com</strong>e SRmn 154 218 220 157 (28.9) 0.5Assets SRmn 1,035 1,154 1,366 1,226 (10.3) 5.8Equity SRmn 824 838 1,031 1,052 2.0 8.4Total Debt SRmn - - - - - -Cash & Equiv SRmn 9 10 3 2 - -EBITDA Mgn % 72.2 72.7 77.2 67.5 - -Net Mgn % 50.8 57.2 64.6 53.9 - -ROE % 18.9 26.2 23.6 15.1 - -ROA % 14.4 19.9 17.5 12.1 - -Div Payout % 90.4 0.6 102.0 86.1 - -EPS SR 11.1 3.1 2.5 1.7 (28.9) -BVPS SR 58.9 12.0 11.5 11.7 2.0 -Source: Company, NCBC ResearchSegment-wise business analysisProduct segment 2008 Geographic 2008%Rev % Net Inc Breakup %Rev % Net IncSaudi Arabia 100.0 100.0Source: Company, NCBC Research• Business brief: TCC held 3.9% market share of <strong>the</strong> domestic cement market in2008, (in terms of sales volumes), a decrease from 5.1% in 2007. The <strong>com</strong>pany hasa 3.37% stake in Industrialization & Energy Services Company, a support servicesand product manufacturing <strong>com</strong>pany catering <strong>to</strong> <strong>the</strong> energy sec<strong>to</strong>r.• Financials: Sales fell 14.7% y-o-y <strong>to</strong> SR290.9 mn in 2008. This could be ascribed <strong>to</strong>a 15.1% y-o-y decline in <strong>the</strong> sales volumes <strong>to</strong> 1.2 mn <strong>to</strong>nnes. TCC <strong>report</strong>ed EBITDAmargin of 67.5% in 2008, a 971 basis points decline over <strong>the</strong> previous year. Declinedsales and higher expenses associated with revamping of <strong>the</strong> production line led <strong>to</strong> afall in <strong>the</strong> bot<strong>to</strong>m-line. Net in<strong>com</strong>e fell 28.9% y-o-y <strong>to</strong> SR156.8 mn in 2008.Consequently, <strong>com</strong>pany’s net margin s<strong>to</strong>od at 53.9% in 2008 from 64.6% in 2007.Top 5 shareholders (%)Khaled Saleh Abdul Rahman AlShethriSource: NCBC Research6.7• Recent developments: In April 2009, TCC announced a 33.8% decline in net profits<strong>to</strong> SR33.5mn driven by a decline in sales as well as cement prices during <strong>the</strong> period.In February 2007, <strong>the</strong> <strong>com</strong>pany announced plans <strong>to</strong> construct a new production linewith a daily capacity of 5,000 <strong>to</strong>nnes. On February 11, 2007, <strong>the</strong> Capital MarketAuthority agreed <strong>to</strong> increase TCC’s capital from SR700 mn <strong>to</strong> SR900 mn by issuingbonus shares.JUNE 2009TABUK CEMENT145