to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

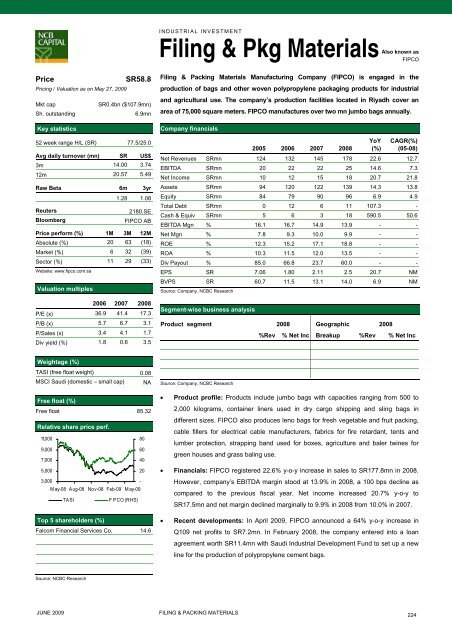

INDUSTRIAL INVESTMENTAlso known asFiling & Pkg MaterialsFIPCOPriceSR58.8Pricing / Valuation as on May 27, 2009Mkt capSR0.4bn ($107.9mn)Sh. outstanding6.9mnKey statistics52 week range H/L (SR) 77.5/25.0Avg daily turnover (mn) SR US$3m 14.00 3.7412m 20.57 5.49Raw Beta 6m 3yr1.28 1.08Reuters2180.SEBloombergFIPCO ABPrice perform (%) 1M 3M 12MAbsolute (%) 20 63 (18)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) 11 29 (33)Website: www.fipco.<strong>com</strong>.saValuation multiples2006 2007 2008P/E (x) 36.9 41.4 17.3P/B (x) 5.7 6.7 3.1P/Sales (x) 3.4 4.1 1.7Div yield (%) 1.8 0.6 3.5Filing & Packing Materials Manufacturing Company (FIPCO) is engaged in <strong>the</strong>production of bags and o<strong>the</strong>r woven polypropylene packaging products for industrialand agricultural use. The <strong>com</strong>pany’s production facilities located in Riyadh cover anarea of 75,000 square meters. FIPCO manufactures over two mn jumbo bags annually.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Revenues SRmn 124 132 145 178 22.6 12.7EBITDA SRmn 20 22 22 25 14.6 7.3Net In<strong>com</strong>e SRmn 10 12 15 18 20.7 21.8Assets SRmn 94 120 122 139 14.3 13.8Equity SRmn 84 79 90 96 6.9 4.9Total Debt SRmn 0 12 6 11 107.3 -Cash & Equiv SRmn 5 6 3 18 590.5 50.6EBITDA Mgn % 16.1 16.7 14.9 13.9 - -Net Mgn % 7.8 9.3 10.0 9.9 - -ROE % 12.3 15.2 17.1 18.8 - -ROA % 10.3 11.5 12.0 13.5 - -Div Payout % 85.0 66.8 23.7 60.0 - -EPS SR 7.06 1.80 2.11 2.5 20.7 NMBVPS SR 60.7 11.5 13.1 14.0 6.9 NMSource: Company, NCBC ResearchSegment-wise business analysisProduct segment 2008 Geographic 2008%Rev % Net Inc Breakup %Rev % Net IncWeightage (%)TASI (free float weight) 0.08MSCI Saudi (domestic – small cap) NAFree float (%)Free float 85.32Relative share price perf.11,000809,000607,000405,000203,000-M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASIF PCO (RHS)Top 5 shareholders (%)Fal<strong>com</strong> Financial Services Co. 14.6Source: Company, NCBC Research• Product profile: Products include jumbo bags with capacities ranging from 500 <strong>to</strong>2,000 kilograms, container liners used in dry cargo shipping and sling bags indifferent sizes. FIPCO also produces leno bags for fresh vegetable and fruit packing,cable fillers for electrical cable manufacturers, fabrics for fire retardant, tents andlumber protection, strapping band used for boxes, agriculture and baler twines forgreen houses and grass baling use.• Financials: FIPCO registered 22.6% y-o-y increase in sales <strong>to</strong> SR177.8mn in 2008.However, <strong>com</strong>pany’s EBITDA margin s<strong>to</strong>od at 13.9% in 2008, a 100 bps decline as<strong>com</strong>pared <strong>to</strong> <strong>the</strong> previous fiscal year. Net in<strong>com</strong>e increased 20.7% y-o-y <strong>to</strong>SR17.5mn and net margin declined marginally <strong>to</strong> 9.9% in 2008 from 10.0% in 2007.• Recent developments: In April 2009, FIPCO announced a 64% y-o-y increase inQ109 net profits <strong>to</strong> SR7.2mn. In February 2008, <strong>the</strong> <strong>com</strong>pany entered in<strong>to</strong> a loanagreement worth SR11.4mn with Saudi Industrial Development Fund <strong>to</strong> set up a newline for <strong>the</strong> production of polypropylene cement bags.Source: NCBC ResearchJUNE 2009FILING & PACKING MATERIALS224