to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

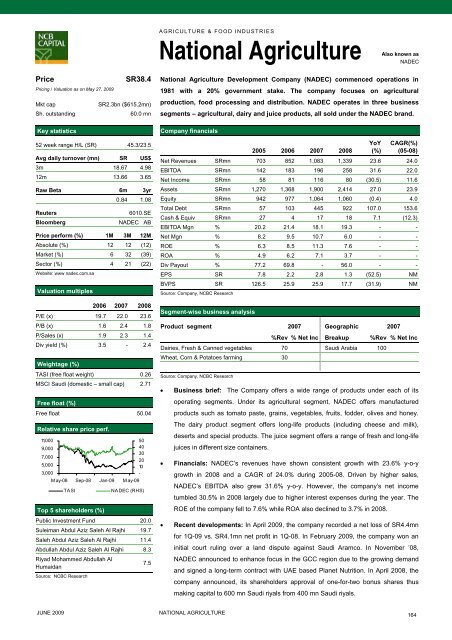

AGRICULTURE & FOOD INDUSTRIESNational AgricultureAlsoknown asNADECPricePricing / Valuation as on May 27, 2009Mkt capSh. outstandingKey statisticsSR38.4SR2.3bn ($615.2mn)60.0 mn52 week range H/L (SR) 45.3/23.5Avg daily turnover (mn) SR US$3m 18.67 4.9812m 13.66 3.65Raw Beta 6m 3yr0.84 1.08ReutersBloomberg6010.SENADEC ABPrice perform (%) 1M 3M 12MAbsolute (%) 12 12 (12)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) 4 21 (22)Website: www nadec.<strong>com</strong>.saValuation multiples2006 2007 2008P/E (x) 19.7 22.0 23.6P/B (x) 1.6 2.4 1.8P/Sales (x) 1.9 2.3 1.4Div yield (%) 3.5 - 2.4Weightage (%)TASI (free float weight) 0.26MSCI Saudi (domestic – small cap) 2.71Free float (%)Free float 50.04Relative share price perf.11,0009,0007,0005,0003,000M ay-08 Sep-08 Jan-09 M ay-09TASITop 5 shareholders (%)5040302010-NADEC (RHS)Public Investment Fund 20.0Suleiman Abdul Aziz Saleh Al Rajhi 19.7Saleh Abdul Aziz Saleh Al Rajhi 11.4Abdullah Abdul Aziz Saleh Al Rajhi 8.3Riyad Mohammed Abdullah AlHumaidanSource: NCBC Research7.5National Agriculture Development Company (NADEC) <strong>com</strong>menced operations in1981 with a 20% government stake. The <strong>com</strong>pany focuses on agriculturalproduction, food processing and distribution. NADEC operates in three businesssegments – agricultural, dairy and juice products, all sold under <strong>the</strong> NADEC brand.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Revenues SRmn 703 852 1,083 1,339 23.6 24.0EBITDA SRmn 142 183 196 258 31.6 22.0Net In<strong>com</strong>e SRmn 58 81 116 80 (30.5) 11.6Assets SRmn 1,270 1,368 1,900 2,414 27.0 23.9Equity SRmn 942 977 1,064 1,060 (0.4) 4.0Total Debt SRmn 57 103 445 922 107.0 153.6Cash & Equiv SRmn 27 4 17 18 7.1 (12.3)EBITDA Mgn % 20.2 21.4 18.1 19.3 - -Net Mgn % 8.2 9.5 10.7 6.0 - -ROE % 6.3 8.5 11.3 7.6 - -ROA % 4.9 6.2 7.1 3.7 - -Div Payout % 77.2 69.8 - 56.0 - -EPS SR 7.8 2.2 2.8 1.3 (52.5) NMBVPS SR 126.5 25.9 25.9 17.7 (31.9) NMSource: Company, NCBC ResearchSegment-wise business analysisProduct segment 2007 Geographic 2007%Rev % Net Inc Breakup %Rev % Net IncDairies, Fresh & Canned vegetables 70 Saudi Arabia 100Wheat, Corn & Pota<strong>to</strong>es farming 30Source: Company, NCBC Research• Business brief: The Company offers a wide range of products under each of itsoperating segments. Under its agricultural segment, NADEC offers manufacturedproducts such as <strong>to</strong>ma<strong>to</strong> paste, grains, vegetables, fruits, fodder, olives and honey.The dairy product segment offers long-life products (including cheese and milk),deserts and special products. The juice segment offers a range of fresh and long-lifejuices in different size containers.• Financials: NADEC’s revenues have shown consistent growth with 23.6% y-o-ygrowth in 2008 and a CAGR of 24.0% during 2005-08. Driven by higher sales,NADEC’s EBITDA also grew 31.6% y-o-y. However, <strong>the</strong> <strong>com</strong>pany’s net in<strong>com</strong>etumbled 30.5% in 2008 largely due <strong>to</strong> higher interest expenses during <strong>the</strong> year. TheROE of <strong>the</strong> <strong>com</strong>pany fell <strong>to</strong> 7.6% while ROA also declined <strong>to</strong> 3.7% in 2008.• Recent developments: In April 2009, <strong>the</strong> <strong>com</strong>pany recorded a net loss of SR4.4mnfor 1Q-09 vs. SR4.1mn net profit in 1Q-08. In February 2009, <strong>the</strong> <strong>com</strong>pany won aninitial court ruling over a land dispute against Saudi Aramco. In November ’08,NADEC announced <strong>to</strong> enhance focus in <strong>the</strong> GCC region due <strong>to</strong> <strong>the</strong> growing demandand signed a long-term contract with UAE based Planet Nutrition. In April 2008, <strong>the</strong><strong>com</strong>pany announced, its shareholders approval of one-for-two bonus shares thusmaking capital <strong>to</strong> 600 mn Saudi riyals from 400 mn Saudi riyals.JUNE 2009NATIONAL AGRICULTURE164