to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

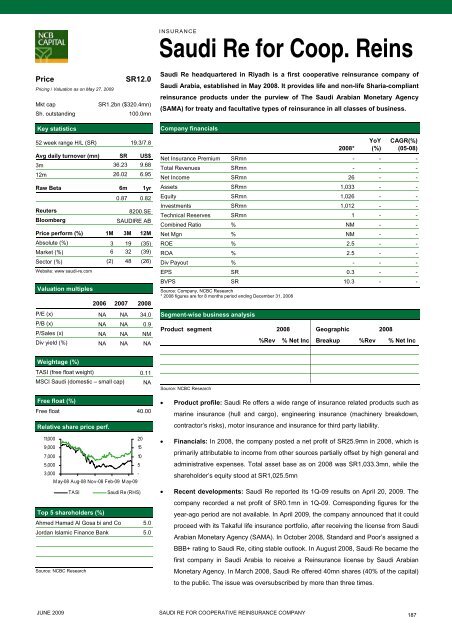

INSURANCESaudi Re for Coop. ReinsPricePricing / Valuation as on May 27, 2009Mkt capSh. outstandingKey statisticsSR12.0SR1.2bn ($320.4mn)100.0mn52 week range H/L (SR) 19.3/7.8Avg daily turnover (mn) SR US$3m 36.23 9.6812m 26.02 6.95Raw Beta 6m 1yr0.87 0.82ReutersBloomberg8200.SESAUDIRE ABPrice perform (%) 1M 3M 12MAbsolute (%) 3 19 (35)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) (2) 48 (26)Website: www saudi-re.<strong>com</strong>Valuation multiples2006 2007 2008P/E (x) NA NA 34.0P/B (x) NA NA 0.9P/Sales (x) NA NA NMDiv yield (%) NA NA NASaudi Re headquartered in Riyadh is a first cooperative reinsurance <strong>com</strong>pany ofSaudi Arabia, established in May 2008. It provides life and non-life Sharia-<strong>com</strong>pliantreinsurance products under <strong>the</strong> purview of The Saudi Arabian Monetary Agency(SAMA) for treaty and facultative types of reinsurance in all classes of business.Company financials2008*YoY(%)CAGR(%)(05-08)Net Insurance Premium SRmn - - -Total Revenues SRmn - - -Net In<strong>com</strong>e SRmn 26 - -Assets SRmn 1,033 - -Equity SRmn 1,026 - -Investments SRmn 1,012 - -Technical Reserves SRmn 1 - -Combined Ratio % NM - -Net Mgn % NM - -ROE % 2.5 - -ROA % 2.5 - -Div Payout % - - -EPS SR 0.3 - -BVPS SR 10.3 - -Source: Company, NCBC Research* 2008 figures are for 8 months period ending December 31, 2008Segment-wise business analysisProduct segment 2008 Geographic 2008%Rev % Net Inc Breakup %Rev % Net IncWeightage (%)TASI (free float weight) 0.11MSCI Saudi (domestic – small cap) NAFree float (%)Free float 40.00Relative share price perf.11,000209,000157,000105,00053,000-M ay-08 Aug-08 Nov-08 Feb-09 M ay-09TASISaudi Re (RHS)Top 5 shareholders (%)Ahmed Hamad Al Gosa bi and Co 5.0Jordan Islamic Finance Bank 5.0Source: NCBC ResearchSource: NCBC Research• Product profile: Saudi Re offers a wide range of insurance related products such asmarine insurance (hull and cargo), engineering insurance (machinery breakdown,contrac<strong>to</strong>r’s risks), mo<strong>to</strong>r insurance and insurance for third party liability.• Financials: In 2008, <strong>the</strong> <strong>com</strong>pany posted a net profit of SR25.9mn in 2008, which isprimarily attributable <strong>to</strong> in<strong>com</strong>e from o<strong>the</strong>r sources partially offset by high general andadministrative expenses. Total asset base as on 2008 was SR1,033.3mn, while <strong>the</strong>shareholder’s equity s<strong>to</strong>od at SR1,025.5mn• Recent developments: Saudi Re <strong>report</strong>ed its 1Q-09 results on April 20, 2009. The<strong>com</strong>pany recorded a net profit of SR0.1mn in 1Q-09. Corresponding figures for <strong>the</strong>year-ago period are not available. In April 2009, <strong>the</strong> <strong>com</strong>pany announced that it couldproceed with its Takaful life insurance portfolio, after receiving <strong>the</strong> license from SaudiArabian Monetary Agency (SAMA). In Oc<strong>to</strong>ber 2008, Standard and Poor’s assigned aBBB+ rating <strong>to</strong> Saudi Re, citing stable outlook. In August 2008, Saudi Re became <strong>the</strong>first <strong>com</strong>pany in Saudi Arabia <strong>to</strong> receive a Reinsurance license by Saudi ArabianMonetary Agency. In March 2008, Saudi Re offered 40mn shares (40% of <strong>the</strong> capital)<strong>to</strong> <strong>the</strong> public. The issue was oversubscribed by more than three times.JUNE 2009SAUDI RE FOR COOPERATIVE REINSURANCE COMPANY187