to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

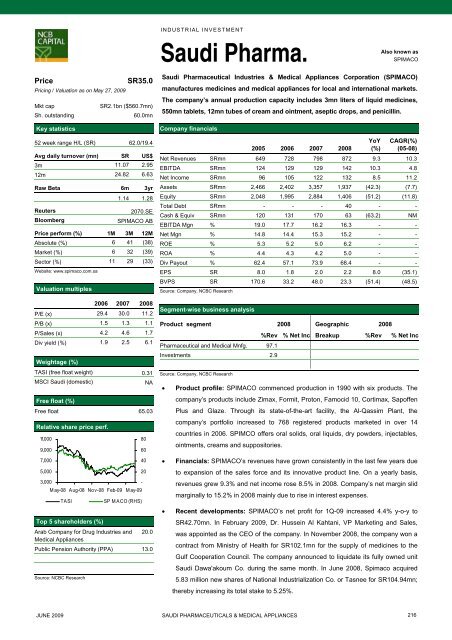

INDUSTRIAL INVESTMENTSaudi Pharma.Also known asSPIMACOPricePricing / Valuation as on May 27, 2009Mkt capSh. outstandingKey statisticsSR35.0SR2.1bn ($560.7mn)60.0mn52 week range H/L (SR) 62.0/19.4Avg daily turnover (mn) SR US$3m 11.07 2.9512m 24.82 6.63Raw Beta 6m 3yr1.14 1.28ReutersBloomberg2070.SESPIMACO ABPrice perform (%) 1M 3M 12MAbsolute (%) 6 41 (38)Market (%) 6 32 (39)Sec<strong>to</strong>r (%) 11 29 (33)Website: www.spimaco.<strong>com</strong>.saValuation multiples2006 2007 2008P/E (x) 29.4 30.0 11.2P/B (x) 1.5 1.3 1.1P/Sales (x) 4.2 4.6 1.7Div yield (%) 1.9 2.5 6.1Weightage (%)TASI (free float weight) 0.31MSCI Saudi (domestic)NAFree float (%)Free float 65.03Relative share price perf.11,0009,0007,0005,0003,000M ay-08 Aug-08 Nov-08 Feb-09TASITop 5 shareholders (%)-M ay-09SP M ACO (RHS)Arab Company for Drug Industries and 20.0Medical AppliancesPublic Pension Authority (PPA) 13.0Source: NCBC Research80604020Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO)manufactures medicines and medical appliances for local and international markets.The <strong>com</strong>pany’s annual production capacity includes 3mn liters of liquid medicines,550mn tablets, 12mn tubes of cream and ointment, aseptic drops, and penicillin.Company financials2005 2006 2007 2008YoY(%)CAGR(%)(05-08)Net Revenues SRmn 649 728 798 872 9.3 10.3EBITDA SRmn 124 129 129 142 10.3 4.8Net In<strong>com</strong>e SRmn 96 105 122 132 8.5 11.2Assets SRmn 2,466 2,402 3,357 1,937 (42.3) (7.7)Equity SRmn 2,048 1,995 2,884 1,406 (51.2) (11.8)Total Debt SRmn - - - 40 - -Cash & Equiv SRmn 120 131 170 63 (63.2) NMEBITDA Mgn % 19.0 17.7 16.2 16.3 - -Net Mgn % 14.8 14.4 15.3 15.2 - -ROE % 5.3 5.2 5.0 6.2 - -ROA % 4.4 4.3 4.2 5.0 - -Div Payout % 62.4 57.1 73.9 68.4 - -EPS SR 8.0 1.8 2.0 2.2 8.0 (35.1)BVPS SR 170.6 33.2 48.0 23.3 (51.4) (48.5)Source: Company, NCBC ResearchSegment-wise business analysisProduct segment 2008 Geographic 2008%Rev % Net Inc Breakup %Rev % Net IncPharmaceutical and Medical Mnfg. 97.1Investments 2.9Source: Company, NCBC Research• Product profile: SPIMACO <strong>com</strong>menced production in 1990 with six products. The<strong>com</strong>pany’s products include Zimax, Formit, Pro<strong>to</strong>n, Famocid 10, Cortimax, SapoffenPlus and Glaze. Through its state-of-<strong>the</strong>-art facility, <strong>the</strong> Al-Qassim Plant, <strong>the</strong><strong>com</strong>pany’s portfolio increased <strong>to</strong> 768 registered products marketed in over 14countries in 2006. SPIMCO offers oral solids, oral liquids, dry powders, injectables,ointments, creams and supposi<strong>to</strong>ries.• Financials: SPIMACO’s revenues have grown consistently in <strong>the</strong> last few years due<strong>to</strong> expansion of <strong>the</strong> sales force and its innovative product line. On a yearly basis,revenues grew 9.3% and net in<strong>com</strong>e rose 8.5% in 2008. Company’s net margin slidmarginally <strong>to</strong> 15.2% in 2008 mainly due <strong>to</strong> rise in interest expenses.• Recent developments: SPIMACO’s net profit for 1Q-09 increased 4.4% y-o-y <strong>to</strong>SR42.70mn. In February 2009, Dr. Hussein Al Kahtani, VP Marketing and Sales,was appointed as <strong>the</strong> CEO of <strong>the</strong> <strong>com</strong>pany. In November 2008, <strong>the</strong> <strong>com</strong>pany won acontract from Ministry of Health for SR102.1mn for <strong>the</strong> supply of medicines <strong>to</strong> <strong>the</strong>Gulf Cooperation Council. The <strong>com</strong>pany announced <strong>to</strong> liquidate its fully owned unitSaudi Dawa'akoum Co. during <strong>the</strong> same month. In June 2008, Spimaco acquired5.83 million new shares of National Industrialization Co. or Tasnee for SR104.94mn;<strong>the</strong>reby increasing its <strong>to</strong>tal stake <strong>to</strong> 5.25%.JUNE 2009SAUDI PHARMACEUTICALS & MEDICAL APPLIANCES216