to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

to download the complete report - GulfBase.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

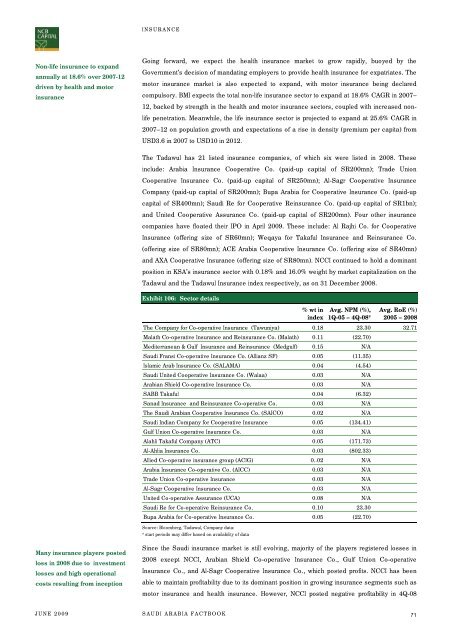

INSURANCENon-life insurance <strong>to</strong> expandannually at 18.6% over 2007-12driven by health and mo<strong>to</strong>rinsuranceGoing forward, we expect <strong>the</strong> health insurance market <strong>to</strong> grow rapidly, buoyed by <strong>the</strong>Government’s decision of mandating employers <strong>to</strong> provide health insurance for expatriates. Themo<strong>to</strong>r insurance market is also expected <strong>to</strong> expand, with mo<strong>to</strong>r insurance being declared<strong>com</strong>pulsory. BMI expects <strong>the</strong> <strong>to</strong>tal non-life insurance sec<strong>to</strong>r <strong>to</strong> expand at 18.6% CAGR in 2007–12, backed by strength in <strong>the</strong> health and mo<strong>to</strong>r insurance sec<strong>to</strong>rs, coupled with increased nonlifepenetration. Meanwhile, <strong>the</strong> life insurance sec<strong>to</strong>r is projected <strong>to</strong> expand at 25.6% CAGR in2007–12 on population growth and expectations of a rise in density (premium per capita) fromUSD3.6 in 2007 <strong>to</strong> USD10 in 2012.The Tadawul has 21 listed insurance <strong>com</strong>panies, of which six were listed in 2008. Theseinclude: Arabia Insurance Cooperative Co. (paid-up capital of SR200mn); Trade UnionCooperative Insurance Co. (paid-up capital of SR250mn); Al-Sagr Cooperative InsuranceCompany (paid-up capital of SR200mn); Bupa Arabia for Cooperative Insurance Co. (paid-upcapital of SR400mn); Saudi Re for Cooperative Reinsurance Co. (paid-up capital of SR1bn);and United Cooperative Assurance Co. (paid-up capital of SR200mn). Four o<strong>the</strong>r insurance<strong>com</strong>panies have floated <strong>the</strong>ir IPO in April 2009. These include: Al Rajhi Co. for CooperativeInsurance (offering size of SR60mn); Weqaya for Takaful Insurance and Reinsurance Co.(offering size of SR80mn); ACE Arabia Cooperative Insurance Co. (offering size of SR40mn)and AXA Cooperative Insurance (offering size of SR80mn). NCCI continued <strong>to</strong> hold a dominantposition in KSA’s insurance sec<strong>to</strong>r with 0.18% and 16.0% weight by market capitalization on <strong>the</strong>Tadawul and <strong>the</strong> Tadawul Insurance index respectively, as on 31 December 2008.Exhibit 106: Sec<strong>to</strong>r details% wt inindexAvg. NPM (%),1Q-05 – 4Q-08*Avg. RoE (%)2005 – 2008The Company for Co-operative Insurance (Tawuniya) 0.18 23.30 32.71Malath Co-operative Insurance and Reinsurance Co. (Malath) 0.11 (22.70)Mediterranean & Gulf Insurance and Reinsurance (Medgulf) 0.15 N/ASaudi Fransi Co-operative Insurance Co. (Allianz SF) 0.05 (11.35)Islamic Arab Insurance Co. (SALAMA) 0.04 (4.54)Saudi United Cooperative Insurance Co. (Walaa) 0.03 N/AArabian Shield Co-operative Insurance Co. 0.03 N/ASABB Takaful 0.04 (6.32)Sanad Insurance and Reinsurance Co-operative Co. 0.03 N/AThe Saudi Arabian Cooperative Insurance Co. (SAICO) 0.02 N/ASaudi Indian Company for Cooperative Insurance 0.05 (134.41)Gulf Union Co-operative Insurance Co. 0.03 N/AAlahli Takaful Company (ATC) 0.05 (171.73)Al-Ahlia Insurance Co. 0.03 (802.33)Allied Co-operative insurance group (ACIG) 0..02 N/AArabia Insurance Co-operative Co. (AICC) 0.03 N/ATrade Union Co-operative Insurance 0.03 N/AAl-Sagr Cooperative Insurance Co. 0.03 N/AUnited Co-operative Assurance (UCA) 0.08 N/ASaudi Re for Co-operative Reinsurance Co. 0.10 23.30Bupa Arabia for Co-operative Insurance Co. 0.05 (22.70)Source: Bloomberg, Tadawul, Company data:* start periods may differ based on availability of dataMany insurance players postedloss in 2008 due <strong>to</strong> investmentlosses and high operationalcosts resulting from inceptionSince <strong>the</strong> Saudi insurance market is still evolving, majority of <strong>the</strong> players registered losses in2008 except NCCI, Arabian Shield Co-operative Insurance Co., Gulf Union Co-operativeInsurance Co., and Al-Sagr Cooperative Insurance Co., which posted profits. NCCI has beenable <strong>to</strong> maintain profitability due <strong>to</strong> its dominant position in growing insurance segments such asmo<strong>to</strong>r insurance and health insurance. However, NCCI posted negative profitability in 4Q-08JUNE 2009SAUDI ARABIA FACTBOOK71